Logistics businesses are going through it in 2025. From the ongoing trucker shortage to general economic uncertainty, owners and managers are under a lot of pressure to adapt in the modern era.

So, what’s the best way to do that? Knowledge is power when it comes to the logistics industry, and staying up to date on all the latest trends can be invaluable for businesses looking to stay relevant. That’s where the Tech.co Logistics Report comes in.

We’ve surveyed hundreds of logistics professionals to gain helpful insights about the industry – helping you to prepare and adjust your business strategy in the long run.

Tech.co Logistics Report 2025: Key Findings

We spoke with 521 logistics professionals to gain valuable insights about the trajectory of the industry, highlighting some of the pain points that are faced on a regular basis. Take a look at some of the key findings, and be sure to download the free report to learn more about where logistics is headed in 2025.

- 63% of logistics professionals report an increase in demand over the past year.

- 85% of logistics businesses are operating at near full capacity.

- 69% of respondents say that driver shortages have had an impact on their ability to meet freight demand.

- 45% of logistics businesses say a lack of qualified applicants is the biggest challenge in maintaining a steady driver workforce.

- 63% of respondents say their ability to recruit and retain drivers has either stagnated or worsened over the past year.

- 63% of logistics businesses are already using technology to reduce reliance on drivers.

Freight Demand Is Increasing, and That Might Be a Problem

The logistics industry may be struggling, but it’s certainly not because of a lack of demand. In fact, 63% of logistics businesses stated that there has been an increase in demand over the last year, with 83% noting that there was just enough or more than enough freight to haul for their business.

That might seem like a good thing, but if businesses can’t keep up with demand, the supply chain breaks down. And given 85% of logistics businesses are operating at near full capacity, the slightest disruption could put a lot of strain on their bottom line.

Staffing Issues Persist Into 2025

We’ve uncovered important insights on the labor crisis within logistics, and the immense impact that it is having. 63% of those that we spoke to told us that their ability to recruit and retain drivers over the last year has stagnated or worsened, with only a very small minority, 11%, saying that they had experienced a significant improvement.

As far as what that disruption looks like, it can take many forms. According to our survey, on-time delivery is the biggest concern, with 43% of respondents describing reliable deliveries as the primary issue. Other problem areas caused by increasing demand include driver availability (42%) and cost control (39%).

Recruiting and Retention in Logistics Aren’t Helping Enough

The problem with this level of demand is that the logistics industry can’t keep up, mainly because of staffing. The trucker shortage has become a persistent problem, and recruiting and retention efforts simply haven’t been able to keep up because of a variety of issues.

For starters, 45% of logistics businesses state that there is a lack of qualified applicants, making it hard to maintain a steady driver workforce to make deliveries. On top of that, competition from other employers (34%) and high turnover rates (31%) are also throwing a wrench in staffing gears.

To make matters worse, drivers have their own complaints about the logistics industry in 2025. In our survey, potential drivers complained about low pay (39%), long hours (38%), regulatory burdens (33%), and job instability (27%) as some of the top barriers to attracting new talent.

Technology Might Be the Answer

It’s obvious that something needs to change, and luckily, most businesses are committed to changing with the times. 79% of logistics businesses that have struggled with the driver shortage have altered their freight movement strategies in some form.

Technology has been the primary means by which businesses are making changes, and, more importantly, they’re seeing results. 73% of respondents in our survey say that technology is already helping them address workplace challenges.

What kind of workplace challenges? The most common response was route optimization software (51%), which points to the industry focusing on actual cost-saving measures rather than big swings. The other top responses — which include driver monitoring and coaching platforms (46%), fleet tracking software (41%), fuel/energy reduction technology (30%) — back that up.

Self-Driving Trucks Just Aren’t There Yet

While technology is clearly improving operations for logistics businesses, there is one innovation that may make headlines, but simply isn’t being embraced by the industry to meaningfully address its biggest issues: self-driving trucks.

In fact, only 10% of respondents said that they had adopted some kind of autonomous technology to improve operations.

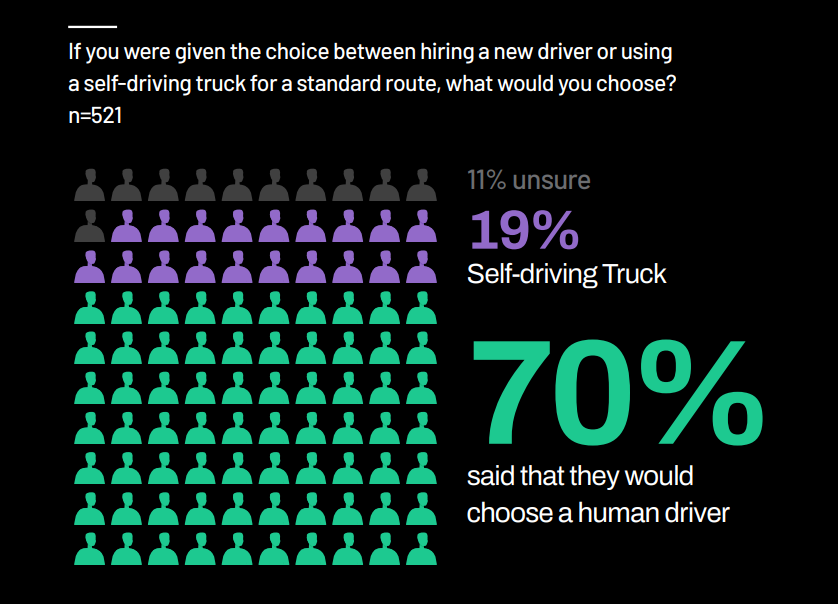

Even worse, those in the industry are simply in favor of human drivers over robot drivers by a sizable majority. Our survey found that 70% of respondents would choose a human driver over a self-driving truck when hiring for a standard route.

The current regulatory environment is one of the biggest issues standing in the way of further adoption. In the absence of a specific federal ruling on the self-driving trucks issue, states have been left to mete out their own policies. This has created the inconsistent landscape that we see today.

The Great Owner-Manager Divide

Owners and logistics managers are both responsible for their businesses, but according to our survey, they are taking a noticeably different approach to weathering the storm in regard to technology.

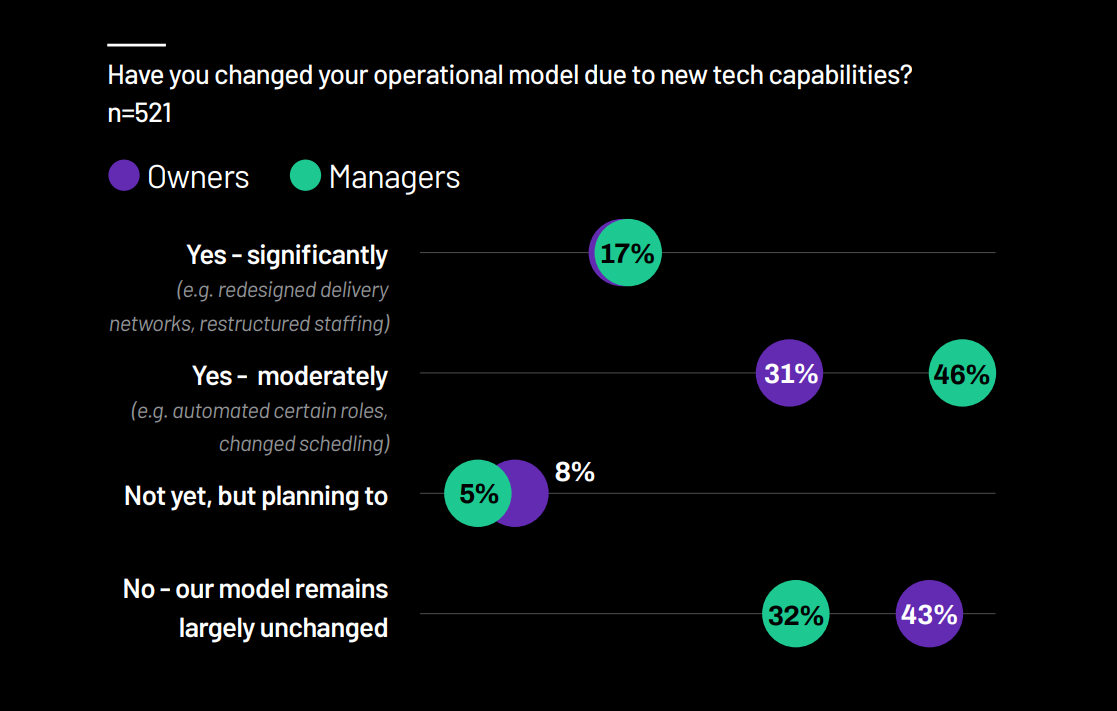

While 63% of logistics managers said they have changed their business model to account for new technologies, only 48% of owner operators said they had done the same, pointing to a more conservative approach that could see them left behind on important innovations.

On the bright side, owners do outpace logistics managers when it comes to future plans. Only 5% of logistics managers said that they’re planning to change their business model in response to new technology, while 8% of owners said the same.

Tech.co Logistics Report 2025: How We Did It

The U.S. Logistics Moving Goods With Fewer Hands 2025 report was put together by the team at Tech.co to shed light on the problems facing the logistics industry and how businesses are finding solutions.

The research in the report is sourced from Tech.co’s proprietary Logistics 2025 Survey, which had 521 respondents across the industry. We distributed online surveys to professionals actively working in day-to-day logistics operations within the U.S. road transportation industry.

More specifically, we reached out to individuals who are responsible for business strategy, operational execution, or workforce and purchasing decisions, so as to get the most valuable insights from serious professionals.

Tech.co: Who Are We?

Tech.co has taken many forms since its inception in 2006 as a networking business aimed at connecting tech startups in Chicago. In 2025, Tech.co is a global media brand that provides insight reviews, explainer guides, and up-to-date news for businesses looking to get ahead.

We cover a wide range of industries — including website builders, CRM platforms, project management tools, and yes, the logistics industry — to provide business owners of all kinds with the information they need to stay on top of the competition.

In that vein, we’ve conducted hundreds of hours of independent, in-depth research to offer unique and valuable insights into your given industry.