FreshBooks offers core accounting tools at an good price for a small business accounting software. It’s a central location for your client communication, billing, and tax needs. One standout tool is the platform’s time tracking functionality, which can log every hour you spend on a project and automatically include it on the right invoice.

However, the platform isn’t comprehensive. You won’t find forecasting and budgeting tools, customization is somewhat limited, and some tasks might be difficult to figure out at first.

Read on to see exactly what features you will and won’t receive from FreshBooks, as well as what each plan costs, what types of around-the-clock support you can expect, and what other competing platforms could help you manage your accounting needs, too.

Once you’re ready to try FreshBooks or a comparable software, head on over to our comparison page for the top deals around.

In This Guide:

FreshBooks: At a Glance

- 24/7 customer support, ensuring help is available when needed.

- One of the most competitive rates in the industry, with plans starting at $21 per month.

- Great Time Tracking functionality that directly logs billable hours and turns them into accurate invoices

- No support for accepting multiple currency options on invoices

- No forecasting and budgeting tool,s and limited customization tools for reporting

Pros

- Intuitive, easy to use interface for beginners

- Time tracking features with invoice compatibility

- 24/7 customer support options for platform help

- Automated reminders are included on all plans

Cons

- Limited functionality in mobile app

- No forecasting or budgeting features for future analysis

- No multi-currency invoicing available for users

- Few custom reporting options

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Select: Custom pricing

Who is FreshBooks best for?

Solo freelancers and small business novice users are a great fit for FreshBooks for three reasons. First, it’s a relatively low-priced software, so new businesses won’t be breaking the bank to pay for it.

Next, it offers 24/7 support through a chatbot in addition to an online knowledge base, giving users plenty of videos and one-on-one chat support to help them through their problems.

Finally, smaller or newer businesses are more likely to just require the basics of what accounting software has to offer, and so they won’t miss the features that FreshBooks omits, such as budget forecasting and multi-currency support.

Professionals who need to track their hours in order to invoice clients will also appreciate the software’s ability to log hours and automatically include them on invoices – a feature that not every accounting platform can handle.

Our experience with FreshBooks

“I did think it was very intuitive to use, and finding things was easy. […] Editing aspects, e.g., on invoices, were all in the same place, so you know where to look the next time.” -Tech.co tester, about FreshBooks

Our testers found the FreshBooks interface to be user-friendly, with a visually appealing look that wasn’t crammed with a confusing number of tools and options. Editing tools were consistently located, making invoices and other templates easy to update. A single main vertical navigation bar helped guide our testers towards core functions, as well.

One example of the clear signposting is a the presence of a timer (designed to allow users to include billable hours on each invoice) which was easy to spot and toggle on or off.

However, the FreshBooks platform drew plenty of concerns, too. The client messaging function was difficult to use, which might deter clients from reaching out to communicate or clarify issues. Our testers couldn’t switch default currencies on their invoices, either. Instead, they found that the accepted currency reverted to USD, causing frustration.

Finally, the interface received another ding for how hard one tester found it was to figure out how to send chase emails when trying to follow up on a delinquent client.

While you might not face these exact struggles yourself, you should expect a few growing pains when trying to get comfortable with FreshBooks, even if the interface is easy to use for most common needs.

The FreshBooks home dashboard is pared down and easy to get started on. Source: Tech.co testing

FreshBooks Review: Key Features

Read on to see which crucial features FreshBooks has to offer, and which ones might not be available at all.

Core accounting tools

FreshBooks offers solid invoicing tools: You’ll be able to set up recurring invoices, automated invoice and quote sending, and payment reminders to slow-paying clients, and built-in read receipts let users see when clients have viewed an invoice.

There’s one function missing, however. Unlike QuickBooks, Xero, or ZohoBooks, you will not be able to create multi-currency invoicing, so international operations will be restricted to accepting a single currency.

Tax forecasting tools aren’t offered, although the software will calculate taxes, adding or deducting them automatically when needed. FreshBooks documents transactions well, with all entries automatically reflected in the general ledger, and allows data importing and exporting. Descriptions, categories, and tax names and amounts will be remembered for invoices, although not for bills.

Financial planning tools

Simply put: FreshBooks isn’t geared towards financial planning. Basic reports are supported, including income statements, cash flow statements, and balance sheets. However, you won’t get any forecasting or budgeting tools, the software is not IFRS or GAAP compliant, and it won’t let you customize reports or otherwise stray from the available templates.

Inventory tracking is included, so you’ll be able to keep an eye on inventory levels as well as track your fixed assets, but asset depreciation or amortisation won’t be automatically accounted for (QuickBooks also lacks this feature, although Zoho Books does include it).

FreshBooks lets you track time with the timer, or by logging time manually. Source: Tech.co user testing

Operational efficiency tools

FreshBooks offers some tools for boosting your business efficiency, but it lacks others, making this area a mixed bag.

The pros? Our testers found that FreshBooks caught most common errors. It automatically flags mismatched balances, and it offers audit trails, so you’ll be able to tie specific actions to the user responsible for them. It also flags accidentally duplicated client profiles, although it won’t flag duplicated invoice numbers in the same way.

Managers can set department-specific permissions for spending and approvals, and the software supports unlimited team members, in contrast to the plan-based user limits that rivals Zoho Books and QuickBooks require.

The cons? Customization and collaboration is limited in a few different ways. Client profiles are limited to one delivery address each, and as we mentioned earlier, reports can’t be customized. There’s no client portal, so clients can’t easily view their invoices, statements, or documents in one place. Users can customize the invoice templates with their company logo and other branding, but that’s not uncommon for accounting software.

FreshBooks’ profit and loss report gives you a detailed breakdown of your business’s financial health. Source: FreshBooks

Integrations

FreshBooks offers over 100 integrations, along with an open API that allows coders the control they need to further tweak or build apps. That’s a healthy amount of options, even if it pales compared to the two biggest accounting software options: QuickBooks has over 750 apps, while Xero has over 1,000.

All that really matters is if the platform offers the exact integrations your business needs, and FreshBooks is more likely to offer what you need than not.

FreshBooks Pricing Plans Explained

FreshBooks offers four main plans:

- The Lite plan: $21 per month

- The Plus plan: $38 per month

- The Premium plan: $65 per month

- The enterprise-level Select plan: available for a custom quote

All plans are 10% off when billed annually, and you can currently get them on sale at 70% off for the first four months.

Our FreshBooks pricing guide breaks down the features available for each plan to a greater extent, but you can see the highlights with our comparison table right here if you’re in a rush.

FreshBooks Help & Support

FreshBooks excels at some support options that our researchers and testers found, but fumbles others. It offers a wide range of support: You’ll get phone support from 8 am to 7 pm Eastern time, email support upon request, and live chat help, both from a bot and from human staffers. The chatbot’s 24/7 support means that you’ll always be able to get some support whenever you need it.

An online knowledge center is available for common fixes, although the company does not provide a community forum (this is rare, since all our other top accounting software picks do offer forums). Our testers found that the online database offered good answers to most of the questions we checked, although it didn’t help with one question focused on tax returns.

You won’t get your data automatically backed up on the cloud with FreshBooks, even though the app does rely on Google Cloud Platform (GCP) for hosting requirements.

| Starting price | Free trial | Best for | Pros | Cons | Try now | ||

|---|---|---|---|---|---|---|---|

| BEST ALTERNATIVE | |||||||

|

|

|

|

| ||||

| 30 days | 14 days | 30 days | 30 days | 30 days | 30 days | ||

| New businesses | Managing sales and inventory | Experienced accountants and established businesses with complex financial needs | Businesses needing advanced financial insights and customization | Budget-conscious businesses | Professionals requiring comprehensive tax preparation tools | ||

|

|

|

|

|

| ||

|

|

|

|

|

| ||

| Try FreshBooks | Try Zoho Books | Try Xero now | Try QuickBooks | Get Quotes | Get Quotes |

Zoho Books: Best for small businesses

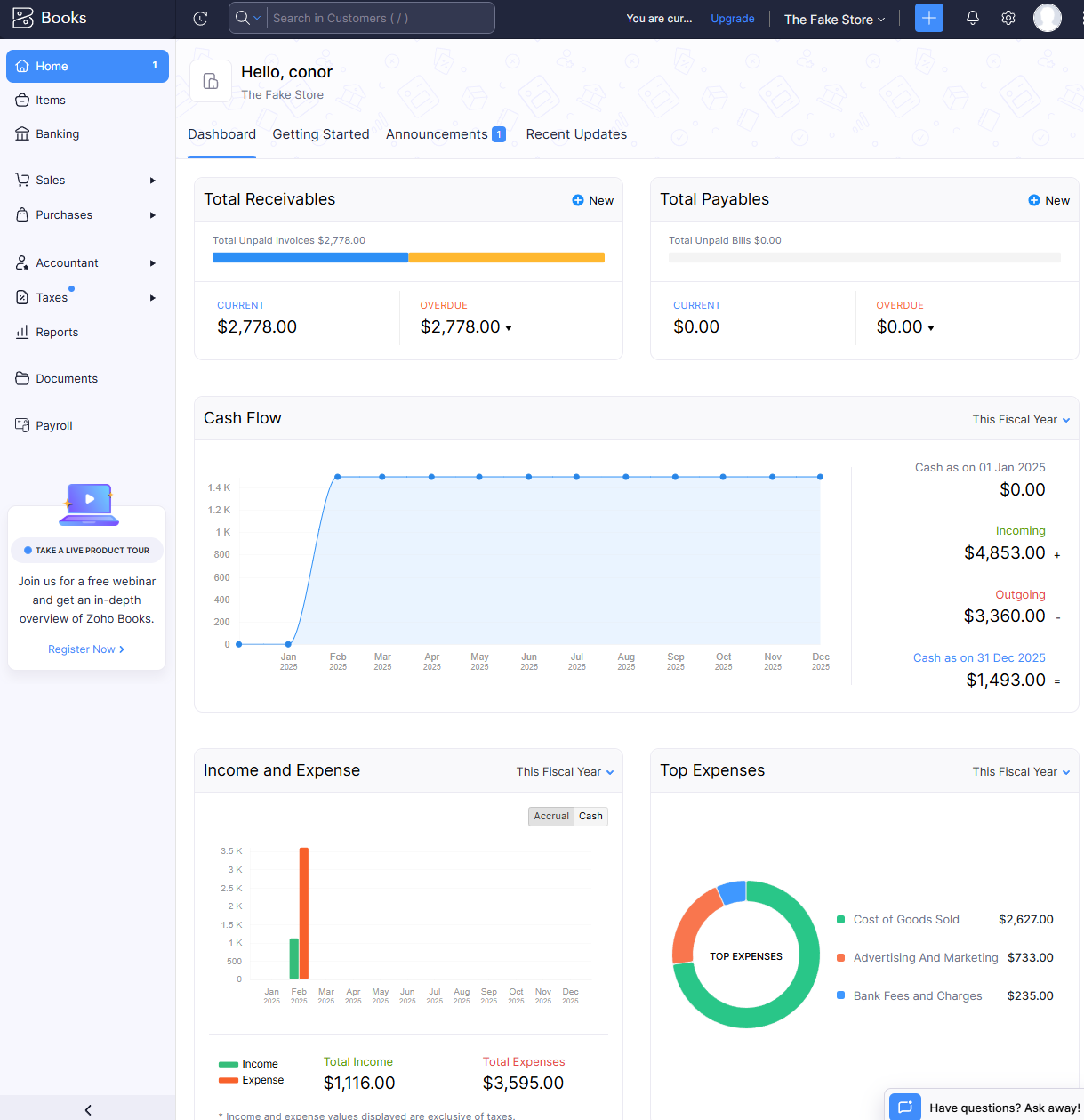

The home dashboard from Zoho Books provided us with lots of valuable data to keep us informed. Source: Tech.co testing

We think Zoho Books offers the best accounting software balance: Great functionality, decent prices, a genuinely useful mobile app, and an interface that’s easy to use and simple to customize. We definitely recommend it compared to FreshBooks.

There’s one catch, however: You’ll get limited support hours. Zoho Books has phone support available only on weekdays between 9 am and 6 pm, while FreshBooks has 8 am to 7 pm phone support, plus 24/7 chatbot help.

Check out our Zoho Books review for a more detailed breakdown of what it offers.

Xero: Best for online businesses

Xero’s reporting dashboard gives you an instant overview of how your business is tracking. Source: Tech.co user testing

Xero stands out for its ecommerce functionality: It has some key integrations that help an online business connect the accounting tool to sellers, including Amazon, Shopify, and Etsy as well as website creation platforms, including Squarespace and Square Online. Plus, much like FreshBooks, there are no user limits across any plan, and 24/7 support options are available.

Check out our guide to the best free accounting software.

QuickBooks: Best for financial forecasting

The QuickBooks app library provides us with access to more than 750 third-party integrations. Source: Tech.co testing

If FreshBooks’ lack of budgeting and forecasting tools puts you off the platform, QuickBooks is likely for you. This platform’s wide range of features and functions includes adjustable cash flow projection, so you’ll be able to predict upcoming profits or losses. With all the economic instability tied to a looming recession and new tariffs, most businesses will appreciate all the projections they can get.

Plus, QuickBooks offers more detailed customization options for interface menus and report templates than most rival software, including FreshBooks. Check out our full QuickBooks review for further analysis.

What’s New for FreshBooks?

Some of FreshBooks’ most recent feature additions or updates include FreshBooks Audit Log, a new report template that serves up a dynamic, sequential record of all your financial transactions, allowing managers to check up on the origins of any given transaction. It’s useful for resolving disputes with clients and managing cash flow with proper transparency.

The General Ledger report template has also been updated, with better summaries and customization options.

The company debuted an entirely new paid add-on late last year, too: FreshBooks Payroll powered by Gusto. For $40 per month plus $6 per month per employee, users can automate their entire payroll to ensure employees are paid on time, every time. Now, new updates give users the ability to pay 1099 contractors as well, log historical pay runs from before they adopted the FreshBooks software, and set up journal entries to be automatically logged in the chart of accounts whenever payroll runs.

At Tech.co, we take our impartial research and analysis seriously, so you can have complete confidence that we're giving you the clearest, most useful recommendations.

After conducting an initial investigation to identify the most relevant, popular, and established accounting tools in the market, we conducted further research, including testing six major accounting software platforms.

Based on years of market and user needs research, we've established an accounting software testing methodology that scores these platforms against six main categories, and 25 subcategories – with a total of 1,512 areas of investigation being considered overall.

We also put the platforms through their paces with hands-on testing to gain a deeper grasp of their average user experience. We dedicated 57 hours to carrying out 37 user tests, with a total of 555 tasks being completed in total.

Our main testing categories for accounting software are:

- Core accounting features: We check how adept a platform will be at managing accounting tasks, focusing on key bookkeeping features like invoicing, tax preparation, journal entry, time tracking, financial transactions, and payment support.

- Operational efficiency: We determine how capable a system is at ensuring day-to-day processes run seamlessly, paying close attention to third-party integrations, collaboration tools, AI automation, and customization options.

- Financial planning: We assess how capable a system will be at measuring income, profits, and losses. Specifically, we check for the presence and quality of forecasting and budgeting, inventory management, reporting, and compliance tools.

- Help and support: We assess how useful and reliable a platform's support system is, focusing on support options, whether it's 24/7 support or knowledge center accuracy, as well as cloud backup, and security safeguards.

- Pricing: We compare the overall cost of each platform, taking factors like monthly costs, set-up fees, hidden fees, and free plans into account. We also measure how strict contracts are, and how much it would cost for a business to terminate them early.

- User experience: An overall judgment of how easily users can interact with the platform. We tested each accounting platform and got our team to report how easy they were to use, how they felt when they were using them, and how likely they were to recommend the platform to another business.

When it comes to calculating a product's final score, not all testing areas are weighted evenly, with factors like “core accounting features” and “operational efficiency” being prioritized for small businesses, while sector-specific features are valued more highly for businesses across different industries.

We understand that accounting software is always evolving. That’s why at Tech.co, we have full-time product researchers to re-run this testing process regularly. It’s the only way to ensure our results remain reflective of the present day.

Learn more about our research.

Verdict: Should You Pick FreshBooks?

FreshBooks may be for you if you operate a very small business that needs core accounting, 24/7 support, and a relatively low monthly cost. It’s particularly good for freelancers who need to include billable hours on each invoice, since the platform’s time tracking functionality is easy to use.

That said, our top pick for the category remains Zoho Books, which offers more tools, including some great budgeting, forecasting, and cash flow projection functions, while maintaining a comparable price and similarly easy-to-use interface.

Once you’re prepared to take the next step, check out our comparison page to view all the top accounting software deals.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page