After researching and testing the best restaurant accounting software, Zoho Books emerged as a clear frontrunner. Not only does it offer strong bookkeeping functions and sector-specific capabilities like inventory management, but it’s also extremely easy to use, lending itself especially well to smaller food businesses.

Xero may be a better choice for larger, more established restaurants, however, boasting impressive budgeting and financial planning tools and a much larger library of third-party integrations, while FreshBooks‘ gradual learning curve and 24/7 support center will be ideal for those trying out accounting software for the first time.

Our researchers tested each provider to assess their suitability for restaurants and other food businesses. Read on to learn how they compare when it comes to accounting features, hospitality-focused tools, user experience, price, and more.

| Tech.co review score | Starting price | Pros | Cons | Best Restaurant Accounting Software for: | Try now | ||

|---|---|---|---|---|---|---|---|

| FEATURED PROVIDER | |||||||

| 4.6 | 4.8 | 4.6 | 4.3 | 4.1 | |||

|

|

|

| |||||

|

|

|

|

| |||

|

|

|

|

| |||

| Best for Tracking Budgets | Best for Managing Suppliers | Best Value for Money | |||||

| Try Xero now | Try Zoho Books | Try QuickBooks | Get Quotes | Try FreshBooks |

Best Accounting Software for Restaurants

We’ve included quick reviews of the features and price for each top restaurant accounting software solution below. Click the provider name to jump to its review, or scroll down to see them all in turn.

- Zoho Books – Best accounting software for restaurants overall

- Xero – Best for more established restaurants

- QuickBooks – Best for multi-location food businesses

- FreeAgent – Best for smaller food vendors

- FreshBooks – Best for accounting software beginners

1. Zoho Books

- Best accounting software for restaurants overall

- Price from: $15 per month

Zoho Books is an ideal piece of accounting software for restaurants, or any food and drink service company, as it will enable you to balance your books and inventory with ease, without having to rely on third-party software.

It offers the best core accounting features out of any provider we researched, and its stock management features can be used to help restaurants track key ingredients and supplies. Combine this with its intuitive, easy-to-use interface, and an affordable entry price, and you can probably understand how it beat rivals like Xero and QuickBooks to the top spot.

Pros

- Extensive data import/export features built in

- Time tracking tools with billable hours conversion for invoicing

- Highly effective transaction documentation

Cons

- No customer support outside business hours (no weekends)

- Limited third party integrations outside of Zoho

- Shorter free trial than most other accounting platforms

- Free: $0/month

- Standard: $15/month

- Professional: $40/month

- Premium: $60/month

- Elite: $120/month

- Ultimate: $240/month

Whether you use accounting software for tax preparation or filing invoices, Zoho Books’ powerful accounting toolkit will have you covered. The platform lets you set up recurring invoices, send payment reminders to clients, and view when clients have viewed invoices. Unlike competitors like FreshBooks, Zoho Books even supports multi-currency invoicing, making it a solid choice for restaurants tracking invoices from international suppliers.

We were able to get help with tasks like creating invoices thanks to the built-in AI chatbot. Source: Tech.co testing

Zoho’s accounting software also supports different tax types like VAT and CIS and automatically applies relevant tax rules and calculations based on current tax laws, eliminating the need for busy restaurants to hire an external accountant to manage the process on their behalf.

Zoho has a very modern interface and is very easy to navigate too. After testing out Zoho Books, our team of user testers was really impressed at how logical and intuitive the platform was, specifically when it came to carrying out simple tasks like managing invoices and quotes. In fact, we found Zoho Books the easiest accounting software to use overall, which will be a huge bonus for small restaurants that want to avoid a steep learning curve.

Zoho Books top restaurant features

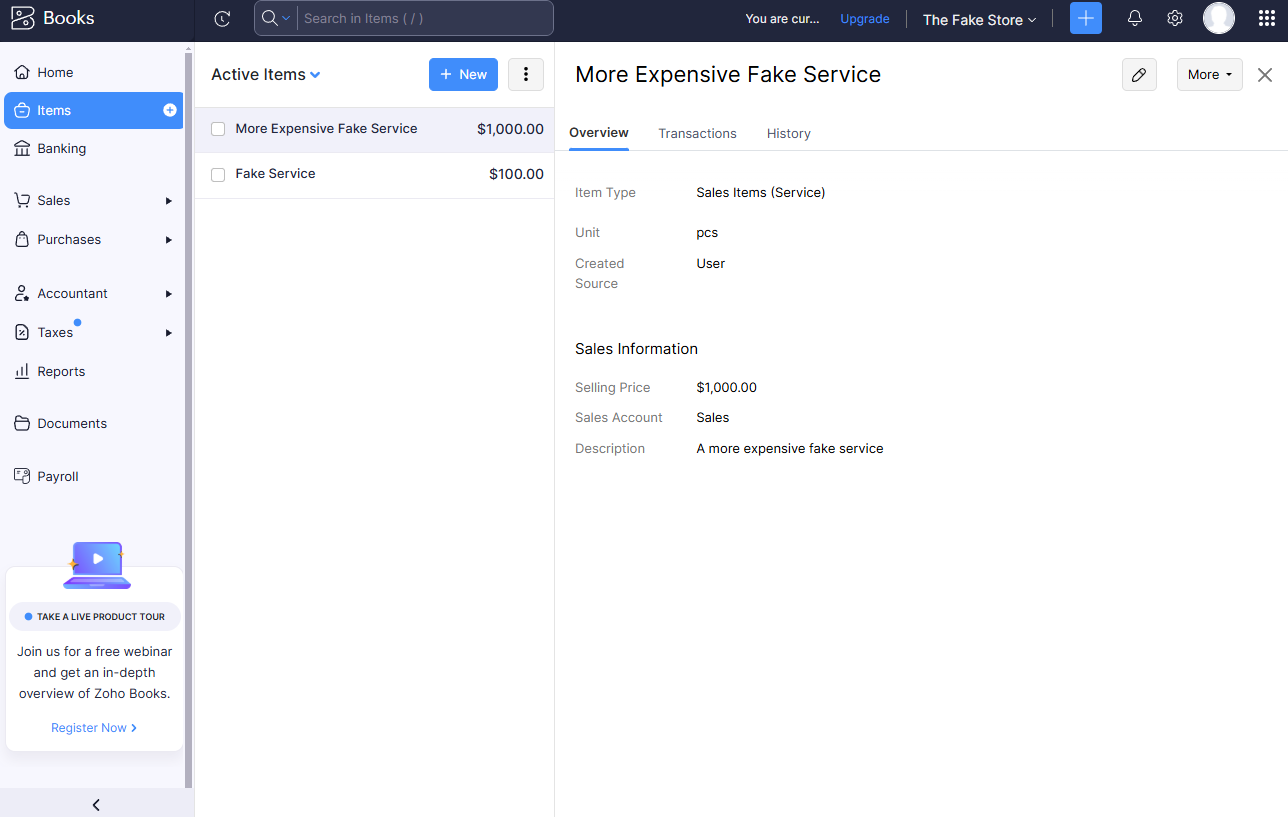

Aside from core accounting features, Zoho Books also offers inventory management in-house, through its Zoho inventory platform. The software gives restaurants a way to centralize their inventory system by tracking stock levels in real time and monitoring the valuation and worth of their stock.

Zoho Books allowed us to track inventory directly on the platform. Source: Tech.co testing

Zoho Books’s app library isn’t as extensive as QuickBooks’s or Xero’s. However, the accounting software does seamlessly integrate with the rest of Zoho’s product Suite which houses apps like Zoho CRM, Zoho Expense, and Zoho Inventory. Zoho Books’ users can connect with a selection of third-party apps too, including CRM platforms, and POS systems like Shopify, Loyverse, and BigCommerce.

The system is ideal for restaurants with basic inventory needs. However, if you manage a particularly large or complicated stock, or require advanced capabilities like real-time perishability tracking we’d point you in the direction of Xero instead, as the platform will be more capable of handling these processes.

Zoho Books pricing

Zoho Books offers a total of six packages, allowing restaurants to find a pricing plan that suits their business.

Its entry-level paid plan – Standard – costs just $15 per month, and is capable of managing tax processes, integrating with bank feeds, creating custom reports, and more. It’s a great starter option for small restaurants, but if you’re in need of stock management features, we’d recommend opting for its Professional plan ($40 per month), instead.

Zoho Books also offers pricier Premium, Elite, and Ultimate plans, which will be more suitable for larger restaurants with high turnovers that require advanced budgeting and cash flow management tools.

Zoho Books is also one of the only providers on this list to offer a free plan, making it ideal for smaller food vendors like pop-ups and food trucks, as well as larger restaurants that want to get a taste of the software before they commit to a contract.

See how Zoho Books’ plans compare side by side below:

| Price | Users | Create and send invoices | Track expenses | Track bills | Record fixed assets | Multi-currency transactions | Advanced analytics | Budget management | Custom reports | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 3 | 5 | 10 | 10 | 15 | ||||||

| 1,000/year | 5,000/year | 10,000/year | 25,000/year | 100,000/year | 100,000/year | ||||||

| 1,000 expenses | 5,000 expenses | 10,000 expenses | 25,000 expenses | 100,000 expenses | 100,000 expenses | ||||||

| | | | | | | ||||||

| | | | | | | ||||||

| | | | | | | ||||||

| | | | | | | ||||||

| | | | | | | ||||||

| | 10 reports | 25 reports | 50 reports | Unlimited | Unlimited |

2. Xero

- Best for more established restaurants

- Price from: $20 per month

Xero is an industry-leading accounting platform, offering an impressive array of book-balancing and sector-specific tools while running special pricing deals that place it within the budgets of most restaurants.

Our research concluded that Xero is especially suited to larger restaurants managing complex workflows, due to the platform’s stand-out cashflow projection tools and expansive library of over 1000 third-party integrations.

However, smaller businesses may be overwhelmed by Xero’s cluttered visuals and steep learning curve. Therefore, we recommend the software for experienced professionals who are willing to dedicate a bit of time getting to grips with the platform.

Pros

- Over 1,000 third party integrations available

- Useful client portal for clients to access financial information

- Robust fixed asset tracking functionality with depreciation values

Cons

- Steep learning curve for advanced features like work flows

- Outdated, poorly designed interface with difficult navigation

- Must give one-month notice before cancellation

- Early: $20/month

- Growing: $47/month

- Established: $80/month

Xero is one of the biggest names in accounting for good reason. The platform offers tons of core accounting tools including granular invoice features, tax capabilities that automatically account for changing regulations, and journal entry features that automatically reflect entries in general ledgers.

The software also offers stand-out reporting features for restaurants interested in boosting their sales performance. The platform lets you create custom reports based on your businesses’ specific needs, and filter results by metrics like date range and customer name.

Xero offers a wide range of accounting features, but its interface isn’t as modern as some alternatives. Source: Xero

Unlike with alternatives like FreshBooks and Clear Books, businesses using Xero can estimate the size and timings of upcoming transactions with its Cash Flow Planner add-on. This can help restaurants predict how much cash they could have in the future, helping them prepare for potential revenue spikes or shortages, making Xero a particularly strong option for businesses experiencing rapid growth.

Xero top restaurant features

Xero’s inventory management features let you track up to 4,000 products, which is just another reason why it should be on the radar of more established restaurants. Its inventory software also helped restaurants manage perishable stock, helping them to reduce waste and lost profits as a result.

Xero’s app store lets you connect with tons of restaurant-focused apps like Square POS and Fresho Inventory. Source: Tech.co user testing

If Xero doesn’t offer a feature your restaurant needs, chances are you’ll be able to find what you need in Xero’s App Store. The app marketplace gives businesses a choice of over 1000 third-party apps to choose from, including hospitality-focused options like Lightspeed POS, and chef order platform REKKI.

What’s more, while Xero doesn’t offer as many payroll features as QuickBooks, the provider’s app store does let you connect with a wide range of third-party platforms like Gusto, ADP, or SurePayroll.

Xero pricing

Xero lets you choose between three pricing plans: Early, Growing, and Established.

Its entry-level early package usually retails at $20 per month, making it slightly more expensive than our frontrunner Zoho Books. However, Xero is currently running a deal where businesses can get 90% off the software for the first three months, temporarily decreasing its entry price to just $2 per month.

If you don’t want to be restricted by invoicing and billing caps, Xero’s Growing ($47 per month), or Established ($80 per month) plans will be a better option for your business. Take a look at how Xero’s plans compare in more detail below:

| Price | Users | Create and send invoices | Track expenses | Track bills | Multi-currency transactions | Budget and forecasting Does it offer budgeting and forecasting tools? | Remote access | ||

|---|---|---|---|---|---|---|---|---|---|

| Unlimited | Unlimited | Unlimited | |||||||

| 20 invoices | | | |||||||

| | | | |||||||

| 5 bills | | | |||||||

| | | | |||||||

| | | | |||||||

| | | |

3. QuickBooks

- Best for multi-location food businesses

- Price from: $35 per month

QuickBooks is a well-known name in accounting, and for good reason. The platform offers enough key bookkeeping features to meet the needs of any large, full-service restaurant, and its interface is much more modern interface than competitors like Xero. QuickBooks also offers stand-out ‘class tracking; features for food businesses with multiple venues, making it a great choice for food truck fleets of chain restaurants.

However, after testing out QuickBooks, we found the platform a bit complex to navigate, suggesting that it may not be the natural choice for small food vendors after a simple solution. This being said, the accounting provider offers the best help and support center we researched. So, if you’re willing to contend with the platform’s moderate learning curve to gain access to advanced features like extensive reports and cash flow planners, then QuickBooks might just be for you.

Pros

- Extensive analytics template customization

- Automatic alerts for mismatched balances

- Built in cash flow projection tools

Cons

- Steep learning curve for advanced functionality

- Limited customer support resources for self-help

- No time tracking features

- Solopreneur: $20/month

- Simple Start: $38/month

- Essentials: $75/month

- Plus: $115/month

- Advanced: $275/month

- 50% off for first 3 months

QuickBooks is capable of streamlining a wide range of accounting processes, from invoice generation and tracking to sales tax management, bank reconciliation, and more. The platform even lets you chase up outstanding invoices with payment reminders, and view when clients have viewed bills.

QuickBooks lets you set up recurring invoices, automatic invoice sending, and more. Source: Tech.co user testing

While QuickBooks takes a little bit of time to adjust to, its useful help and support center helps to ease the learning process. You’re able to resolve queries through live agents, or an AI chatbot if you’d prefer not to speak to someone in person.

The provider also offers an expansive user forum and knowledge center, for users interested in solving problems independently. This flexible knowledge center is especially useful for busy restaurants that work outside traditional hours, and it’s a big reason why QuickBooks was able to outrank competitors like FreshBooks and FreeAgent.

QuickBooks top restaurant features

The accounting giant didn’t score as well as Zoho Books in our accounting features research category, largely because the platform doesn’t offer time-tracking tools as part of its core offering. However, if you’re planning to use a platform to accurately manage labor costs, you’ll be able to access this capability using QuickBooks’s impressive app library.

The platform really shines when it comes to multi-location management. QuickBooks lets you track income and expenses for multiple locations simultaneously using its “class tracking feature“. This capability gives users detailed reports on the profitability of each restaurant site, preventing them from needing to track metrics through two different accounts. This gives QuickBooks the edge for restaurants with multiple locations, especially compared with stripped-back alternatives like FreeAgent.

The QuickBooks app library provide us with access to more than 750 third-party integrations. Source: Tech.co testing

The platform offers 49 POS integrations on its app store, including connections industry leaders like Square, PayPal POS, and Clover. This makes QuickBooks one of the best accounting platforms out there for restaurants interested in synchronizing company sales data.

If you want to streamline employee payments, QuickBooks offers its very own payroll service -QuickBooks Payroll. This platform is fully integrated into its accounting software and gives users a way to manage payroll tasks like tax calculations, direct deposits, HR support, and accounting processes from one single platform.

QuickBooks also offers inventory management tools, although our research found they aren’t as capable as Zoho Books or Xero as most plans don’t let you track batches, or log expiration dates, making them less suitable for restaurants managing perishable goods.

QuickBooks pricing

QuickBooks offers five different pricing plans in total.

While its packages start from as little as $20 per month for its Solopreneur package, this tier is designed for self-employed individuals so won’t be able to meet the needs of restaurants and other food businesses.

Small restaurants will be better off going for its Simple Start plan ($35 per month) plan, which offers income and expense, cash flow management, bookkeeping automation features, and access to QuickBooks’ tax helper TurboTax. QuickBooks’ price packages offer more generous user limits, and extra perks like multi-currency support, making them more suitable for larger food businesses.

QuickBooks’ is also running a special pricing promotion where businesses get 50% off all plans for the first three months, enabling you to try its Simple Start tier for just $17.50 per month.

| Price | Users | Bookkeeping Does it include bookkeeping functions? | Accounts payable Does it include a range of accounts payable functions? | Accounts receivable Does it include a range of accounts receivable functions? | Project accounting Does it offer tools to track different projects? | Financial reporting Does it offer financial reporting tools? | Budget and forecasting Does it offer budgeting and forecasting tools? | ||

|---|---|---|---|---|---|---|---|---|---|

| $20/month | $38/month | $65/month | $99/month | $235/month | |||||

| 1 | 1 | 3 | 5 | 25 | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | |

4. FreeAgent

- Best for small restaurants and food vendors

- Price from: $11.25 per month

FreeAgent is a simple yet effective accounting platform that is as beginner-friendly as they come. Our team of user testers was really impressed with the software’s shallow learning curve and clear layout, which suggests FreeAgent will be a failsafe option for those using accounting tools for the first time.

Its simple yet effective suite of features makes it a great choice for smaller restaurants with relatively basic accounting needs. But don’t let its stipped-back software fool you. FreeAgent is also the only provider we researched that offers built-in tax forecasting and planning features, making it an equally promising choice for restaurants that want to use accounting software to manage tax-related processes.

Pros

- Simple, low cost pricing options for businesses

- Built-in tax forecasting tools for future financial planning

- Helpful cash flow alerts for surpluses and shortfalls

Cons

- Overly complex and unhelpful support options

- Difficult to navigate for basic feature usage

- Distracting call-to-action buttons everywhere

- Billed monthly: $27/month

- Billed annually: $270/year

- 30-day free trial

FreeAgent doesn’t hold back when it comes to key accounting features. The platform gives users access to a wide range of book-balancing tools, including accounts receivable and accounts payable, bank reconciliation, and reports that measure financial activity.

FreeAgent lets you make granular edits to your invoices, included changing the table style and density. Source: FreeAgent

It’s the software’s tax management features that really give it the edge over the competition, though. FreeAgents offers a Tax Timeline which enables users to see their upcoming dates for self-assessment, payroll, VAT, and more. This useful feature helps businesses to forecast their taxes and cash flow, making it easier for them to financially plan for the future.

FreeAgents Tax Timeline helps businesses prepare for future outgoings. Source: FreeAgent

FreeAgent top restaurant features

FreeAgent does offer some very basic stock management features, enabling users to add items to their inventory and keep track of what they sell.

While FreeAgent doesn’t offer payroll features in-house, the platform does let you access the feature by connecting with apps like Staffology, BrightPay, and Employment Hero. These extras do come at a premium, however, so if you don’t want to spend extra for payroll tools, we’d go for a provider that offers the capability in-house like Xero, instead.

However, because FreeAgent is primarily geared towards freelancers and small businesses, it lacks some sector-specific features from which restaurants would benefit. For instance, the platform offers very limited POS integrations for businesses looking to sync systems and lacks restaurant-specific reporting options.

FreeAgent’s poor multi-location support also makes it a poor option for large chain restaurants, or food truck fleets, especially in comparison to bigger providers like QuickBooks and Xero.

FreeAgent pricing

FreeAgent has a very simple pricing structure, with only one plan.

Businesses can get started with the platform for $22.50 per month. However, with the provider’s current 50% off deal, you’re able to pay just $11.25 per month for the first six months, making the platform more affordable than alternatives like Zoho Books initially.

After this period, FreeAgent will return to it’s original price, making it a bit more of an investment for small food vendors.

5. FreshBooks

- Best for accounting software beginners

- Price from: $19 per month

FreshBooks’ is a user-friendly accounting platform that’s perfectly suited to new restaurant owners managing simple processes. Not only is it very easy to set up and navigate, but its reliable 24/7 help and support center is always available to help users with any potential hitches they might have with the software.

Full-service restaurants with high turnovers might struggle with FreshBooks, however, as the platform lacks robust forecasting and budgeting tools. The platform doesn’t let users create custom reports to measure metrics like sales and employee performance, either, which would be frustrating for restaurants keen on measuring a variety of metrics.

Pros

- Intuitive, easy to use interface for beginners

- Time tracking features with invoice compatibility

- 24/7 customer support options for platform help

- Automated reminders are included on all plans

Cons

- Limited functionality in mobile app

- No forecasting or budgeting features for future analysis

- No multi-currency invoicing available for users

- Few custom reporting options

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Select: Custom pricing

FreshBooks’s core accounting toolkit will be able to meet the needs of most small restaurants and food businesses. The platform’s customizable invoice feature takes the headache out of creating bills, and you’re also able to use the software to send clients payment reminders, and automatic late fees as soon as the invoice becomes overdue.

FreshBooks makes managing invoices straightforward. Source: Tech.co user testing

If you’re chasing multiple payments, FreshBooks also lets you duplicate previous invoices to streamline the process. Yet, while the software has good basic bookkeeping features down, if you need an accounting platform that’s capable of tracking upcoming expenses, and creating cash flow projections, you’d be better off going with an alternative like QuickBooks or ZohoBooks instead.

FreshBooks top restaurant features

FreshBooks lets you handle simple processes like adding, editing, and reviewing inventory for billable items. The platform even lets you track fixed assets, which is a feature that even QuickBook reserves for its priciest tier. However, FreshBooks won’t be suitable for food businesses serious about reducing waste, as it lacks advanced capabilities like perishable goods management.

FreshBooks’ inventory management makes it easy to add new items and apply relevant taxes. Source: FreshBooks

If FreshBooks lacks a feature you need, the provider does let you expand its service with over 100 third-party integrations capable of managing a wide range of processes including tax preparation, time tracking, and appointment booking. FreshBooks’ AppStore definitely doesn’t hold a candle to providers like Xero, as it lacks many options restaurants would benefit from including POS options.

FreshBooks pricing

FreshBooks offers four pricing plans to choose from: Lite Plus, Premium, and Select.

It’s an entry-level plan, Lite, costs $19 per month and will be ideal for small restaurants with basic accounting needs. It only lets you send invoices off to five clients, though so if you’ve got a wider network we’d recommend going for the Plus, or Premium tier instead – while its custom-priced Select plan will be a suitable fit for larger restaurants with complete requirements.

The provider is also running a special deal that gives you 60% off plans for six months, temporarily bringing its entry price down to $7.60 per month.

See how FreshBooks compare side-by-side below:

Buying Guide: What to Look For in Restaurant Accounting Software

Not every accounting platform will be able to cater to the unique needs of restaurants. Instead of looking for a one-size-fits-all platform, you’ll need to focus on what features your restaurant needs and work backward from there.

Here are some important aspects to consider when shopping for a restaurant-friendly accounting platform.

- Core accounting features – In order to balance your books efficiently, you’ll need a piece of software that provides strong invoicing, tax preparation, and payment features. If you’re looking to maintain a healthy cash flow, it’s worth finding a platform with capable forecasting and budgeting tools too.

- Stock management features – Strong inventory management software can help restaurants control the costs of food and beverages, reduce unnecessary waste and spoilage, and anticipate when stocks need to be reordered. This capability will be all the more essential if it’s not offered in your POS system.

- Labor cost controls – The right accounting system will also be able to help you manage employee schedules, monitor labor costs as a percentage of revenue, and track working hours. This feature will be especially useful for restaurants with large teams.

- POS integrations – Connecting your accounting platform to your POS system will help you streamline your operations by centralizing your company data and automating payment processes. The integration will also remove the need to log down sales information manually, saving your team precious time.

- Payroll integrations – Choosing a platform with integrated payroll functions will make it much easier for busy managers to manage employee payments, and comply with labor regulations. If a piece of accounting software doesn’t offer this feature in-house, we recommend checking if its capable of integrating with third-party software.

How We Research and Compare Accounting Software

At Tech.co, we take our impartial research and analysis seriously, so you can have complete confidence that we're giving you the clearest, most useful recommendations.

After conducting an initial investigation to identify the most relevant, popular, and established accounting tools in the market, we conducted further research, including testing six major accounting software platforms.

Based on years of market and user needs research, we've established an accounting software testing methodology that scores these platforms against six main categories, and 25 subcategories – with a total of 1,512 areas of investigation being considered overall.

We also put the platforms through their paces with hands-on testing to gain a deeper grasp of their average user experience. We dedicated 57 hours to carrying out 37 user tests, with a total of 555 tasks being completed in total.

Our main testing categories for accounting software are:

- Core accounting features: We check how adept a platform will be at managing accounting tasks, focusing on key bookkeeping features like invoicing, tax preparation, journal entry, time tracking, financial transactions, and payment support.

- Operational efficiency: We determine how capable a system is at ensuring day-to-day processes run seamlessly, paying close attention to third-party integrations, collaboration tools, AI automation, and customization options.

- Financial planning: We assess how capable a system will be at measuring income, profits, and losses. Specifically, we check for the presence and quality of forecasting and budgeting, inventory management, reporting, and compliance tools.

- Help and support: We assess how useful and reliable a platform's support system is, focusing on support options, whether it's 24/7 support or knowledge center accuracy, as well as cloud backup, and security safeguards.

- Pricing: We compare the overall cost of each platform, taking factors like monthly costs, set-up fees, hidden fees, and free plans into account. We also measure how strict contracts are, and how much it would cost for a business to terminate them early.

- User experience: An overall judgment of how easily users can interact with the platform. We tested each accounting platform and got our team to report how easy they were to use, how they felt when they were using them, and how likely they were to recommend the platform to another business.

When it comes to calculating a product's final score, not all testing areas are weighted evenly, with factors like “core accounting features” and “operational efficiency” being prioritized for small businesses, while sector-specific features are valued more highly for businesses across different industries.

We understand that accounting software is always evolving. That’s why at Tech.co, we have full-time product researchers to re-run this testing process regularly. It’s the only way to ensure our results remain reflective of the present day.

Learn more about our research.

Verdict & Next Steps

The best restaurant accounting service is Zoho Books. It’s easy to use, affordable, and offers the best accounting features out of any other software we’ve researched.

Xero is also a good option, with scalable pricing packages, a huge library of integrations, and powerful cash flow management tools. However, its learning curve is much steeper than Zoho Book we we only recommend it for users willing to spend a bit of time adjusting to the software. QuickBooks should also be on your radar, especially if you’re after a system with a modern interface and a useful 24/7 customer support helpdesk.

But don’t take our word for it, to see all of the best deals on these top accounting services, take a quick look at our well-researched comparison page:

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page