QuickBooks is better than FreshBooks when it comes to the best accounting software, providing multi-currency invoicing and quoting, better forecasting and budgeting features, and more customization throughout the platform. QuickBooks is also well-known for its robust analytics functionality, which is miles ahead of FreshBooks’ own reporting abilities.

FreshBooks is no slouch, though, offering time tracking functionality that is not available with QuickBooks, and the ability to add additional team members on all paid plans, although it does cost a bit extra. Our in-depth research also found that FreshBooks is a bit easier to use and is more affordable than QuickBooks, making it a clearer choice for small businesses.

In this guide, you’ll learn about the differences between these two admirable accounting software providers, including what kind of features they offer, how much they cost, and what you can expect when it comes to usability.

| Tech.co review score | Starting price | Free trial | Pros | Cons | Custom reports | Fixed inventory tracking | Time tracking | Multi-currency invoicing | Try now | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.6 | 4.1 | ||||||||||

|

|

| ||||||||||

| 30 days | 30 days | ||||||||||

|

| ||||||||||

|

| ||||||||||

| | | ||||||||||

| Advanced plan only | | ||||||||||

| | | ||||||||||

| | | ||||||||||

| Try QuickBooks | Try FreshBooks |

Both QuickBooks and FreshBooks offer special deals to save a bit of money on your accounting software. QuickBooks offers 50% off for the first three months, so the starting price is actually $17.50 per month. FreshBooks is currently offering 70% off for the first four months, so the starting price is actually $6.30 per month.

FreshBooks vs QuickBooks Online: Key Differences

FreshBooks and QuickBooks are two of the best accounting software providers available today, but they have some major differences. It’s these differences that could help decide which one is best for your business.

- QuickBooks offers better analytics and reporting tools than FreshBooks, including the ability to create custom reports.

- FreshBooks is more affordable than QuickBooks, with a starting price of only $21 per month.

- QuickBooks is better for international businesses than FreshBooks, as it offers multi-currency invoicing and quoting.

- FreshBooks is easier to use than QuickBooks, thanks to the intuitive, simple layout for users.

- QuickBooks offers forecasting and budgeting tools, and FreshBooks does not.

The rest of this guide will delve a bit deeper into how these platforms differ, but these key differences are a good way to get started and find out which one of these platforms is a better fit for your business.

QuickBooks Pricing vs FreshBooks Pricing

When it comes to pricing, QuickBooks and FreshBooks offer relatively competitive pricing options, even if they do take very different forms. For example, FreshBooks pricing starts at only $21 per month, while QuickBooks starts at $35 per month. However, QuickBooks does have the Solopreneur plan, which only costs $20 per month, but that only applies to individuals who are self-employed, so it’s comparatively quite limited.

Additionally, FreshBooks only allows one user on all its paid plans, with an additional $11 per month charge for additional users. QuickBooks, on the other hand, allows an increasing number of users on its various pricing plans, and you can’t add additional users, even for a fee.

All in all, FreshBooks is slightly more affordable, but QuickBooks is still the better value, providing more functionality and allowing for more than one user without the additional cost. Check out a more in-depth look at each accounting software’s pricing below.

QuickBooks pricing

QuickBooks offers five different pricing plans, including the Solopreneur plan aimed at individuals. QuickBooks does not offer a free plan, but there is a 30-day free trial that can get you started before you make a financial commitment. Here’s how much the pricing plans cost:

- Solopreneur – $20 per month

- Simple Start – $35 per month

- Essentials – $65 per month

- Plus – $99 per month

- Advanced – $235 per month

QuickBooks is also currently running a special deal that allows you to get access to these pricing plans at a substantial discount. You’ll be able to get 50% off all these plans for the first three months. So if you opt for the Essentials plan, for example, you’ll only pay $32.50 per month for the first three months.

| Price | Users | Bookkeeping Does it include bookkeeping functions? | Accounts payable Does it include a range of accounts payable functions? | Accounts receivable Does it include a range of accounts receivable functions? | Project accounting Does it offer tools to track different projects? | Financial reporting Does it offer financial reporting tools? | Budget and forecasting Does it offer budgeting and forecasting tools? | ||

|---|---|---|---|---|---|---|---|---|---|

| $20/month | $38/month | $65/month | $99/month | $235/month | |||||

| 1 | 1 | 3 | 5 | 25 | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | |

FreshBooks pricing

FreshBooks offers four different pricing plans, although one of them is a custom enterprise plan that requires businesses to reach out to the company to find out how much it will cost. FreshBooks also offers a 30-day free trial, so it’s the same as QuickBooks in that regard. Here’s how much each plan costs:

- Lite – $21 per month

- Plus – $38 per month

- Premium – $65 per month

- Select – Custom

FreshBooks now offers a similar deal to QuickBooks, allowing users to get 70% off for the first four months of your contract. That means the Lite plan, for example, will only cost you $6.30 per month when you’re just starting out.

Best for Accounting Features: QuickBooks

In our research, we organized accounting features into three different categories to better understand exactly how effective each platform was at performing certain tasks. Those categories are core accounting, financial planning and visibility, and operational efficiency.

In these categories, QuickBooks performed better than FreshBooks across the board, but that doesn’t mean FreshBooks isn’t sporting some features that aren’t available with QuickBooks. Check out how these two accounting platforms compare on all three below.

Core accounting

FreshBooks and QuickBooks were pretty much right down the middle when it came to core accounting features. Both offer the necessary tools for accounting software, like recurring invoices, non-payment reminders, and automated quoting. On top of that, their tax preparation features are nearly identical, with tax calculations and support for various tax types, along with a lack of tax forecasting and planning features.

Where QuickBooks pulls ahead, however, is its support of multi-currency invoicing and quoting, which is not available with FreshBooks. Additionally, QuickBooks offers better journal entry features, supporting more export types like Excel, Google Sheets, and PDF, whereas FreshBooks only supports Excel.

FreshBooks does have one advantage, though: time tracking. QuickBooks offers no time tracking features at all, while FreshBooks provides a lot of functionality, including time tracking tools on specific tasks, conversion to billable hours, and detailed time entry details reports.

FreshBooks allowed us to track time with the timer, or by logging time manually. Source: Tech.co user testing

Financial planning & visibility

This is one feature category that QuickBooks really excelled at over FreshBooks. Most notably, FreshBooks offers no forecasting and budgeting tools, while QuickBooks allows you to do a lot, like tracking upcoming monthly bills and expenses, managing cash flow projections for incoming and outgoing funds, and setting budgets for specific departments and teams.

Most notably, however, is that QuickBooks reporting functionality isn’t just better than FreshBooks; it’s better than all the accounting software we tested. From the customizable reports and templates to the supported data export platforms, QuickBooks provided a robust analytics platform for our team that could handle even the most niche of requests.

FreshBooks does have an edge over QuickBooks when it comes to inventory management, though, allowing users to track fixed assets across all paid plans. QuickBooks, on the other hand, only allows fixed asset tracking on the Advanced plan, which costs quite a bit compared to any other FreshBooks pricing plan.

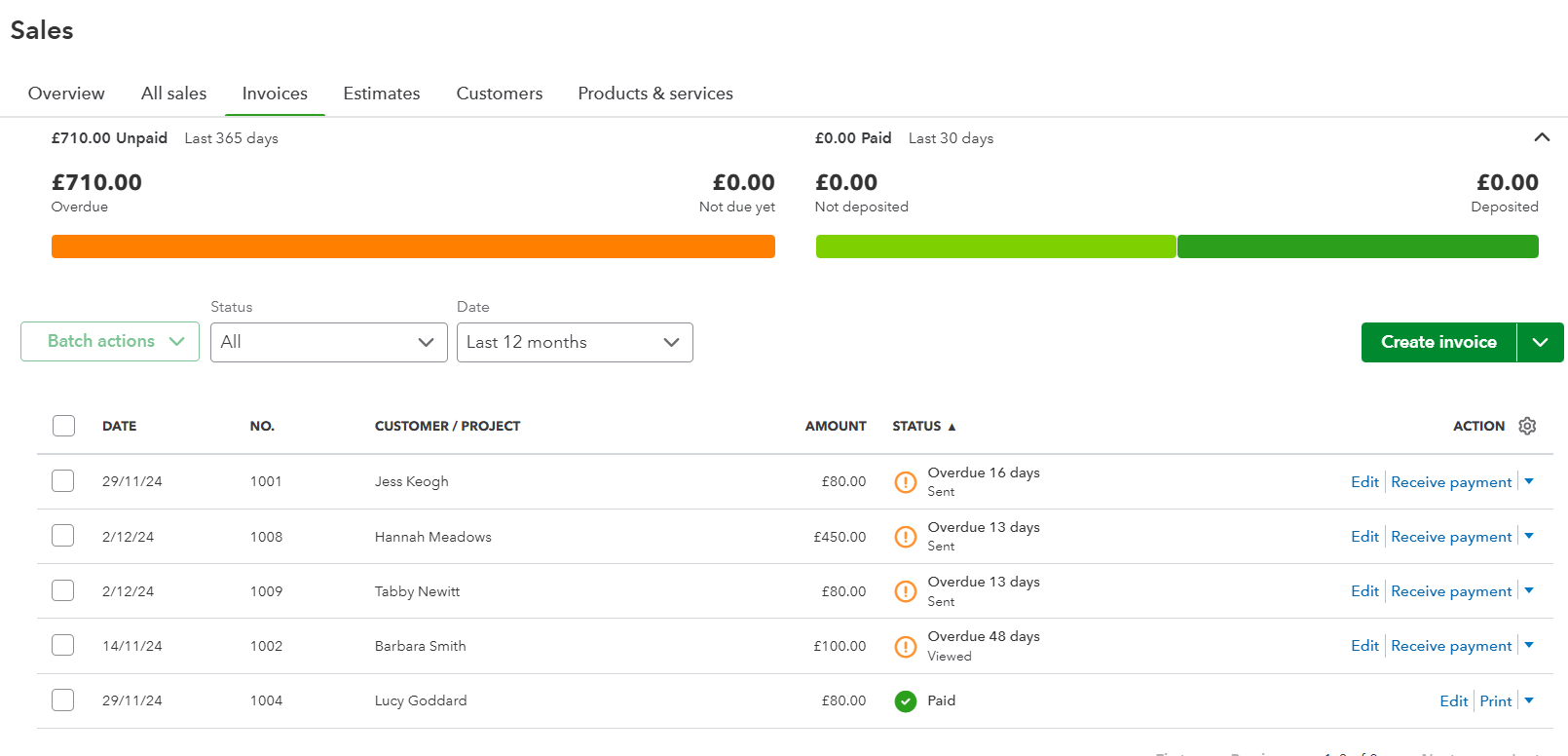

We were able to access invoice records under the Sales section of QuickBooks Online, with clear data visualizations for better analytics. Source: Tech.co testing

Operational efficiency

This category also handily went to QuickBooks, largely due to the customizability of the platform. The ability to create custom reports made it easy for our team to find the data they need to make informed decisions was paramount. On top of that, we were able to create custom templates, so that we could save time in the long run when it comes to these in-depth reports. Unfortunately, none of that was available with FreshBooks.

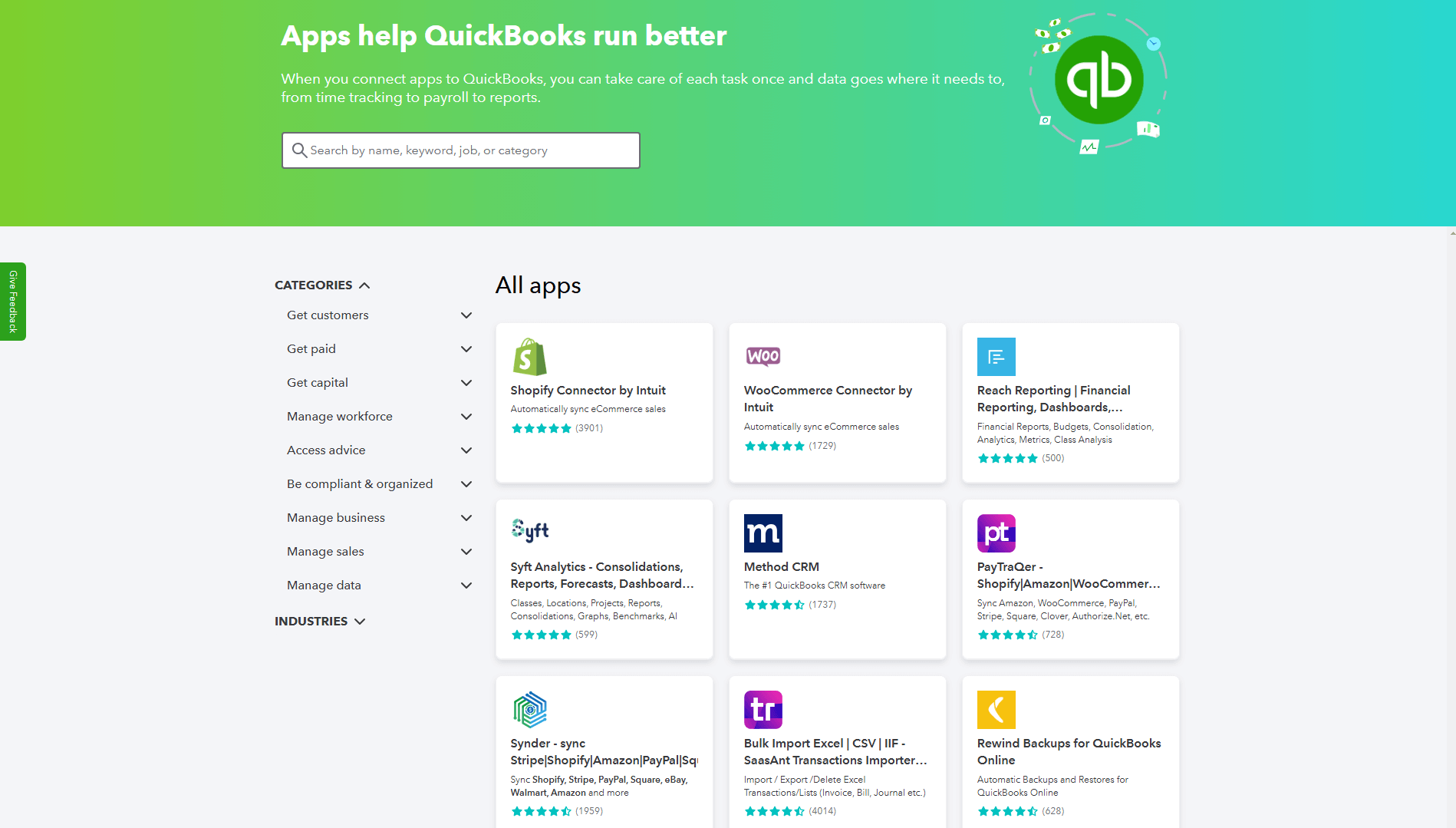

For integrations, QuickBooks is also a bit better than FreshBooks, with over 750 third-party services that are compatible with the accounting software, whereas FreshBooks only has around 100 options. Still, in most cases, the standard integrations are available for both, so this is more of a tie depending on what kind of compatibility you actually need.

QuickBooks Online offers a library of integrations, so users can connect with useful third-party tools. Source: Tech.co testing

Best for Ease of Use: FreshBooks

When it comes to the ease with which we were able to actually access and utilize these accounting platforms, our research found that FreshBooks is easier to use than QuickBooks.

The big decider was the fact that FreshBooks simply has less overall functionality than QuickBooks, making it generally easier to navigate throughout the system. The vertical navigation sidebar wasn’t cluttered, and virtually all editing tools were consistently placed throughout, so finding what we needed at any given moment was a breeze.

The only downfall we found was the messaging system, which required both parties to be comfortable with the platform to really make messaging convenient, as notifications were often hard to track down.

The FreshBooks interface is intuitive and simple, so we were able to easily navigate the entire system with ease. Source: Tech.co testing

QuickBooks isn’t necessarily hard to use, but compared to FreshBooks, the learning curve is decidedly steep. Advanced functionality like taxes, for example, require a lot of time and manual input to get started, made even more complicated by the lack of clear setup instructions.

On top of that, the QuickBooks navigation tools were kind of cluttered and even overwhelming for us, with so many options at our fingertips that we regularly got lost on our way to the desired outcome. Once you get used to it, though, the advanced functionality is absolutely worth it, allowing for a lot of customization and automation that saved us a lot of time.

The QuickBooks interface is modern and sleek, but the advanced customization makes it a bit harder to use for some. Source: Tech.co testing

At Tech.co, we take our impartial research and analysis seriously, so you can have complete confidence that we're giving you the clearest, most useful recommendations.

After conducting an initial investigation to identify the most relevant, popular, and established accounting tools in the market, we conducted further research, including testing six major accounting software platforms.

Based on years of market and user needs research, we've established an accounting software testing methodology that scores these platforms against six main categories, and 25 subcategories – with a total of 1,512 areas of investigation being considered overall.

We also put the platforms through their paces with hands-on testing to gain a deeper grasp of their average user experience. We dedicated 57 hours to carrying out 37 user tests, with a total of 555 tasks being completed in total.

Our main testing categories for accounting software are:

- Core accounting features: We check how adept a platform will be at managing accounting tasks, focusing on key bookkeeping features like invoicing, tax preparation, journal entry, time tracking, financial transactions, and payment support.

- Operational efficiency: We determine how capable a system is at ensuring day-to-day processes run seamlessly, paying close attention to third-party integrations, collaboration tools, AI automation, and customization options.

- Financial planning: We assess how capable a system will be at measuring income, profits, and losses. Specifically, we check for the presence and quality of forecasting and budgeting, inventory management, reporting, and compliance tools.

- Help and support: We assess how useful and reliable a platform's support system is, focusing on support options, whether it's 24/7 support or knowledge center accuracy, as well as cloud backup, and security safeguards.

- Pricing: We compare the overall cost of each platform, taking factors like monthly costs, set-up fees, hidden fees, and free plans into account. We also measure how strict contracts are, and how much it would cost for a business to terminate them early.

- User experience: An overall judgment of how easily users can interact with the platform. We tested each accounting platform and got our team to report how easy they were to use, how they felt when they were using them, and how likely they were to recommend the platform to another business.

When it comes to calculating a product's final score, not all testing areas are weighted evenly, with factors like “core accounting features” and “operational efficiency” being prioritized for small businesses, while sector-specific features are valued more highly for businesses across different industries.

We understand that accounting software is always evolving. That’s why at Tech.co, we have full-time product researchers to re-run this testing process regularly. It’s the only way to ensure our results remain reflective of the present day.

Learn more about our research.

Best for Help & Support: Tie

QuickBooks and FreshBooks are nearly identical when it comes to help and support, which is why we couldn’t choose a clear winner in this category. Both offer a vast array of communication channels to get in touch with representatives, including phone and 24/7 live chat. On top of that, both offer a helpful knowledge center with comprehensive information to self-serve some issues.

Where they differ, however, is minor. QuickBooks offers a user forum, which FreshBooks doesn’t, but FreshBooks offers email support, which QuickBooks doesn’t. All in all, both providers proved to provide top tier help and support options in our in-depth research, so it’s really just a matter of preference when it comes to which one fits your particular needs.

Verdict: Which Is Better, QuickBooks or FreshBooks?

Our research found that QuickBooks is better than FreshBooks for most businesses, because it provides more features for forecasting and budgeting, offers robust reporting tools with a lot of customization, and allows users to invoice in multiple different currencies.

FreshBooks has a clear use case for smaller businesses, though, providing its service at a notably lower price than QuickBooks and providing an easy-to-use platform that beginners can get the hang of quickly. On top of that, it offers some features not found in QuickBooks, like time tracking, so if you need to manage billable hours, FreshBooks is a better fit.

We’ve done some painstaking research to bring you these rankings and ratings for accounting software providers. For more information on that process, check out our research guide to get a better idea of how we pick the best of the best.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page