Our content is funded in part by commercial partnerships, at no extra cost to you and without impact to our editorial impartiality. Click to Learn More

Overall, the best personal finance software is Quicken. Its unmatched speed, comprehensive features, and reasonable price point all unite to create a product that can help anyone take full control of their finances. However, if you’re looking for a free option, Mint is entirely free and a very useful tool. For small business owners looking to manage their finances, the best small business accounting software might be a better fit to meet your professional needs.

Managing your money is an essential skill set – one that isn’t taught in school (apparently learning about the mitochondria is more important). So when you hit a certain point in your life when money starts really coming in, keeping on top of your finances can be a daunting task.

That’s where personal finance software can really come in handy. Using these tools, you can stay on top of your taxes, manage a budget, and stay in tune with your wallet. Here are what we consider to be the top seven personal finance software.

Best Personal Finance Software: Comparison

| Key features | Cost tiers | |||||

|---|---|---|---|---|---|---|

|  |  |  |  | ||

| Quicken | Mint | YNAB | Personal Capital | PocketGuard | TurboTax | QuickBooks |

|

|

|

|

|

|

|

| Free | $11.99 a month or $84 a year | Free | Subscription of $3.99 a month, or one time payment of $34.99 |

|

|

Quicken – Best Overall

Our favorite personal finance software is Quicken. Quicken has one of the most comprehensive lists of features of all the software listed here, and is known for being one of the fastest personal finance software on the market.

Quicken has four paid tiers, with a 30 day free trial on offer for each of them. Their Starter tier costs $35.99 a year, and allows you to view all your financial accounts in one place. You can also create a budget and manage your bills, to see exactly how much money you’re spending, and where it can be saved. Quicken can be used on both a desktop and their mobile app.

The next tier, the Deluxe tier, costs $51.99 a year, and Quicken claims this is their most popular tier. This tier gives you everything in the Starter tier, as well as the ability to create customised budgets, manage and track any debts you have, or create savings goals.

The Premier tier, the next step up, is $77.99 a year, and Quicken claims this tier has the best value for your money. On top of everything in the Deluxe tier, you’ll be able to pay your bills through Quicken, access customer support, and simplify any taxes or investments you’re dealing with.

The final tier, the Home and Business tier, is the only tier that allows you to manage a business as well as your personal finances. This costs $103.99 a year, and, as well as everything in the previous tiers, you’ll be able to manage both personal and business expenses, email invoices through Quicken itself, and track your business’s taxes, profits, and (hopefully lack of) losses.

Quicken is the most well rounded software on this list, giving you everything you’d expect from a personal finance app, being accessible from anywhere you’d need it, and having lightning fast speed.

It should be noted that, as a personal finance tool, Quicken does not support inventory or payroll management, so if you’re looking to eventually use this tool for your own small business, it won’t be as suitable, and you might instead want to take a look at QuickBooks. Read our guide to Quicken vs QuickBooks.

Mint – Best for Budgeting

Let’s start off with the good news, Mint is entirely free. There are no features locked behind paywalls, and no choices to be made about which is the best tier for you. If you’re wondering, Mint makes money through referrals made to financial institutions in their “Ways to Save” section.

So what can Mint do for you? Mint can easily aggregate all of your financial accounts (whether they’re credit cards, investments, or good ol’ bank accounts) and present all their data in easily digestible reports on the main dashboard.

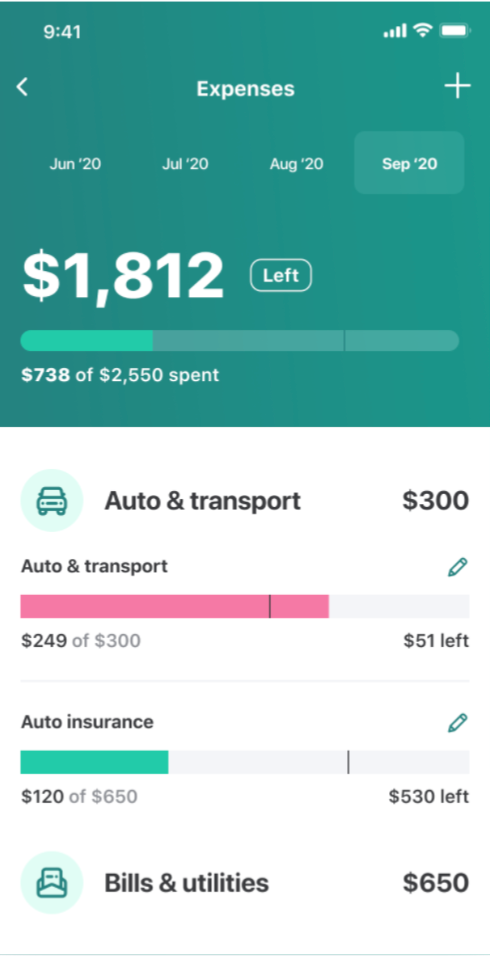

While it can do a lot of things that you’d want from a personal finance app, like creating goals, there are also some very solid budgeting features that can help those trying to limit their spending. After setting up all your accounts, your transactions will be auto-sorted into categories, allowing you to see where most of your money is going. You can even make your own subcategories.

There are also some features that are extremely useful, like giving you your credit score, as well as alerting you when bills come in. You’ll even get weekly summaries of your finances sent to you over email.

If you’re worried about keeping a budget, then using a free app is one of the best ways to go about saving money. Not only is Mint free, but its budgeting capabilities will really help anyone looking to squeeze pennies.

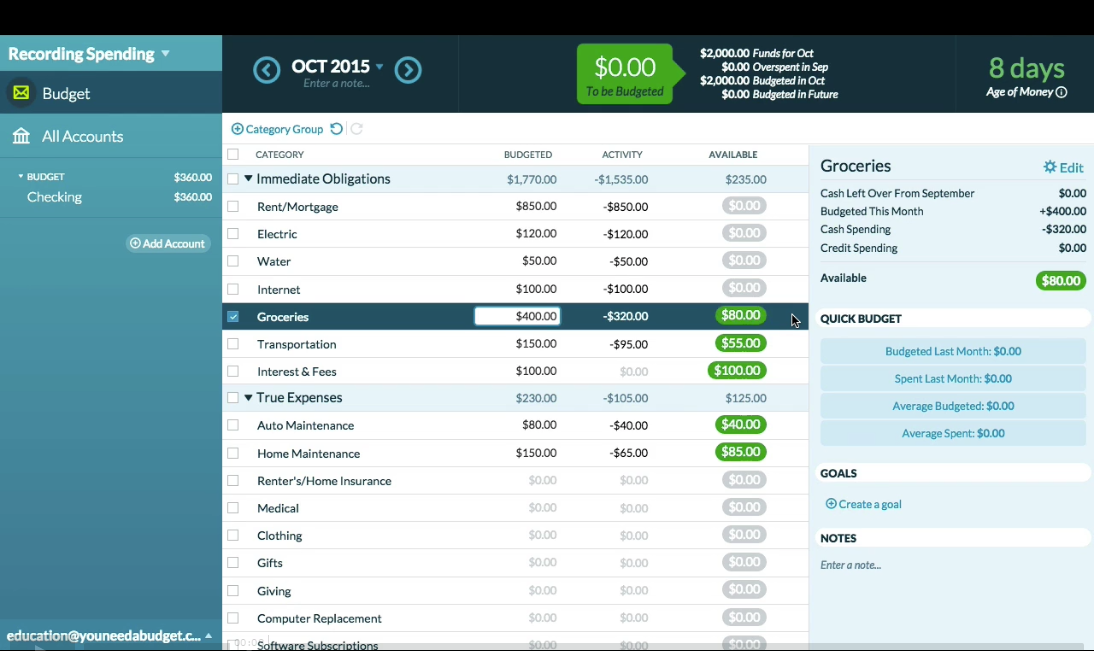

YNAB – Best for Habit Building

YNAB is not the name of a lesser eldritch god – it actually stands for You Need A Budget. If you’re someone who is prone to spending money when you feel like it, you might know that being financially flippant can put you in some pretty hot water. That’s why YNAB is intended for those who need to create, and, more importantly, stick to good money-saving habits.

YNAB doesn’t have any kind of tiered structure. There’s just one product, and you can either pay for it at a rate of $11.99 a month, or $84 a year (which will save you $59). Both can be cancelled at any time.

As the name would suggest, YNAB lets you set budgeting goals. You can share these goals with a partner, hopefully holding each other accountable for paying bills, monitoring investments, and saving money. It allows you to set saving goals, and rewards these goals with a lot of fanfare.

Your progress will be fed back to you in the form of various charts and graphs that can show you how well you’re doing in your quest to save money. And on top of this, YNAB offers free online workshops that can help you learn and retain good money management skills.

It’s not the most feature-packed software on this list, but it’s very fairly priced and will allow you to get used to saving money, hopefully using the app’s positive feedback to encourage you to learn these habits for good.

Personal Capital – Best for Wealth Management

If you have a lot of cash in various locations, whether it’s investments, bank accounts, or wherever else, you’ll want a software that has the capability to understand and process it all. Enter Personal Capital, the software intended for tracking all kinds of wealth.

For an app intended for wealthier customers, you might be surprised to hear that the software itself is free. Instead, Personal Capital contacts their users who have over $100,000 in investments, hoping to turn them into full-on clients.

Don’t worry, you don’t need $100,000 worth of investments to use the software. You can still use Personal Capital’s budgeting tool and savings planner to keep on top of your money.

When it comes to exclusive features, Personal Capital has two pretty handy features that most other software don’t offer. The first is the net worth calculator, which subtracts what you owe from what you have, giving you your official net worth. The other is a retirement planner, which you can use to see how close you are to putting your feet up on a beach for the rest of your life.

If you’re an adult with established wealth in your pockets, Personal Capital can help you manage your investments, calculate your overall wealth and retirement path, and even set you up with a free portfolio review worth $799 (provided you have more than $100,000 in the software).

QuickBooks – Best for Small Businesses

The software that can help a business stay on top of their finances. QuickBooks is a great software for anyone looking to save money, with four varied tiers that can allow increased amounts of people to use the software.

Firstly, their Simple Start tier is $25 a month, and supports a single user. It offers basic accounting software features, like expense tracking, reports, unlimited invoices and estimates, and contact management.

However, as you start to look at more expensive tiers, the amount of users steadily increases. Their Essentials plan, costing $40 a month, gives access to three users, and also enables you to manage bills and track time on certain tasks.

The Plus plan costs $70 a month, and provides access to five users, as well as unlocking the ability to track inventory, job costing, and tax support. Finally, at $150, the Advanced tier gives access to 25 users, and enables a lot of customer support features.

If you’re running a small business, you probably wouldn’t go above the Essentials plan ($40 a month), which offers useful features to three users at a very reasonable price point.

PocketGuard – Best for College Students

As you can assume with a product ranked best for college students, PocketGuard is very affordable and simple. It’s a very simple personal finance app, not tackling more complex issues like taxes or business expenses, opting instead to give its users a simple birds eye view of their finances.

There are two tiers in PocketGuard, the standard PocketGuard account, which is entirely free, or the PocketGuard Plus account, which can be bought for a single payment of $34.99, or a monthly subscription fee of $3.99.

A standard account breaks its users finances down into extremely basic illustrations in order for them to compare income and expenses. You can set spending limits, saving goals, and compartmentalise your expenses into things like rent, food, or entertainment.

A PocketGuard Plus account opens a few more options, like additional goals and categories, tracking physical cash, and tinkering with transaction information (like dates). None of this is hugely necessary, but can definitely help make the PocketGuard experience a bit more fleshed out.

If you’re not juggling too many accounts or investments and are simply looking to keep track of where your money is going, PocketGuard is a good pick. The one downside is that there’s no dedicated app, which isn’t too conducive to the rest of its vibe.

TurboTax – Best for Taxes

Taxes can be a nightmare. Terminology, different forms for different individuals, and not too much help out there. If you’re struggling with the tax end of your finances, TurboTax might just be the finance software for you.

TurboTax is made up of four tiers. The first tier is free, and, as you’d expect, is a bit barebones, allowing you to file simple tax returns and use a photo of your W-2 tax form to begin the process.

Their first paid tier, the Deluxe tier, is their most popular tier. For a single payment of $60, you’ll be able to search their list of over 350 tax deductions and credits to find any that apply to you. You’ll also be able to easily figure out your deductions relating to property tax or charitable contributions.

The next level up, the Premier tier, costs $90. On top of everything in the Deluxe package, you’ll be able to cover your stocks, bonds, and other investments, as well as automatically import your investment income. It will also cover rental property income, as well as any gains (or losses) from cryptocurrency transactions.

Their most expensive tier is intended for those who are self-employed or own small businesses. It costs $120, and lets you manage business taxes on top of personal ones. It will help you uncover any industry-specific deductions for more tax breaks, as well as offering one-to-one help with a specialist.

It’s worth noting that each of these prices are subject to state-based changes. It’s also worth noting that you only pay for TurboTax once you’ve filed. You can use the software all you like up until you actually file your taxes, so if you’re halfway through using it and don’t like it, you can just stop, with no financial setback.

TurboTax doesn’t do much (or anything) beyond taxes, so you wouldn’t get it to help with a budget, but if you’re specifically looking for help with what you owe Uncle Sam, TurboTax is a very solid choice.

How to Choose a Personal Finance Software

The first step you’ll want to take when choosing a personal finance software is nailing down what you need. For example, if you’re really pinching pennies, you won’t want to go for a pricier software. And if you’re looking for help with taxes, you obviously wouldn’t want to use a software that doesn’t help with that.

There are three big things to consider when picking a perfect software: your budget, your goals, and your desired features. As mentioned, you’ll want to opt for a software you can afford – since saving money is the whole point in the first place. If you’re concerned about saving money on your software, PocketGuard is a great choice.

However, if you’re looking to manage different incomes and minimize expenses, then Personal Capital or Albert are good choices. There are all kinds of reasons you’d want to opt for a personal finance software, so make sure you know what you want.

Verdict

What Is the Best Personal Finance Software?

While each personal finance software fills its own niche, on the whole, Quicken is the best choice you can make. It’s sleek, easy to use, and covers almost all the bases you’d want in a personal finance software, like budgeting and taxes.

However, there are definitely reasons to choose other software. PocketGuard is far cheaper, and Mint is even free, letting you create budgets without factoring in the cost of the software itself, and TurboTax is laser-focused on tax, allowing you to go in depth with different forms and numbers.

Overall, all the software listed here will be able to help with financial situations, so if you opt to invest in one, feel free to send a percentage of your savings to the author of this article for generously helping you choose!

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page