Over the last few months, Tech.co has been surveying logistics professionals to get an idea of how tariffs are impacting their bottom line, and spoiler alert, they’re not exactly good for business.

In February, newly-elected President Trump announced a bevy of new tariffs for countries around the world. Dubbed the Liberation Day tariffs, these import taxes have been hitting businesses like a ton of bricks, with the logistics industry in particular baring the brunt of the financial burden.

In this report, we’ll evaluate some key statistics that explain how tariffs are causing tension in the logistics industry, so that businesses can properly prepare for any strife they may experience as a result.

Key Takeaways

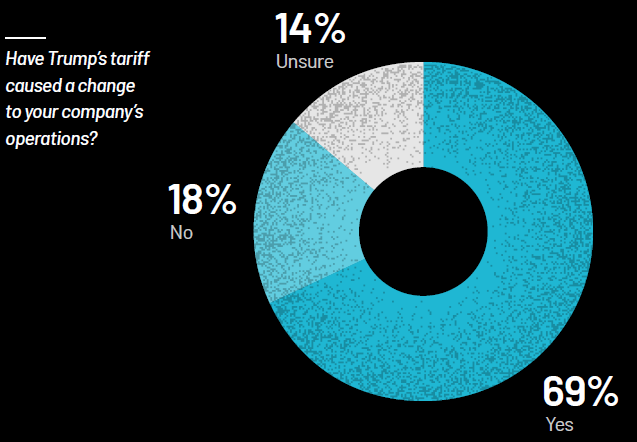

- 69% of businesses state that Trump’s tariffs have caused a change to their company’s operations.

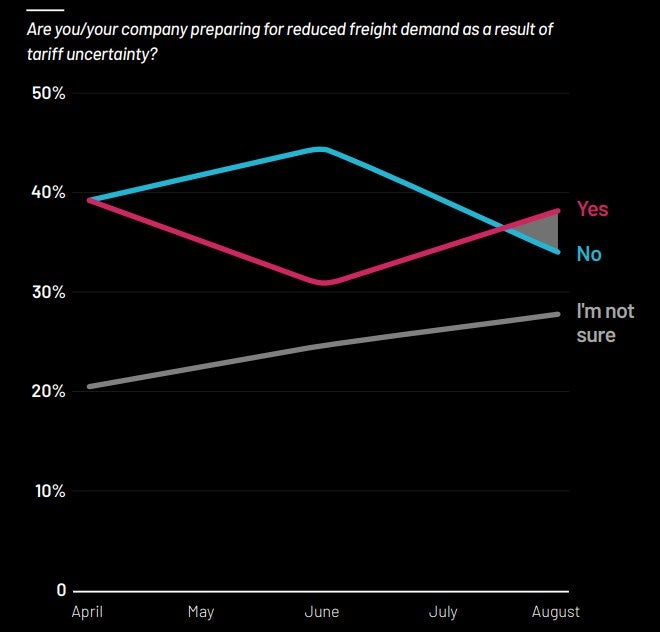

- 39% of logistics professionals said that they are preparing for reduced freight demand as a result of tariff uncertainty.

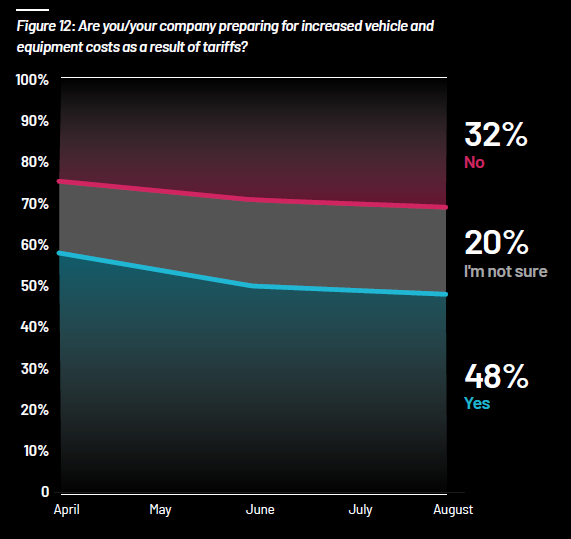

- 48% of businesses are preparing for increased vehicle and equipment costs as a result of tariffs.

The Impact of Tariffs on Logistics

It may seem like tariffs are nothing more than an additional tax that will cost businesses more, but the reality is that these tariffs are having a domino effect on the logistics industry as a whole.

From stifling decision-making due to uncertainty around future tariffs to the added costs of doing business, the logistics industry is effectively stuck in a holding pattern when it comes getting the job done. Our data found that 69% of logistics businesses have changed their operations in response to tariffs in August.

Even worse, that number isn’t getting smaller as tariffs become more engrained in the economy. In April, only 66% of businesses were changing operations in response to tariffs, which points to the general turmoil that these tariffs are creating.

The Impact of Tariffs in 2025

While the knock-on effect of the tariffs has touched most industries, it’s fair to say that the one facing the full force of the legislation is logistics. It’s not just those dealing with imports, either. Peaks and troughs in product demand as a direct result of the tariffs have caught many off guard, and an increase in costs for vehicle parts has had a major impact on many firms when it comes to maintenance and upgrading fleets.

Could Tariff Uncertainty Lead to Lower Demand?

Tariffs impact the entirety of the supply chain, which means that businesses need to prepare not just for higher import taxes, but they also need to make sure they are equipped to manage reduce freight demand for customers that don’t want to pay the extra fee.

In our survey, we found that 38% of businesses say that they are preparing for reduced freight demand as a result of tariff uncertainty. However, these numbers have fluctuated substantially over the last few months, with only 31% stating the same in June and 39% in April. This is likely due to the freight frontloading that occurred at certain points this summer, to keep costs low before more tariffs went into effect.

Perhaps the only consistent response in regard to freight demand in response to tariffs is that more and more businesses are simply lost at what actions to take. Our data found that 28% of businesses are not sure how to respond to tariff uncertainty in regard to freight demand, up from 25% in June and 21% in April.

The Impact of Tariffs on Equipment Costs

President Trump’s tariffs have had far-reaching effects in a variety of industries, and it’s worth noting that almost all of them have some kind of equipment costs associated with doing business. The majority of businesses are worried about these increasing costs, with 48% of professionals stating that they are preparing for increased vehicle and equipment costs as a result of tariffs, compared to only 32% stating that they are not.

However, the good news is that optimism seems to be taking hold in regard to how bad these costs will impact business. In April, 58% of businesses said that they were worried, and only 25% said that they weren’t, pointing to a substantial reduction in how concerned businesses are about the additional costs associated with tariffs.

Still, that could change. Tariffs take a while to manifest these extra charges, which means that these costs could ramp up and create more uncertainty in the coming months.

Tech.co: Who Are We and Where Did This Report Come From?

Tech.co is a global media brand with a focus on B2B technology. We cover a broad range of business technologies, from white collar solutions like website builders, project management tools, or CRM platforms to blue collar tech solutions like field service, asset tracking, and fleet management.

For our most recent project — a series of 7 reports covering the key dynamics of the logistics sector across most of 2025 so far — we opted for multi-faceted in-depth research that combined three core data sources.

First, we included the results from a Pulse tracker survey we’ve been running every month since April 2025. Our 1,582 responses include logistics professionals from ground-level staffers to senior management.

Second, we used our BenchmarkMe Survey data, which tracked 840 responses from purchase-decision makers discussing their technology priorities. Finally, we conducted direct interviews with a selection of industry leaders, for added context.