Zelle is a popular digital payment platform that allows direct access to user bank accounts, which means that it is, of course, a prime target for scammers online.

The internet is tragically filled with scammers in the modern era, with bad actors focusing on everything from Google Chat to Geek Squad in hopes of scoring an easy payday.

Unfortunately, Zelle represents a particularly attractive scam candidate, as there is little recourse for scammed individuals to get their money back. So what can you do to keep yourself safe? You can understand what kind of Zelle scams are out there, so you can spot them before it’s too late.

What Are Zelle Scams?

Zelle scams are simply scams that are perpetrated through the Zelle platform. For those that don’t know, Zelle is an online payment service that allows users to send and receive money directly to their bank accounts. Unlike platforms like Venmo and CashApp, Zelle doesn’t have an in-app wallet, but instead facilitates transfers directly into and out of bank accounts for faster payments.

While this feature is understandably quite convenient, it does lend itself to abuse from scammers. Because the funds go immediately into, or in the case of scams out of, you’re bank account, there’s little recourse for getting it back when fraudulent situations arise.

Here are some of the most common Zelle scams to look out:

Zelle Fake Purchase Scams

As you can imagine, one of the most prominent scams on Zelle is centered around purchasing and selling products on a variety of marketplace platforms. Facebook Marketplace, in particular, is primed for Zelle scams, as it’s specifically aimed at selling to, and purchasing from, strangers.

In most cases, these scams are pretty straightforward. You reach out to a user on a marketplace platform, and they demand that you pay via Zelle. Once you send over the payment, the user will disappear with no plans to send you the product in question.

Because Zelle transfers are not reversible, there’s little you can do to get your money back, and the scammer is already in the wind due to what is likely a fake name, a fake account, and even a fake product.

How to avoid this scam: Many marketplace platforms require some kind of government-issued identification card to get verified, which means you can ask for this kind of information before committing to a purchase. Otherwise, you better get buddy-buddy with your bank, as that’s the only way to reverse a charge through Zelle.

Zelle Phishing Scams

While straightforward purchase scams on Zelle are common, phishing scams impersonating the financial service company are just as problematic and a little harder to spot.

This scam typically occurs when trying to sell an item on a marketplace platform. The user will reach out to purchase the item and will ask for your email address to send over the Zelle payment.

You’ll then receive the email below, which basically states that you’re not a “business account,” so your Zelle account can’t accept a payment of that size. To remedy this, the email says that you need to send an even larger amount back to the alleged purchaser to “expand” your limit.

The problem? This is not an email from Zelle, individual accounts don’t have limits like this, and you’re going to get scammed if you send the money back to the send. They’ll keep your money, you’ll still have your unsold product, and your Zelle account won’t be expanded (because that’s not a thing).

How to avoid this scam: If you’re selling a product, there’s no reason to ever be sending someone money. If they can’t figure out how to send you the money for a product you’re selling in an easy and comprehensive way, trust us, they’re not the right buyer for you.

Zelle Charity Scams

This scam is typical across the payment service spectrum, but Zelle is a particularly popular option, because again, you don’t have much recourse for a refund.

The scam goes like this: You’re contacted, either via text message, email, or another messaging service, and are told that a particular current tragedy requires donations and that you can help with your Zelle payment. The language is typically a bit off, with spelling errors and grammatical mistakes throughout.

Obviously, the money is not going to the cause in question, but rather directly into the wallet of a potential scammer. And because it’s with Zelle, there is no way for you to get the funds back once they’re on the way.

How to avoid this scam: Always verify whether or not a charity is real before making a donation, particularly with a non-refundable option like Zelle. Even if it seems legit, a cursory glance online can help you make sure your funds are actually going to help the cause they say they are.

Zelle Fake Job Scams

This scam is a bit convoluted, but despite its complexity, it’s quite a common scam to occur, as multiple news sources have reported on first-hand accounts from those that have been scammed.

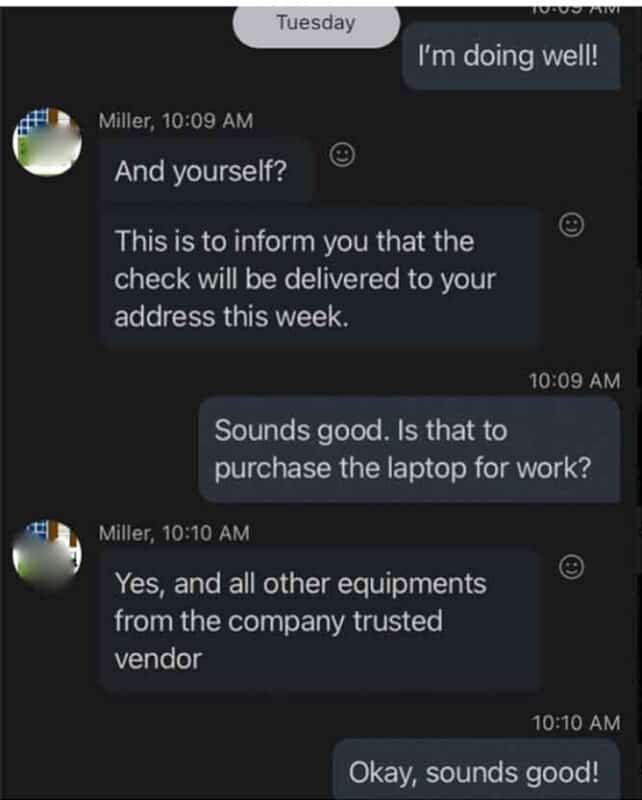

It starts with a job search, typically for a remote work position. An applicant will receive word that they’ve been granted an interview with a company, but that the interview will be conducted over messaging app, rather than through normal channels like video chat or phone call. After the messaging interview, you’ll learn that you got the job.

As with any job, you need to get set up with hardware to access the company’s database. Your interviewer will explain (see below) that the company will mail you a check, and then you’ll have to purchase a laptop and software through their “trusted vendors.” The check will arrive, you’ll deposit it, and the funds will appear to be available, leading you to believe that buying your work supplies through these Zelle-requiring vendors is all above board.

Because this is a guide to Zelle scams, you probably already know that the check from that company isn’t legitimate. Because banks make funds available to trustworthy accounts before confirming the validity of checks, the user will appear to have the funds available, but after a few days, they will be unavailable to the applicant, leaving them with a smaller bank account and no job to speak of.

How to avoid this scam: For starters, always make sure you actually see the person interviewing you for a job. Beyond that, if you’re ever buying something that is being reimbursed, confirm that the funds are actually available before committing to a purchase, particularly via Zelle.

Read more on how to avoid remote job scams.

Zelle Property Rental Scams

Scams on Zelle are often most prominent when highly priced items are in the mix, and there’s nothing more expensive than property rental. Subsequently, you have to keep your eye out for this scam when looking for a new apartment or even just talking to your “landlord.”

This scam takes advantage of rushed nature of housing with rental listings for units that are either unavailable or simply don’t exist. Supposed landlords will request payment via Zelle for deposits and first month’s rent, banking on the fact that renters won’t need to see the space in advance.

Obviously, the rental property ends up being fraudulent in some way, and the scammer in question is already off to their next target while you still need to find a place to live.

How to avoid this scam: First off, look out for listings with no pictures, that’s an immediate red flag for scams. Additionally, always ask to see a property before making a deposit or paying first month’s rent. As hectic as the housing market is right now, a sight-unseen rental has a good chance of ending up as a scam if you don’t confirm it’s actually on the market in the first place.

How to Spot and Report Zelle Scams

The first step of spotting Zelle scams is understanding how they happened. Fortunately, now that you’ve made it to the end of this guide, you’ve taken your first step to stop these scams in their tracks. The most important thing to remember is that if a stranger wants you to send money through Zelle, for any reason, make sure you have some assurances that you’ll receive what you’re paying for.

If you want to report a Zelle scam, you can always head on over to the platform’s “report a scam” page to fill out a form that will help the company track down the scammer and, hopefully, bring them to justice.