Most nonprofits will find that QuickBooks is a good solution to their business needs. It delivers some great sector-specific accountancy tools, as well as some features that aren’t available at all from other platforms, including detailed budget-tracking and its checking account app.

QuickBooks for Nonprofits also stands out for its specialist toolkit, and its respectable entry price of $99 per month. If this is a bit too steep for you, it’s worth checking out our list of the best free accounting software options for small businesses and nonprofits.

It’s not perfect, though: Users will have to pay extra for remote access and specialized online training, so QuickBooks for Nonprofits is best for in-person nonprofits, and less accessible for the rising number of smaller nonprofits with remote or hybrid teams.

To help you find out if QuickBooks NonProfit is worth the investment, scroll down to learn more about its value offering, features, and limitations. Alternatively, check out our comparison table to see how it stacks up against its competition.

Pros

- Flexible donation management. Accept donations by credit card, debit card, bank transfer, cash, or check.

- Create budgets with real-time data and collaborate with teammates.

- Integrations with over 750 third-party apps, including nonprofit platforms such as Kindful.

Cons

- Remote access requires the Advanced plan, which costs $235 per month.

- 25-user limit won't be suitable for large enterprises.

- Price from: $99/month

- 30-Day free trial

- Deal: 50% off the first 3 months

- Enterprise plan costs $208/month

QuickBooks for Nonprofits: Quick Fact File

Not sure if QuickBooks for Nonprofits is right for you? Take a look at some key deciding factors below:

- Price – QuickBooks for Nonprofits pricing packages start at $99 per month for the provider’s Plus plan. That’s notably pricier than competitors like FreshBooks and Xero, making it less suitable for nonprofits with limited funds. At the moment, however, QuickBooks is running a promotional offer, so customers can get 50% off the first 3 months of a year-long plan.

- Free trial – Free trials are available for the QuickBooks for Nonprofits Plus and Advanced plan, but not for Enterprise for Nonprofits. And unlike Wave, no free versions are available. If you go for the promotional offer outlined above, you’ll have to waive your free trial.

- Help and support – QuickBooks offers outstanding customer support. With 24/7 phone support, useful video tutorials, and help articles, it outstrips competitors like Xero and Wave.

- Donation features – Organizations can use the QuickBooks mobile app to collect and record donations on the go, but it doesn’t let you filter client information granularly like FreshBooks.

- Accountancy features – QuickBooks’ accounting tools are a cut above the rest. The provider offers a number of unique features like detailed budget tracking and streamlined expense reporting.

- Reporting features – QuickBooks reports let you monitor financial metrics through a customizable dashboard. The results are easily exported and shared too, which is great if you’re pulling together a report.

- Integrations – QuickBooks integrates with tons of industry-specific add-ons like Kindful and DonorPerfect, but these do come at a premium.

| Price | Users | Inventory management | Financial reporting Does it offer financial reporting tools? | Budget and forecasting Does it offer budgeting and forecasting tools? | Premium integrations | Account team access | Remote access | ||

|---|---|---|---|---|---|---|---|---|---|

| 5 | 25 | 40 | |||||||

| | | | |||||||

| | | | |||||||

| | | | |||||||

| | | | |||||||

| | | | |||||||

| | | |

All QuickBooks’ Nonprofit plans offer all the bookkeeping and accounting features you need to get by, from invoicing and receipt capture to advanced financial tracking. However, QuickBooks’ Plus plan is limited to five users, so will only be suitable for sole-member nonprofits or small teams.

It also lacks a number of features included in the Advanced plan, like advanced analytics, workflow automation, and employee expenses – making it unsuitable for larger nonprofits or organizations with specific needs.

While both these plans offer unique and useful capabilities, QuickBooks’ entry price of $99 per month is much steeper than similar software like Xero and FreshBooks, which both have advanced plans for $20 per month or less. If you manage remote teams or require up to 40 users, you’ll need to fork out $208 a year for the provider’s Enterprise solution too.

All in all, Quickbooks for Nonprofits is pretty pricey. Xero’s equivalent offering starts at just $20 per month (currently discounted to $2 for the first three months of a year-long plan). FreshBooks, meanwhile, offers a discount to its nonprofit customers. If you were interested in the Plus plan ($33 per month), for instance, you would only have to pay the cost of the previous plan (Lite plan, $19 per month).

Is there a free plan?

QuickBooks for Nonprofits doesn’t have a free plan, but it does offer a free trial for its Plus and Advanced plan. Unfortunately, users aren’t able to trial the provider’s Enterprise solution for free, so will need to enter monthly contracts to unlock features like remote access and online training.

If it’s free accountancy software you’re after, Wave’s always-free service is by far the best complimentary option out there. The market isn’t short of affordable solutions either, so check out our accounting comparison table for a simple breakdown of costs.

QuickBooks for Nonprofits Review: Key Features

QuickBooks’ impressive feature stack is hardly a secret, but how does the tool lend itself to nonprofit organizations? We break down some of QuickBooks’ for Nonprofit’s standout accountancy and sector-specific features below.

Invoicing

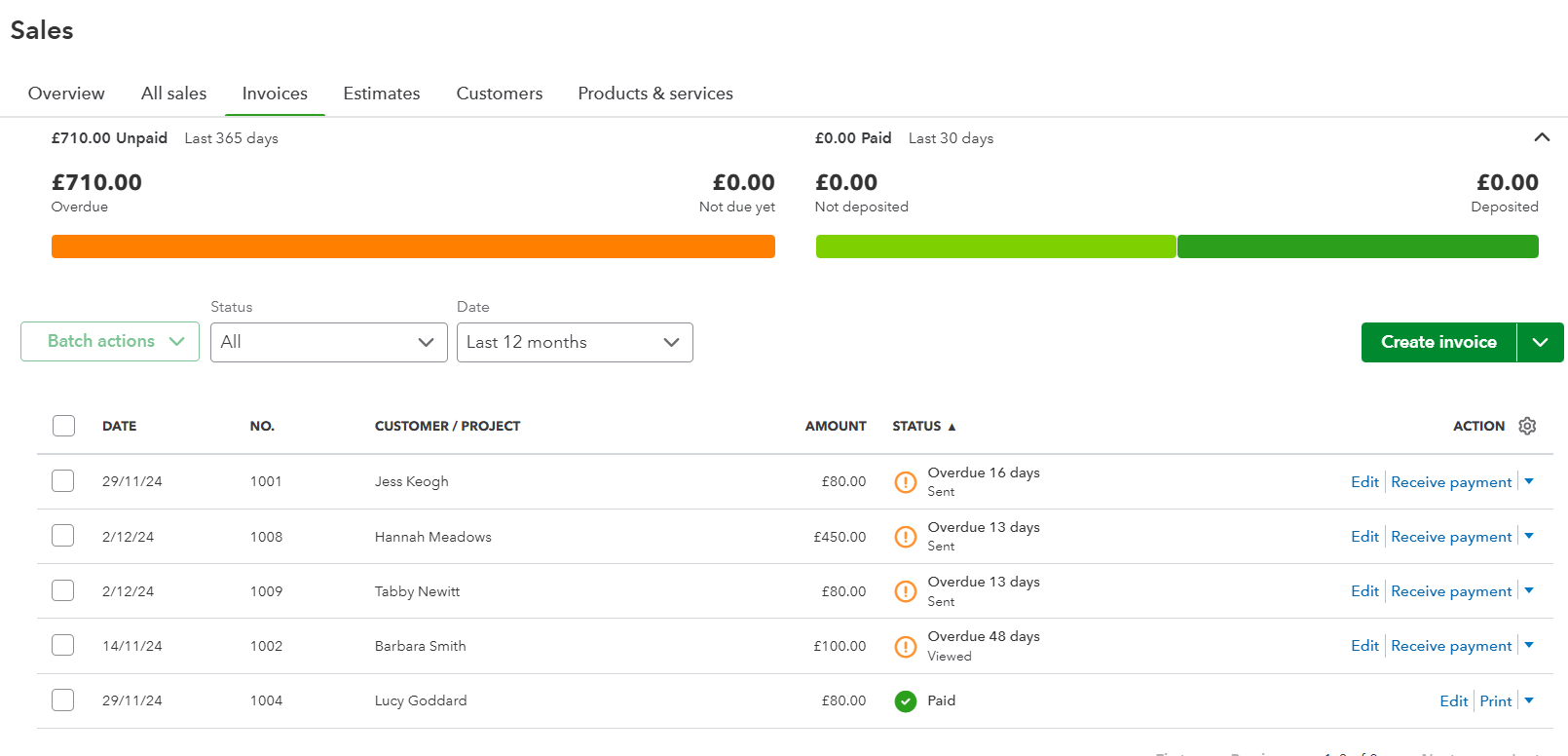

With QuickBooks’ invoice features, nonprofits can create custom invoices with their business logo, instantly accept online payments through the invoice in question, and track status, send payment reminders, set up recurring payments, accept optional tips, and match payments.

These advanced capabilities make QuickBooks much better-suited to larger organizations than solutions with more stripped-back invoicing tools, such as Wave and Zoho Books. If you’re not running a large operation, however, check out our guide to small business invoicing software.

Invoice records can be accessed under the Sales section of QuickBooks Online. Source: Tech.co testing

Financial management

QuickBooks tries to make managing your cash flow as simple as possible. The platform lets you categorize revenue expenditures by fund or program, track budgets by fund or program, track tax deductions, and even forecast money-in and money-out up to 90 days in advance.

QuickBooks for Nonprofits users can even open a QuickBooks Checking account for free, allowing them to make custom forecasts, receive instant deposits, and even earn 3.00% APY by storing their spare cash in envelopes.

Donor management

QuickBooks makes it easy to keep track of donations no matter which forms they take: It handles cash, check, e-check, credit card, or debit card.

The provider also offers a mobile app that lets users record money directly through their mobile devices. This feature isn’t offered by similar software, which makes QuickBooks one of the most useful tools for recording charitable contributions. Please note, this isn’t available on the Enterprise solution, which is orientated towards desktops.

Fund accounting

Like Xero and FreshBooks, QuickBooks has fund accounting software that helps non-business entities record the journey of their finances easily so they’re able to function efficiently and comply with legal standards. The platform even lets you use Class location to track each fund separately and sub-accounts to keep tabs to keep tabs on them from your Chart of Accounts.

Financial reports

Insufficient funding is a top five reason why nonprofits fail. For organizations looking to become more financially efficient, QuickBooks for Nonprofits gives users access to powerful sales and profitability reporting software.

QuickBooks even lets organizations build customizable reports based on their distinct needs – a benefit that you’ll miss if you opt for solutions like Wave or FreeAgent. Advanced users can even use QuickBooks to track revenue streams, cash flow, expenses, and more.

There’s a lot going on on the QuickBooks dashboard, but clever segmentation and color coding ensures that it never gets confusing. Source: Tech.co testing

Integrations

If QuickBooks is lacking features your nonprofit needs, you’re also able to use its app store to integrate with over 750 third-party apps including fundraising solutions like KindFul and LittleGreenLight and donation management tools like Method:Donor, and Donor Receipts.

Premium integrations like LeanLaw, Docusign, and HubSpot are available too, but only for organizations willing to pay a little more for QuickBooks’ Advanced plan ($235 per month).

Here are just some of the integrations you can get with QuickBooks. Source: Tech.co testing

Benefits of QuickBooks for Nonprofits

Here’s our quick at-a-glance summary of the advantages that this platform offers when compared to other accounting solutions.

- Versatility – QuickBooks lets you track finances, create reports and manage donations from one platform – saving nonprofits from needing to invest in separate software.

- Quality of features – QuickBooks doesn’t sacrifice quality for quantity. It has an impressive accounting toolkit, with advanced features including automatic data sync with Excel, the ability to connect all of your sales channels, and multiple available currencies.

- Ability to import donations – You’ll be able to integrate popular donation apps including Fundly or DonorPerfect, so all nonprofit transactions can be centralized.

- Excellent support – For new non-business entities new to accounting software, QuickBooks’ 24/7 phone support and expansive knowledge base make resolving queries easy.

- Scalability – Charities can upgrade the service or pay for add-ons as they grow, helping the service to scale alongside them.

For a taste of how you might find it to set up Quickbooks for your nonprofit, read our guide on How to Use Quickbooks Online, a very similar product offered by Quickbooks.

Drawbacks of QuickBooks for Nonprofits

- Entry price – QuickBooks for Nonprofits’ entry price of $99 per month excludes small nonprofits with more limited funds to invest.

- No free version – Unlike accounting software like Wave and Zoho Books, charitable organizations can’t use QuickBooks for Nonprofits for free. Check out our guide to free accounting software, if this is a key factor for you.

- Remote access costs extra – If your team isn’t based in a single location, you’ll need the Advanced plan, which starts at a very steep $235 per month.

Should You Use an Alternative Accounting Software?

QuickBooks is a one-size-fits-all accountancy tool, but it won’t be the number one choice for every nonprofit.

Wave is a solid free option for nonprofits with basic accounting needs, while Xero has an impressive feature set, with in-depth reports that can easily be shared with donors and volunteers. Appealingly, it’s also cheaper than QuickBooks, with plans starting at $20 per month.

However, if you do go for Xero, be prepared for a highly frustrating user experience. In our most recent round of user testing, Xero scored very poorly for usability (2.9/5), with our testers pointing out that the interface was outdated and difficult to use, with a particularly overwhelming dashboard that won’t be suitable for software novices or time-poor businesses.

If you’re looking to take full control over your finances, but aren’t able to front QuickBooks’ pricey plans, FreshBooks offers advanced tools like automated bank imports and business health reports for as little as $19 per month. FreshBooks also offers tailored software to Churches, making it more adept than QuickBooks at meeting the needs of religious organizations.

Every accounting provider has its own unique benefits, though. Check out our QuickBooks alternatives guide here, see our pricing guide for the main QuickBooks Online platform, or take a look at our table to see how it weighs up against its rivals:

| Starting price | Free trial | Best for | Key features | |||

|---|---|---|---|---|---|---|

|

|

| |||||

| 30 days | It’s free, no trial needed | 14 days | 30 days | 30 days (demo only) | 30 days | |

| Experienced accountants and established businesses with complex financial needs | Best free option | Managing sales and inventory | New businesses | Businesses seeking tailored financial solutions and strong brand reputation | Budget-conscious businesses | Easiest Setup |

|

|

|

|

At Tech.co, we take our impartial research and analysis seriously, so you can have complete confidence that we're giving you the clearest, most useful recommendations.

After conducting an initial investigation to identify the most relevant, popular, and established accounting tools in the market, we conducted further research, including testing six major accounting software platforms.

Based on years of market and user needs research, we've established an accounting software testing methodology that scores these platforms against six main categories, and 25 subcategories – with a total of 1,512 areas of investigation being considered overall.

We also put the platforms through their paces with hands-on testing to gain a deeper grasp of their average user experience. We dedicated 57 hours to carrying out 37 user tests, with a total of 555 tasks being completed in total.

Our main testing categories for accounting software are:

- Core accounting features: We check how adept a platform will be at managing accounting tasks, focusing on key bookkeeping features like invoicing, tax preparation, journal entry, time tracking, financial transactions, and payment support.

- Operational efficiency: We determine how capable a system is at ensuring day-to-day processes run seamlessly, paying close attention to third-party integrations, collaboration tools, AI automation, and customization options.

- Financial planning: We assess how capable a system will be at measuring income, profits, and losses. Specifically, we check for the presence and quality of forecasting and budgeting, inventory management, reporting, and compliance tools.

- Help and support: We assess how useful and reliable a platform's support system is, focusing on support options, whether it's 24/7 support or knowledge center accuracy, as well as cloud backup, and security safeguards.

- Pricing: We compare the overall cost of each platform, taking factors like monthly costs, set-up fees, hidden fees, and free plans into account. We also measure how strict contracts are, and how much it would cost for a business to terminate them early.

- User experience: An overall judgment of how easily users can interact with the platform. We tested each accounting platform and got our team to report how easy they were to use, how they felt when they were using them, and how likely they were to recommend the platform to another business.

When it comes to calculating a product's final score, not all testing areas are weighted evenly, with factors like “core accounting features” and “operational efficiency” being prioritized for small businesses, while sector-specific features are valued more highly for businesses across different industries.

We understand that accounting software is always evolving. That’s why at Tech.co, we have full-time product researchers to re-run this testing process regularly. It’s the only way to ensure our results remain reflective of the present day.

Learn more about our research.

Verdict – Is QuickBooks for Nonprofits Right for Your Business?

QuickBooks for Nonprofits is a versatile accountancy and donation management tool that should be able to meet the needs of just about any nonprofit – but this is hardly surprising. QuickBooks is a robust accounting tool which scored well across core accounting, operational efficiency, and help and support in our most recent round of testing.

Despite this, QuickBooks for Nonprofits’ plans may be on the pricier side for smaller charities or sole member nonprofits – especially if they require additional tools like remote access. For nonprofits with a keen eye on their bottom line that aren’t willing to compromise on features, we would recommend using Xero or Zoho Books instead.

If you still aren’t done playing the field, check out our free comparison table for a crystal clear view of how QuickBooks stacks up against the rest.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page