2025 put the logistics industry through the wringer when it came to regulatory changes. One big new law was the addition of proficiency in English legislation, which cracked down on drivers with poor English language skills. Another was the removal of the nearly-a-century-old De Minimis Exemption, a law that allowed low-value packages to enter the US duty free.

More changes are likely to arrive in the near future, like potential emissions regulation. At the same time, fleets have plenty of existing laws to keep on top of, from state fuel taxes to mandated ELD telematics in every commercial vehicle.

How are logistics pros handling it all? We found out.

Download Tech.co’s brand-new Policy Pressure report to get our high-level overview covering how the industry is thinking about regulatory changes and what types of technology it’s adopting in response to them.

Policy Pressure 2025 Report: Key Takeaways

- The share of operators who claimed “adapting to regulations” as their top focus grew from 7% to 11% between April and August 2025.

- 58% of respondents settled on “safety and compliance requirements” above other types of regulatory compliance.

- Of those adopting new technology in August, 46% said they planned to adopt electronic logging devices, a piece of hardware for mandatory compliance.

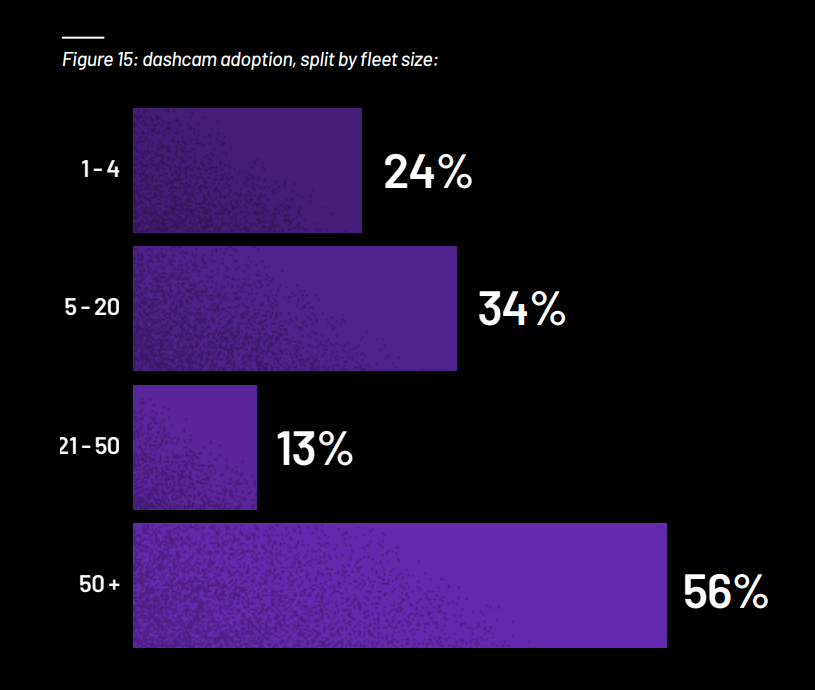

- Of the fleets that are adopting dash cams, 56% are large fleets with 50 or more vehicles.

The Biggest Focus Right Now: Safety and Compliance

In April 2025, 7% of the logistics operators we polled said that “adapting to regulations” was the priority they were most focused on during that quarter. By August, that amount had nearly doubled, reaching 12%.

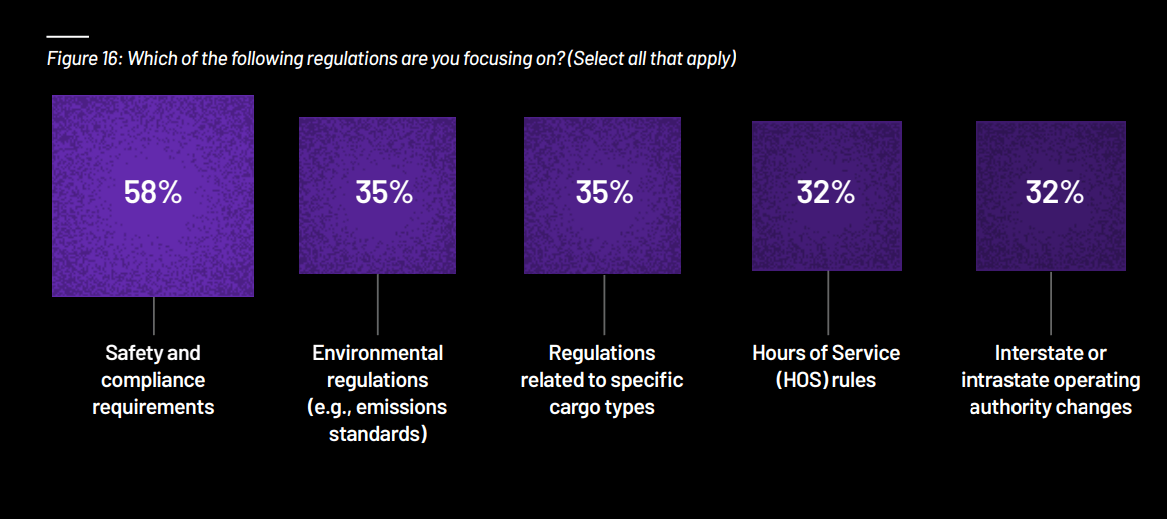

What exact laws are they so focused on? A whopping 58% of respondents settled on “safety and compliance requirements” when asked to name their current regulatory focus.

Logistics Policy Changes in 2025

We’ve seen steady growth over the past few months when it comes to prioritizing regulations, with the most efforts being made in the safety and compliance sector. [Our new report covers] how much priority firms are placing on regulation types, and the danger of a divide between small and large logistics companies.

Keeping workers safe on the job while meeting all legal conduct regulation is a top focus of attention for the majority of logistics operations, well ahead of other regulatory issues, including environmental concerns (35%), cargo types (also 35%), or even hours of service tracking (32%).

Common Fleet Compliance Tools Include ELDs and Dash Cams

For many logistics companies, installing new tech solutions is the key to keeping on top of compliance regulations.

Out of the 15% of professionals who told us they were prioritizing “adopting new technology” in August, 46% of them said they planned to adopt electronic logging devices (ELDs).

Not all fleets are equal, however. For example, 48% of businesses are adopting dash cam technology. However, within this group, the size of the fleet makes a big difference: 56% are large fleets of 50 or more vehicles. All smaller types of fleets were less likely to adopt dash cam systems.

Tech.co: Who Are We and Where Did This Report Come From?

Tech.co is a global media brand with a focus on B2B technology. We cover a broad range of business technologies, from white collar solutions like website builders, project management tools, or CRM platforms, to blue collar tech solutions like field service, asset tracking, and fleet management.

For our most recent project — a series of seven reports covering the key dynamics of the logistics sector across most of 2025 so far — we opted for multi-faceted in-depth research that combined three core data sources.

First, we included the results from a pulse tracker survey we’ve been running every month since April 2025. Our 1,582 responses include logistics professionals, from ground-level staffers to senior management.

Second, we used our BenchmarkMe Survey data, which tracked 840 responses from purchase-decision makers discussing their technology priorities.

Finally, we conducted direct interviews with a selection of industry leaders, for added context.

To see the full insights we gleaned, click here to download our full Policy Pressure report today.