An increasing number of businesses operating in the transport and shipping sector are being forced to spend more each month on fuel, data obtained by Tech.co in July 2025 reveals.

The news comes after a sharp increase in crude oil prices in June, and signals that US businesses are really starting to feel the pinch.

To make matters worse, being forced to manage these immediate financial pressures means logistics businesses now have less time and resources to address deeper issues impacting their industry, such as driver shortages.

Rising Fuel Costs: A Creeping Concern

In July, we asked 264 logistics professionals working in the US shipping and transportation sector about the issues affecting their businesses the most.

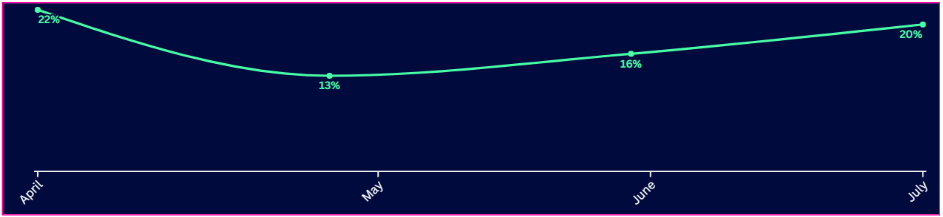

20% of our survey’s respondents reported that rising fuel costs were hitting their businesses harder than any other issue at present.

This just in! View

This just in! View

the top business tech deals for 2026 👨💻

Concerningly, this is the highest this figure has been in since April. It’s a 4% rise on the number of businesses that said the same about diesel prices in June, and a 7% rise on May’s figure, which sat at just 13%.

Businesses aren’t suddenly using more fuel; as we’ve mentioned, there has been a sharp uptick in the price of crude oil. Spurred on by escalating tensions in the Middle East over the past few weeks, prices rose by 11.3% in June, and we’re now seeing it start to eat into operating budgets across the US transport and shipping sector.

The percentage of logistics professionals stating that their business is being hit the hardest by rising diesel prices has hit a three-month peak. Image: Tech.co Research

Diesel Prices Are Squeezing Budgets

Over half (52%) of the logistics professionals we surveyed said that their companies were now spending more than one-fifth of their monthly operating budget on fuel alone.

Fuel is, of course, a core operating expense — and when these sorts of outgoings start to rise, other things have to give. Recent weather volatility means that preparing for unforeseen circumstances is also becoming a non-negotiable for an increasing number of businesses, so there’s even less spare cash to play with.

This means that, after accounting for these critical priorities, firms often can’t fund the strategies needed to deal with the more persistent challenges impacting the US transport sector.

Month-to-Month Pressures Take Priority

Indeed, in our July survey, we found more evidence that immediate pressures like rising fuel prices have turned many eyes to the here and now, and away from investing in solutions to challenges like driver shortages, which inhibit growth and expansion.

For instance, only 14% of logistics companies are prioritising recruitment and retention, even though 24% listed workplace shortages as their biggest concern. A larger proportion of companies reported that they were prioritizing “vehicle upkeep” (20%) and “managing financial pressures” (17%) instead.

If fuel prices continue to rise, it may make it more difficult for some logistics companies to address long-standing challenges — and justify splashing out on solutions.

A slightly smaller percentage (16%) of businesses reported that they were prioritizing adopting new technology, but this number could quickly shrink if budgets continue to be directed towards core operational demands. And, with the tariff uncertainties still looming overhead, there’s every chance they will be.