It’s no secret that the US economy is built on the shoulders of logistics. By 2030, it’s expected that the market will generate $671.2 billion, up from $455.4 billion in 2024, as per a study by Horizon Grand View Research. It’s also no secret that logistics has a massive hiring problem.

In our recent report, Moving Goods with Fewer Hands, we spoke to 521 industry leaders to get a sense of the scale of the issue, amongst other things. Their insights paint a pretty striking picture: 63% of respondents confirmed that their ability to recruit and retain drivers has taken a hit in the last year.

The consequences of this hiring slowdown are severe: missed deliveries, broken supply chains, and an industry increasingly stretched to breaking point. But what exactly is causing the downturn in fortune? And what measures are freight firms adopting to alleviate it? In this guide, I’ll take you through the logistics labor shortage in detail and explore some possible solutions.

In this guide:

The Logistics Labor Shortage: An Overview

Contrary to popular opinion, and as covered in this guide to automation in the industry, the biggest issue facing logistics today isn’t consumer demand. Rather, it’s a widespread hiring problem that has gripped the nation in the last few years.

Today, the situation is dire — our survey found that 85% of logistics businesses are operating at near-full capacity, with 69% of participants confirming that these shortages have negatively impacted their ability to meet freight demand. When the freight in question includes vital medical supplies, the consequences can literally be deadly.

And with the US potentially needing as many as 160,000 new drivers by 2030, it’s a problem that urgently needs addressing. But before we turn to the future, let’s look back and examine the root causes of the labor crisis.

Why Is There a Labor Shortage in Logistics?

In truth, there are several factors that have contributed to the current labor shortage. For starters, the industry has an ageing workforce, and there aren’t enough younger employees to plug the yawning gaps. According to the Bureau of Labor Statistics, the median age for warehousing, manufacturing, and transportation employees is 45 and older.

As alluded to above, freight businesses are having a hard time attracting new drivers, with many put off by perceived long hours, poor work-life balance, and labor-intensive work. Our report found that low pay was the most significant barrier to entry for potential applicants, as confirmed by 39% of respondents. This is closely followed by long hours (38%) and regulatory burdens (33%), with job instability (27%) and limited career development (23%) rounding it out.

To compound the issue, younger people in 2025 have a different set of priorities to preceding generations, especially since the Covid pandemic. Flexibility and work-life balance are particularly high on the agenda, with mental wellbeing taking center stage.

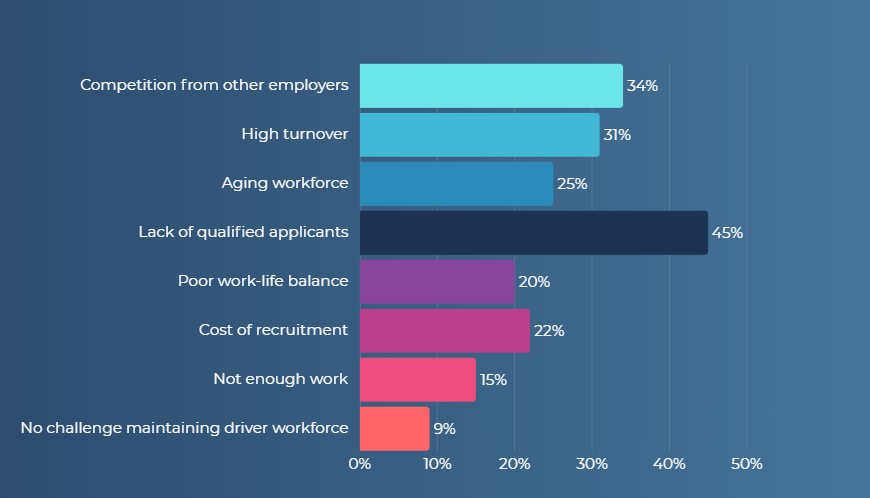

Not only are firms struggling to attract drivers, but the ones they do attract are often unsuitable for the job. In our report, a shocking 45% of businesses cited a lack of qualified applicants as the biggest challenge in maintaining a steady trucker workforce. The skills gap poses a massive issue for hiring managers, as trucking depends upon safe drivers to prevent accidents, delayed deliveries, and skyrocketing insurance premiums.

The reasons why logistics leaders are struggling to hire. Source: Tech.co research

Another issue plaguing the logistics industry is the sheer breadth of work available for people entering the job market. The Chamber of Commerce notes that, towards the end of 2024, there were 8.1 million jobs available across different industries, but only 6.6 million people looking for work.

This surplus of choice means that prospective employees can afford to be selective, and logistics firms are forced to offer high salaries and better benefits packages. The sad reality is that they simply can’t compete with other businesses, such as finance and technology, which consistently offer more money.

What Can Freight Firms Do to Address the Labor Shortage?

The good news is that there are solutions available to remedy the recruitment and retention problem. Among them, business owners can focus on making their places of work more enticing to prospective employees.

With low pay the biggest deterrent for potential new hires, businesses could focus on improving their remuneration packages as a key recruitment driver. After all, freight demand has increased in the last year for 63% of surveyed respondents, so finances aren’t in short supply for a lot of businesses.

Encouragingly, some businesses have begun to act on this. Our report shows that in Texas, for instance, 14% of respondents are raising pay and benefits for drivers in an effort to boost recruitment and retention.

Alongside this, companies should think about the training and development opportunities that they’re offering their staff. Almost a quarter (23%) of survey participants confirmed that career development concerns were the primary reason for not entering the logistics industry, pointing to a wider perception that the trucker career path is short.

However, this needn’t be the case. As highlighted in this guide to federal regulations, the trucking environment exists in a state of flux, with new mandates being rolled out on a regular basis. This means that opportunities for learning and upskilling are always arising.

For instance, with Automatic Emergency Braking (AEB) systems due to become law for Class 3 to 6 heavy trucks, you will need to train your drivers on how to operate vehicles with this new technology embedded.

The Role of Technology in Addressing the Labor Shortage

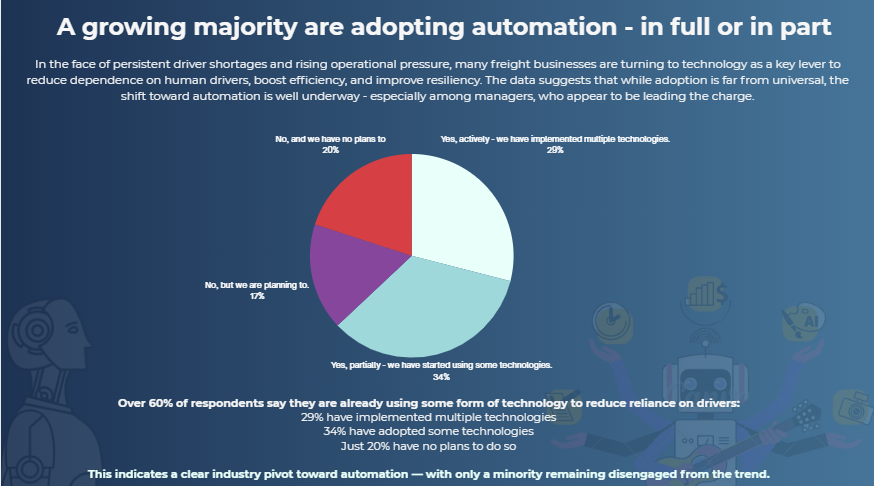

As I’ve covered elsewhere, freight tech solutions have a huge role to play in overturning the present labor shortage. In particular, automation offers a raft of potential benefits, some of which are yet to be fully realized.

Fleet management and telematics software can make a big difference. Both work by collating and aggregating detailed insights into your vehicle and driver performance, including GPS location, vehicle speed, engine idling time, and more. This gives you a complete picture of how your drivers and vehicles are faring, and can be used to train employees, optimize route planning, schedule maintenance, and ultimately improve your bottom line.

As observed in our report, this software is already turning the logistics industry on its head. 51% of surveyed participants revealed that they had recently adopted route optimization software, with a further 46% investing in driver monitoring and coaching platforms and 41% adopting telematics and fleet tracking platforms.

A breakdown of how freight firms are responding to the opportunities offered by technology. Source: Tech.co research

Veering further into the realm of sci-fi, self-driving trucks have long been heralded as the future of the freight business. The appeal is obvious — fleet owners could potentially cut costs, save time, and eliminate human error. But in spite of this, autonomous trucks have yet to take off.

Largely, this is due to legal restrictions. There is no federal ruling on the issue of autonomous vehicles, meaning that responsibility falls to state legislatures. As I’ve covered in this guide, this has created a highly fragmented landscape in which different states have different permission levels.

While it’s not currently the silver bullet that many in the industry had hoped, it’s widely expected that autonomous trucks will change the face of logistics in the near-distant future. As a matter of fact, 42% of respondents to our survey believe that we can expect their “widespread” use in the next 15 years, with just 14% believing that it won’t happen until after 2050.

How Are Real-World Companies Addressing the Labor Shortage?

In this section, I’ll take you through some real-world examples of how companies are turning the tide on the logistics labor shortage. Freight giant XPO, for instance, has been using a multipronged approach to tackle the crisis head-on.

In May 2025, the company was awarded its third consecutive 4-Star Employer designation from VETS Indexes, which recognizes “exceptional support of veterans and military-connected communities.”

Through a combination of targeted hiring and development, alongside inclusive policies and support for military spouses, XPO exhibits genuine support for the veteran community — and reaps the rewards. With a population numbering 22 million, the veteran community represents a rich source of prospective hires with transferable skills.

Another titan of the freight space, FedEx, has similarly been taking steps to lessen the impacts of the labor shortage. In 2021, the company introduced a new internal app that allows workers to pick up extra shifts when required, or swap shifts with colleagues when time off is needed.

This flexibility is a great way to make your employees feel appreciated, as well as a practical solution to ensure that downtime is kept to a minimum.

That same year, FedEx raised its hourly wages for package handlers to $20 and started handing out referral bonuses. While it came at a considerable financial cost to the company, it paid off handsomely in terms of recruitment — in one week in December alone, FedEx processed 111,000 job applications.

Solving the Labor Crisis: A Summary

The current logistics labor shortage poses an existential threat to the industry and its future. A dearth of qualified talent, combined with an inability to attract and retain drivers and an ageing workforce, is leading to delayed deliveries and broken supply chains. It’s an urgent problem that requires a speedy solution.

Fortunately, there are steps that freight firms can take to ease the worst of the shortage. Improving their compensation packages, investing in new technology, and mapping out training and development opportunities are just a few examples. FedEx and XPO are two companies that are tackling the crisis through a layered approach.

For more information on the labor shortage, and what the logistics industry can expect over the next few years, download Moving Goods with Fewer Hands. It’s packed full of detailed insight from industry leaders and experts, and will provide everything you need to set your freight firm up for success in 2025.