Well, another year has come and gone, and while we’re yet to leave the pandemic behind, it has led to a record number of small businesses starting up. With all these businesses forming, it’s possible that some future household names are finding their footing as we speak.

Many of these businesses will take a while to gain some momentum, but there are already some fresh faces on the tech scene that are worth keeping your eyes on as the next year progresses.

Whether it’s making 3D printing more accessible or optimizing delivery routes, these businesses are looking to make the world a more streamlined, affordable, and equal place. In no particular order, here are seven tech companies to watch out for in 2022.

SoLo Funds

It’s no secret that a lot of people in America (and worldwide) were forced into some pretty unfavorable conditions over the course of the pandemic, and that’s not to mention the millions of people who were already in under-served communities. Add on top of this the general lack of financial understanding amongst the US population (only 57% of us are classed as financially literate), and you’ve got quite a cocktail for a cycle of poverty.

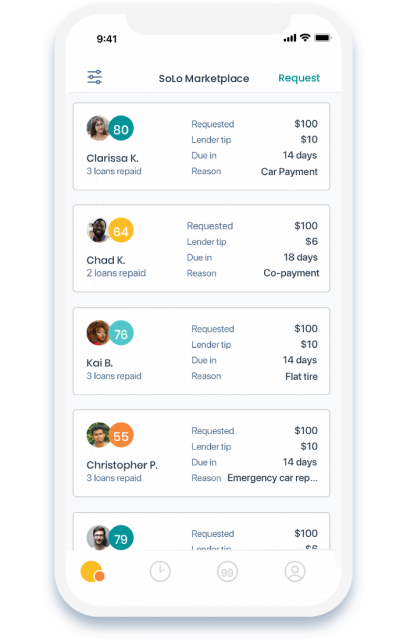

Founded by Travis Holoway and Rodney Williams, SoLo is looking to break this cycle. By allowing people to use their own unused capital as loans for the less fortunate, SoLo acts as an intermediary between those who need the money, and those who are willing to lend it.

An easy way to think of it is like Uber or AirBnB, but with money instead of cars or housing being borrowed. Someone with a financial need can post their request, and someone with the necessary capital can accept the request, setting their own terms.

A lot of people are in dire financial straits right now, and with traditional banks having such strict thresholds on who can qualify for loans, SoLo might bring the help that people need to get back on their feet.

FinMark

A startup for startups! A rise in the number of businesses finding their footing means a rise in the number of questions being asked about business growth and how to manage it.

Enter FinMark (founded by Rami Essaid), a financial tool that businesses can use to manage their finances as they start up – one of the most precarious times in any business’s life. Standard spreadsheets can work for basic systems, but starting a business is extremely complicated, and financial nuances can get lost if your system isn’t watertight.

“We’ve been in your shoes. Having built our own startups we know that startup models are usually wrong from day one. Financial modeling is difficult and time consuming. Spreadsheets are error-prone, poor for collaboration and version control is a nightmare. We knew something better was needed. So we built it.” – FinMark’s website

FinMark’s business model is based on their users’ revenue. For example, a smaller business with $10-20,000 in monthly revenue will only need to spend a monthly $25 on FinMark’s product, while a business that makes over $1 million will be spending $2,500 a month on FinMark.

As the business boom really takes hold, 2022 could be FinMark’s banner year.

Grifin

Investing in stock is a great idea for anyone, and you can never get started too early. However, the world of investment can be daunting, leading many to drag their feet in figuring out the meaning of dividends, stock options, and a wealth of other terms that can seem impenetrable from the get go.

Investment app Grifin is looking to simplify investment for people, with their tagline being “the new way to invest is you.” Grifin’s model is simple: every time a user shops at a business, a dollar of their money is invested into that business. For example, if a user spends $3.95 at a Starbucks, a dollar of their money will go into Starbucks stock, meaning they spend $4.95 in total. If they spend $23.95 at Chipotle, they’ll spend a total of $24.95, etc.

As for their business model, Grifin doesn’t rely on any kind of monthly fee from their customers. Instead, it relies wholly on their investors to make ends meet.

“The only way we can make Grifin a free-to-use app is through the support of our investors and their belief in our mission to make everyone an owner.” – Griffin’s FAQ answer about how they make money.

Ever since 2021’s GME/AMC investment boom, investment has hit an all time high for general public interest. With investment being more at the forefront of social conversation, we may see massive growth from companies like Grifin in the coming years.

Jeenie

Despite how far we’ve come as a society, language barriers can still be a roadblock that grinds conversations to a screeching halt before they even get started. Jeenie is looking to fix this problem by supplying language interpreters on demand.

Founded by Kirsten Brecht Baker, Jeenie’s mission is to enable people to communicate on the fly, without pulling out a dictionary. The Jeenie app is home to a host of certified translators who speak multiple languages and can be summoned (like a genie) through the phone, when needed.

As these calls happen in real-time, Jeenie charges a time-based rate, with calls costing $1 per minute. That’s pretty affordable for the power to communicate clearly with someone you’d otherwise struggle to. And for those who have grown up multi-lingual, it could be an easy side hustle. Jeenie’s translators make between $30 and $60 per hour, depending on things like the rarity and skill of the language they speak.

Jeenie boasts that it takes less than one minute to find an applicable translator, covers over 250 languages, and is usable through desktop and mobile devices, including directly through Zoom. And it’s not just spoken language either – Jeenie covers sign language, and is also expanding into things like medical consultations with certified medical interpreters. As Jeenie expands, you can be sure that they’ll add more languages and services to their repertoire.

re:3D

There was a period in the mid 2010s when 3D printing looked poised to become the next step in engineering revolution. However, the unbelievably high cost of entry into the industrial 3D printing world has prevented it from fully grasping its potential.

re:3D, founded by Matthew Fiedler and Samantha Snabes, hopes to finally take that potential to its highest heights. By making 3D printing more accessible, they look to “decimate the cost & scale barriers to 3D printing.” Affordable 3D printing could be the thing to help poor communities build necessary infrastructure, like wind turbines and housing.

As for their business model, it’s pretty simple. They’re selling 3D printers, but not at the outrageous prices that they used to be known for. Their main product, the Gigabot printer, claims to rival the printing quality of other industrial printers at 1/10 the cost.

As 3D printing becomes more viable, we might be seeing re:3D lead the charge in a 3D printing revolution over the coming years.

Onward Delivery

Delivery has never been a more lucrative business opportunity. When government and health guidance locked us into our homes, we all turned to ordering and shipping the things we needed to survive (either the pandemic or our own boredom). And now we’ve gotten used to it.

Onward Delivery, founded by Grafton Elliot, seeks to both capitalize on the surge in demand for delivered goods, as well as make the very industry more affordable and sustainable. In short, Onward matches deliveries with empty space on existing trucks in order to optimize every delivery route.

For example, let’s say Joe’s Flowers, Jim’s Fridges, and Josh’s Farms all needed to make deliveries to a nearby neighborhood. Provided there were enough room on the truck, all three businesses could combine their stock into one shipment, meaning that they all save money, the roads are clearer, and the customers save money too, as they wouldn’t need to cover as large a delivery cost.

Delivery has always been a massive industry, but since society has adapted to it more than ever over the pandemic, the odds of the industry maintaining this momentum are very high. Any business that can in any way disrupt the realm of delivery has a lot of potential to be a huge player if they play their cards right.

The Beans

One of the hardest hit by the global pandemic have been those in caring positions. Social workers, nurses, and teachers, have all been forced to work in brutal conditions, being overworked and underpaid.

Fintech startup The Beans, founded by Melissa Pancoast, looks to support those who are lacking in adequate reimbursement, as well as anyone who might be struggling to make ends meet, by supplying a financial management app that can help make every dollar count.

“The world is rapidly becoming more visual and traditional financial services are too complicated, or so costly that they become inaccessible.” – Melissa Pancoast, CEO and founder of The Beans

The Beans offers two tiers of features. The first is a free tier, which allows users to securely connect their bank account to the app. The app will then track transactions, and find trends and patterns that customers can use to develop financial plans that fit their lives and priorities, and cut out unnecessary spending.

The Beans’ paid tier is $30 per year. This tier adds a data visualization option on top of everything else, which allows users to look past numbers on a page and see the real proportions of their finances. This tier is valued by The Beans at $500, which, if true, means that it’s still a pretty solid deal for the return that users could see.

The Beans is set to grow both their value and brand reputation in 2022, raising millions in funding, and hosting financial literacy workshops in the Atlanta area, looking to expand outward as time goes on.

Looking at the year ahead

Will the above startups win big in 2022? While signs are promising, truth be told, there are hundreds of hopeful tech companies looking to become the next big thing in the new year and only time will tell. But with the amount of businesses started during the pandemic, we may see a bigger wave of tech innovations than ever before.