The current driver shortage continues to pose problems for the logistics industry, and it only seems set to worsen, according to professionals.

While the issue continues to impact delivery, the knock-on effects extend beyond it. For instance, consistently delaying or cancelling deliveries poses a risk to brand reputation and customer experience, and increasing economic incentives for drivers to join up will impact operational costs.

However, according to Tech.co’s new Logistics Report: Moving Goods With Fewer Hands, businesses are finding new ways to adapt and combat the driver shortage through human-centric and technology-based methods.

The Driver Shortage: A Freight Bottleneck

According to data from Tech.co’s 2025 Logistics Report, 38% of respondents describe the issue of workforce limitations as either critical or high urgency, meaning it’s affecting their day-to-day operations or their long-term planning.

Likewise, of the respondents who reported workforce limitations pose a “critical, immediate operation risk”, 64% said their ability to recruit and retain drivers has gotten significantly worse.

The driver shortage poses a significant problem for modern-day logistics businesses, particularly as 63% of logistics professionals have reported a rise in demand, and 85% are operating at or near full capacity. Evidently, the sector is giving no signs of slowing down, and businesses are having to do more work at a faster rate. And, with fewer drivers on their side.

Impact on delivery

Logistics professionals reported to Tech.co that on-time delivery (43%) is the part of their operation currently under the most pressure, with driver availability (42%) being nearly equal in concern. A shortage of drivers often means there aren’t enough hands to haul freight; this can lead to deliveries being rerouted or delayed, or in some cases, cancelled altogether.

69% of respondents said that driver shortages have had an impact on their ability to meet freight demand. And, of that 69%, 23% say this has caused service disruptions or delivery failures.

Frequent and inevitable delivery issues will not only slow down individual businesses but also the entire supply chain.

Beyond Delivery: The Knock-On Effects of Driver Gaps

While delivery is certainly impacted by a shortage of drivers, the problem facilitates a ripple effect throughout the logistics sector. Businesses become vulnerable not only to missing and rescheduling deliveries, but also risk their brand reputation, operational costs, and long-term growth.

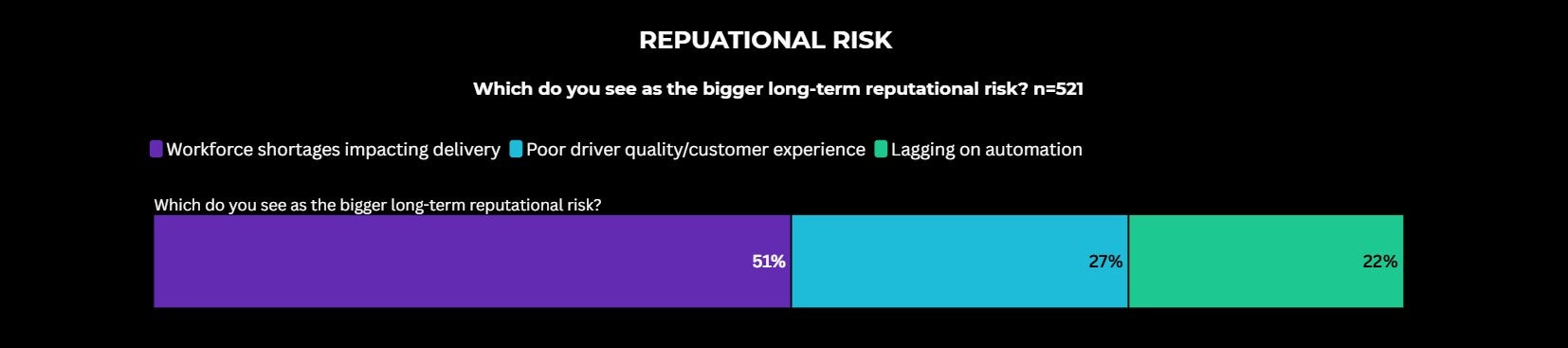

Reputational damage

51% of logistics professionals we spoke to said that workforce shortages impacting delivery were their biggest long-term reputational risk.

As companies struggle to provide deliveries on time and report continuous disruptions, their reputation will take a hit. This could include negative reviews from past customers and complaints that have to be dealt with.

Therefore, it’ll be difficult for them to secure customers in the long run, impacting the company’s longevity and overall profitability.

Poor customer experiences

51% of companies told Tech.co that driver constraints have occasionally or frequently impacted customer expectations.

When deliveries are late or delayed, customers notice. Meeting the demands of customers and ensuring they are pleased with the service they’ve received becomes increasingly difficult when there are fewer drivers and services can’t run as efficiently as they ought to.

Likewise, as the problem continues to worsen, it becomes more difficult to plan and manage customer requests.

Which do you see as the bigger long-term reputational risk? Source: Tech.co

Higher operational costs

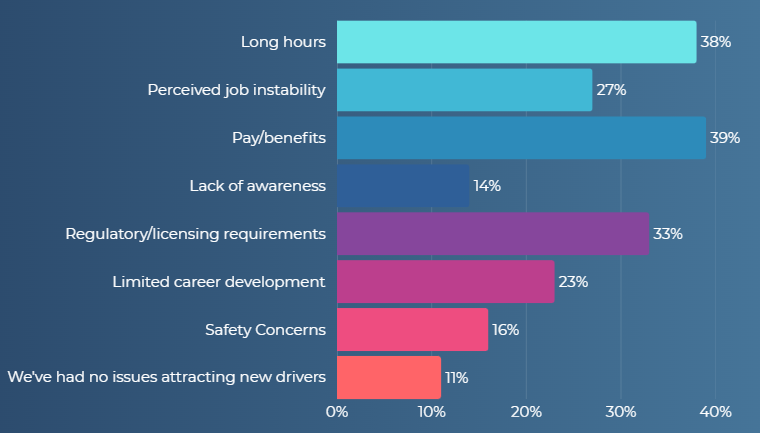

On top of tariff news and regulation changes upping prices, there are many ways that driver shortages are forcing logistics companies to pay up. 39% of respondents reported that poor pay was a primary barrier in attracting new drivers, and 45% of respondents said that a lack of qualified applicants is the biggest challenge they face when trying to maintain their workforce.

These figures suggest that businesses will have to offer more financial incentives to drivers they want to recruit. Companies may find themselves spending more on wages and training programs, and having to offer more to new and experienced drivers because of competition from other businesses.

Likewise, companies may need to compensate customers for late deliveries. And, with 67% of businesses now relying on third-party carriers at least occasionally, money will have to be spent there, also. Third-party costs increase too, as more companies compete for their services when a lack of drivers is an issue.

Strain on existing drivers

For the drivers already established in the industry, the shortage could add a level of strain on their roles. Experienced drivers could be expected to work longer hours or take new routes to maximise their efficiency.

Similarly, making drivers work longer hours and under more pressure could increase fatigue, leading to safety concerns while on the road. According to a recent Samsara report, drivers are increasingly concerned and aware of the dangers of distracted driving, and 90% of drivers revealed that they are more likely to stay with companies that take steps to foster a culture of safety.

What are the primary barriers to attracting new drivers into the workforce? Source: Tech.co

Long-term growth

91% of our survey respondents agree that America’s economy depends on fast, affordable, and reliable freight movement. However, the driver shortage has the potential to slow businesses and the overall industry down significantly, impacting their long-term potential.

Significantly, the industry is also failing to attract the next generation of drivers. A study from the International Road Transport Union (IRU), which surveyed 4,700 trucking companies in the Americas, Asia, and Europe, the share of drivers under 25 remains 12% or less.

In order to ensure their growth, businesses should invest more in training opportunities for young people to bring them into the profession, and provide a culture of safety and awareness when it comes to the dangers of the road. Other tech solutions like supply chain risk platforms or other analysis tools can’t hurt.

How Are Businesses Navigating The Driver Shortage?

79% of companies that spoke to us revealed that they have made strategic changes to how they move goods. On top of that, 58% have made minor changes such as shift tweaks and load balancing, and 21% have made significant overhauls, such as outsourcing and route redesigns.

Only 3% of impacted companies reported no change or need for change. This is descriptive of a wider understanding that the problem is severe, and changes are necessary. Below are some of the ways companies are adapting to the circumstances.

Prioritizing driver benefits

Companies are shifting their focus to attracting and retaining the drivers they have. 56% are focused on increasing driver compensation and benefits, and another 56% are improving work-life balance for drivers.

There are also attempts to provide better training and development opportunities (44%), suggesting that businesses are working more to create an environment where drivers want to be, rather than hiring more aggressively. Indeed, 27% of respondents said they were focused on improving company culture.

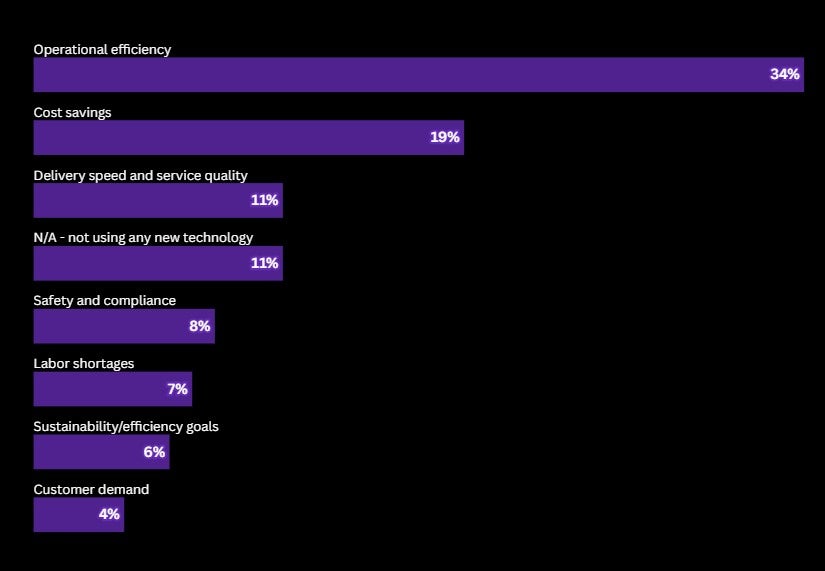

What was the main reason you started using new logistics technology? Source: Tech.co

Adopting new technology

Although businesses generally agree that driverless fleets aren’t ready for full-scale adoption yet, they are looking to technology in order to streamline and reinvent current processes.

In our report, we found that over 60% of companies are already using some form of technology to help reduce their reliance on drivers. The most common tools are route optimization software (51%), driver monitoring and coaching platforms (46%), and telematics/fleet tracking (41%).

Three out of four businesses are even reporting that technology has already helped with workforce challenges. However, it isn’t just challenges in the workforce that are encouraging businesses to adopt new tech, with most respondents citing operational efficiency (34%) as the leading motivator.

All of these figures confirm that trust in technology is growing. 78% of respondents reported that they place either very high or moderate trust in technology to support core logistics operations.

Verdict: How Can Businesses Combat the Shortage of Drivers?

Logistics businesses should look for ways they can decrease their reliance on drivers, such as adopting new technology and providing better benefits for retaining drivers, to remain profitable and efficient.

Likewise, keeping up-to-date with the latest logistics news and influencers will help your business stay agile and focus on what’s coming next.

For more expert insight into how businesses are combating this issue, you can download our free Logistics Report.