Take everything you know about accountancy and throw it out of the window. New technologies, combined with the changes with remote work policies, are set to shake up the world of small business accounting this year. In this guide, we’ll take you through the hottest trends and explain why they’re important for businesses of all shapes and sizes.

Here at Tech.co, though, we don’t just talk the talk – we’ve spoken to leading industry figures and conducted our own independent research, to find out exactly how companies are making changes.

Below, we’ve included some in-depth infographics that outline some of the research we collected on our top four accounting trends, which include blockchain, automation, agile accounting, and third-party involvement.

Our survey also revealed some interesting stats on accounting technology and highlighted 11 more accounting trends you should be aware of.

Please note: If you’d like to use any of the graphics in this article on your site, or a summary infographic, you can access these images here. If you do use any, please just credit Tech.co with a link back to this article. Enjoy!

A blockchain is a digital ledger of transactions that are distributed across a decentralized network. Each block on the chain contains a number of transactions that can be viewed and verified by everyone on the network. In essence, this allows transactions managed on blockchains to be completely transparent.

The term is most closely associated with cryptocurrency and other digital assets, as the technology provides the infrastructure that allows these kinds of decentralized entities to be used by members of the public. US president Donald Trump is a notable advocate, even creating a meme coin at the start of his presidency in 2025 that has since declined in value.

Beyond that, though, blockchain has a lot of applications in the accounting world. It can also help with record keeping – particularly for accountants – because records cannot be forged or tampered with. Plus, each transaction can be verified by multiple different participants on the blockchain.

Blockchain technologies are also super secure. Multiple verifications keep things in order, and each transaction is also recorded with a unique and unchangeable cryptographic signature called a hash.

Since it relies on independent verification, blockchain could be used in place of traditional external auditing. Blockchain’s visibility means that inconsistencies will be impossible to hide. Instead of the old-school double-entry system for record-keeping, blockchain will let you write transactions directly into a joint register that is both secure and publicly accessible. Writing transactions into standardized joint registers would help auditors work through records faster, allowing them to verify transactions using their unique hash keys.

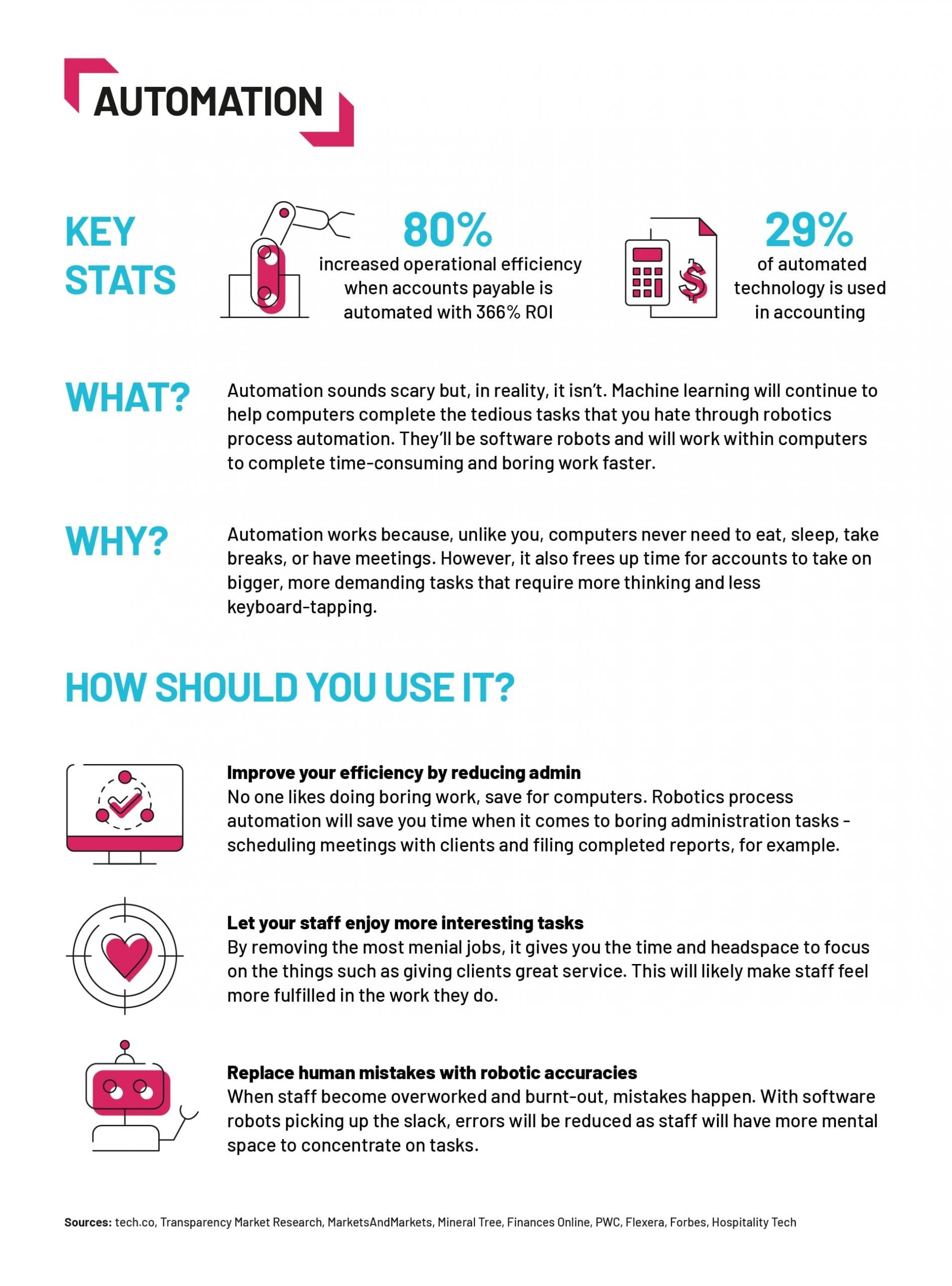

With the rise of generative AI platforms like ChatGPT, automation has gotten a bad wrap over the last few years, but it is integral when it comes to accounting. Given all the tedium that comes with tracking finances, automation tools are a hugely necessary time-saver for accountants. In fact, around 29% of high-tech automation can be found in accounting functions.

“Artificial intelligence and robotics are reducing operational costs and increasing performance by automating complex and repetitive tasks and procedures with extreme precision.” – Thilo Huellmann, CTO of AI company Levity.

Automation in accounting takes many different forms, from filing invoices to scheduling meetings. Accounting automation technology allows these processes or procedures to be completed with minimal human assistance.

First and foremost, you and the company will be saving time – time that could be used for other more exciting and impactful work. Indeed, 30% of our accounting survey respondents said that the biggest advantage has been the time it has saved.

The second benefit is vastly improved efficiency. In fact, this saved time can help businesses improve efficiency by up to 80%, and can earn a return on investment of up to 366%.

3. Agile Accounting

Agile accounting refers to performing your everyday accountancy work from a location of your choosing. While return-to-office policies have become more common in the business world of late, many businesses are still encouraging hybrid and remote jobs in order to attract top talent with the popular perk.

This approach to work can have a positive impact on your employees’ well-being, with studies showing that remote workers are often happier than their in-office counterparts. What’s more, flexible working is shown to boost productivity and employee relationships.

4. Third-Party Involvement

Third-party involvement is a fancy way of saying that businesses in 2025 rely heavily on other businesses to help them run their day-to-day operations. Restaurants are reliant on delivery services like GrubHub and UberEats to sell more food, retail spaces are dependent on POS companies like Square and Shopify to check out customers, and now, accountants are utilizing services like QuickBooks and Xero to streamline their business.

Third-party involvement is a big plus because it allows accounting businesses to focus on the more granular and specific accounting needs of clients while letting other businesses handle the broad, tedious processes. And they’re quite popular, with 80% of businesses around the world currently making use of third-party involvement.

Third-party services also keep their own records of transactions, which will help you ensure that all your client’s transactions are properly tracked. You can also build new systems: Some services offer open APIs, and computer-savvy accountants can connect these to new systems to help track transactions automatically – both improving reliability and saving you time.

5. Data Security

Data breaches are a rising concern for any enterprise around the globe. A breach is usually financially motivated, meaning that it can be costly. To combat this growing problem, the accounting industry has increasingly focused on its own data security.

The right security protocols for software may involve two-factor verification (2FA) and role-based security, as well as extra tools such as password managers and VPNs. Alongside this, companies should train their employees in security best practices.

6. The New Accountant Role

The rise of automations and AI wizardry will impact which skills accountants need. Now that streamlining tools can handle the boring parts, employees will find that “soft skills” are more important than ever. Developing a high “EQ,” or emotional quotient, refers to a talent for addressing your own (and others’) emotions in ways that relieve stress, communicate better, demonstrate real empathy, and ultimately defuse conflict.

Employers are increasingly searching for employees with these skills, and they can be hard to find: 74% of organizations say that it’s “more difficult today to attract qualified candidates.” The most frequently cited as missing skills? Effective communication, problem solving, and critical thinking. If your accounting team can do these, they’re fitting into the “new” accounting role.

On top of that, Tech.co’s research has found that hiring managers are increasingly looking for applicants that have AI expertise so that they can prepare their workforce for a future with more automation tools.

7. Remote Workforce

Remote work has been a hot-button issue over the last few years. While the pandemic saw millions working from home, return-to-office mandates across the tech industry have spurred backlash and caused issues for businesses that have held firm like Amazon and Dell.

Suffice to say, deciding on a hybrid work policy could be a big sticking point for your business in 2025. Remote work statistics show that, in most cases, businesses are more productive, have higher retention, and even earn more revenue when they allow employees to work from home. So, if you want your employees back in the office, you better have a good reason.

8. Artificial Intelligence

AI has become the belle of the ball for the tech industry over the last few years. Since the inception of ChatGPT in 2022, nearly every business under the sun has been itching to add generative AI technology to its system, and accounting has been no different.

The technology can be used to create helpful summaries, develop thoughtful strategies, and generate copy for your other business operations. It’s worth nothing, however, generative AI platforms in 2025 are decidedly mistake-prone, and in accounting, you don’t have room for even the smallest of errors. Subsequently, you’ll have to decide in 2025 what you’re using AI for before you get ahead of yourself.

9. Workplace Wellness

Taking care of your employees isn’t just an accounting trend; it’s a growing movement in the workplace for all workers. Employee perks like remote work, parental leave, mental health days, and even the 4-day workweek have become commonplace at many businesses around the world.

As a result, companies that fall behind on providing perks will have a notably difficult time attracting top talent. After all, some statistics show that employees are willing to take a pay cut to maintain their flexible working arrangements, while others would rather quit than return to the office five days a week.

Simply put, employee retention and low turnover rates are valuable to businesses on a foundational level, and considering workplace wellness will yield positive results in your staff, as well as your bottom line, in the long run.

Need more inspiration? We’ve rounded up the top 20 companies known for their premium benefits.

10. Cloud-Based Accounting

Many of the biggest accounting trends have to do with workplace flexibility and remote options. As companies grow more flexible with their employees, their accounting software must become more flexible to cope. Enter the cloud-based solution.

With all accounting software and data hosted on the cloud, an accountant can access everything they need by simply typing their password in a browser anywhere in the world. They can work from home, in the office, or while visiting their grandparents in Arizona.

Greater integration is one advantage of a cloud-based tech stack. Accounting software can work with other key solutions including supply chain management or payroll, all of which can be cloud-based. E-signature and file-sharing services can also help more employees operate from the cloud.

Reduced labor costs are another benefit: One study estimates a 50% labor cost savings from those with cloud-based software, in part because it reduces on-premises hardware investments and the IT teams needed to sustain them.

11. More Forensic Accountants

Forensic accountants are the detectives of accountancy, spending their time looking into company files in search of white-collar crimes like employment fraud or identity theft. These crimes are on the rise, so forensic accountants are more likely than ever to take a look over your own company’s books.

To stay clear of forensic accountants working for law enforcement or insurance companies, ensure that anyone working on accounting for your business has oversight from someone else. By establishing a system of accountability, you’ll help to nip any potential for insider fraud in the bud.

12. Data Forecasting

Forecasting is a skill that accountants can use to predict the future. This technique depends on a knowledge of how to read historical data, which can be used to inform estimates about future trends in business expenses.

It’s a core skill to have in accounting, but it’s only growing in importance: Knowing what cash flow, earnings, and consumption rate to expect in the future is even more essential when the future is less defined.

This makes any data forecasting talent a huge part of an accounting team’s successful performance. To keep up with the pack, we recommend brushing up on the skill with the right online courses or initiatives.

13. Tax Policy Updates

Tax laws change every year, and with President Trump back in office in 2025, it’s safe to say there will be some serious changes to consider for your accounting business.

Third-party involvement through accounting software can often help with these changes, though, guiding users to the correct steps and even automatically filing with certain plans.

14. Value-Based Pricing

In accounting, it’s increasingly important to match your firm’s prices with the value that any given customer perceives you’ll provide. This is called value-based pricing. Spurred by concerns about a fragile economy, businesses want to be sure that they aren’t overpaying.

This metric ensures that you leave every client feeling as if they’ve gotten their money’s worth. As a result, you’ll foster loyalty and increase return customers. It may mean that you don’t hike your costs quite as much as you could, but a focus on long-term growth will ultimately pay off far more than a nearsighted focus on the short term.

Additional benefits include greater price certainty and boosted efficiency for all accountants, who can directly tie their work to the price they charge.

15. Outsourcing

Outsourcing offers many of the same benefits as third-party involvement but passes the saved value on to your company rather than simply to your clients.

Reportedly, the value of the outsourcing industry could grow as much as $75 trillion between last year and 2027. Granted, that applies to far more than just the financial and accounting sector. Still, accounting has been projected to see a potential growth of $56.6 billion between 2020 and 2027, which is enough to confirm that this is a trend worth considering for your own operation.

Outsourcing allows you to keep your own headcount low, as well as a greater range of skillsets and tech knowledge than you would otherwise be able to access.

New Accounting Technology

Computers have irrevocably changed workplaces since their very introduction. However, the changes that are set to be introduced thanks to blockchain, automation, the cloud, and third-party providers will signal a new era for accounting.

These new technologies will create a marked improvement in efficiency and productivity, while also offering accountants a better balance between their domestic and work lives.

We surveyed 39 accountants from a variety of industries, who told us how technology has impacted them:

- 97.5% said they have been impacted by accounting technologies

- 75% said it made a positive impact

- 60% believe the future of accounting technology is going to be very positive, whereas 40% believe it will be quite positive.

The biggest positives of the new technology included time saved (30%), better productivity (15%), cloud access (10%), data accuracy (7.5%), and fast data retrieval (7.5%).

However, there were some perceived downsides to the new tech, including training staff (30%), increased cost (10%), bugs in the software (7.5%), fewer accounting positions (5%), and security issues (5%).

Verdict: The Future of Accounting

Accountants are going to meet a lot of new challenges in the coming years.

Third-party involvement will expose businesses to new risks, but also potentially reduce workloads and lead to more reliable bookkeeping.

Agile work practices could lead to more diverse workplaces, as well as allow businesses to find better recruits in different locations. However, not all workplaces might feel comfortable with committing to remote working in the long term.

Automation won’t see robots replace accountants, but it will lead to some tedious processes being made things of the past. It will also help accountants spend more time working on more important tasks.

Blockchain technologies offer a huge benefit to accounting firms, with more reliable transactions and greater trust between organizations.

2025 is set to be a big year for accountancy, so make sure you’re ahead of the curve.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page