The waters are choppy for the freight industry in 2025.

Tariffs are continuing to be levvied, paused, or increased, which in turn erratically boosts or decreases the cargo volumes that freight and logistics companies depend on. At the same time, trucking operations struggle to find qualified drivers, with 63% of respondents to a recent Tech.co survey saying their recruition attempts have stagnated or worsened in the last year. Rising costs of living aren’t exactly helping, either.

However, the industry is gradually transforming to cope with these issues. Small operational shifts – largely driven by tech innovations – are adding up. The secret may be incremental changes that address genuine pain points, not lofty trends or sweeping revolutions.

Now, thanks to data from a new report, we may have a better idea of what those changes are.

In This Guide:

- How New Technology Is Reshaping Logistics

- Biggest Pain Points: The Need for Greater Efficiency and Higher Visibility

- Common Tech Solutions Include Route Optimization, Driver Monitoring

- How Businesses Are Responding to Emerging Cyberthreats

- The Dangers of Rapid Adaptation

- In 2025, the Best Tech Adaptation Is Slow and Steady

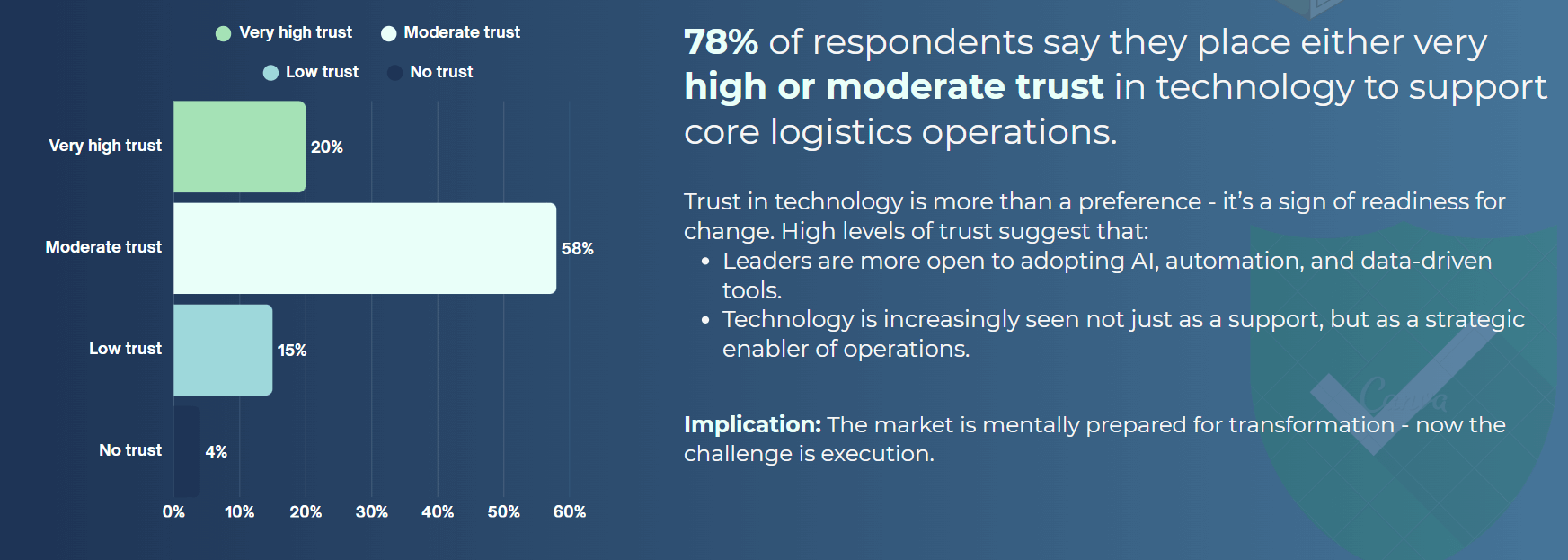

Many logistics companies say they trust technology to support core processes. Source: Tech.co survey results

How New Technology Is Reshaping Logistics

Over half (57%) of logistics professionals say they have changed their operational model due to new technology.

This is just one new statistic gleaned from the Tech.co Logistics Report 2025 — a brand-new survey covering over five hundred logistics owners, managers, and others, which you can read over here.

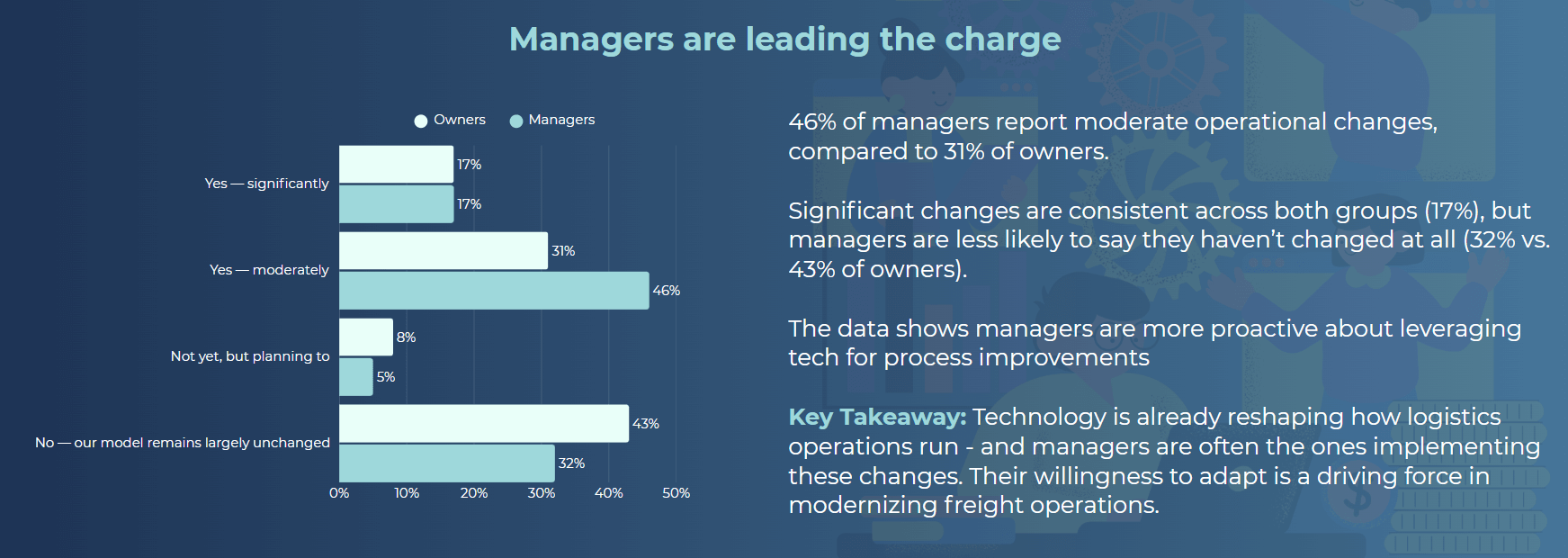

The impact of tech innovations, we learned, was slow but steady. Only 17% of respondents went so far as to say that they had “significantly” adjusted their business model, but a healthy 46% of logistics company managers said they had “moderately” adjusted.

Plus, we learned that over 60% of these companies already use automation to reduce driver reliance, indicating that many companies today see the driver shortage as a problem that’s here to stay, and that tech can help remediate.

Managers see a higher need for change, compared to logistics business owners. Source: Tech.co survey results

Managers were noticeably less likely to say they hadn’t adjusted at all, with 32% of them saying this, in comparison to 43% of owners — Perhaps because managers are more exposed to operational struggles on a daily basis.

Owners and managers alike agreed overall, however: They trust technology to help. 78% of logistics businesses place very high or a moderate trust in technology to support their core logistics operations, according to the 2025 Tech.co report.

Biggest Pain Points: The Need for Greater Efficiency and Higher Visibility

Slow and steady innovation is only worthwhile if it addresses specific needs of an industry. So, we asked what those needs were.

Operational efficiency is the biggest pain point motivating managers and owners alike to opt for new logistics technology, with 34% of respondents picking it. This is no surprise: Any logistics business is built around moving, storing, and tracking goods, and profit margins increase as this process is streamlined.

Plus, since the shortage of qualified truck drivers remains a growing concern, efficiency makes sense as a top priority. By making each route less time-consuming, managers can — at least to an extent — free up more work hours to meet the same delivery volumes with fewer drivers.

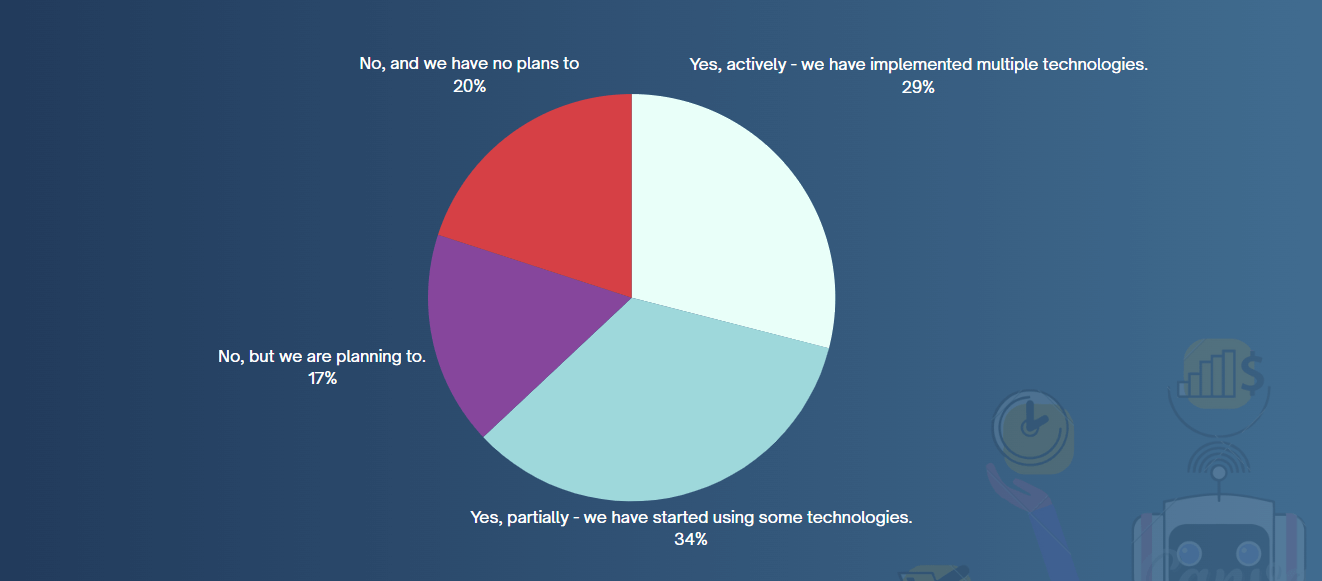

Our 2025 survey charts how many logistics businesses have or plan to reduce their dependence on human drivers through tech. While adoption is far from universal, the shift toward automation is well underway. Source: Tech.co survey results

Earning mentions from nearly one in five respondents (19%), cost savings was the second most common pain point driving tech adaptation. The number of logistics professionals who proritize savings may rise in the future, too, if industry trends surrounding fuel prices and economic uncertainty continue.

Other meaningful factors that didn’t rise as high as efficiency and financial economy include delivery performance (11%) and safety and compliance measures (8%).

Our findings indicate that industry decision-makers tend to hone their tech investments in two main goals: Boosting efficiency and saving money. Keeping goals simple leads to clear results.

Common Tech Solutions Include Route Optimization, Driver Monitoring

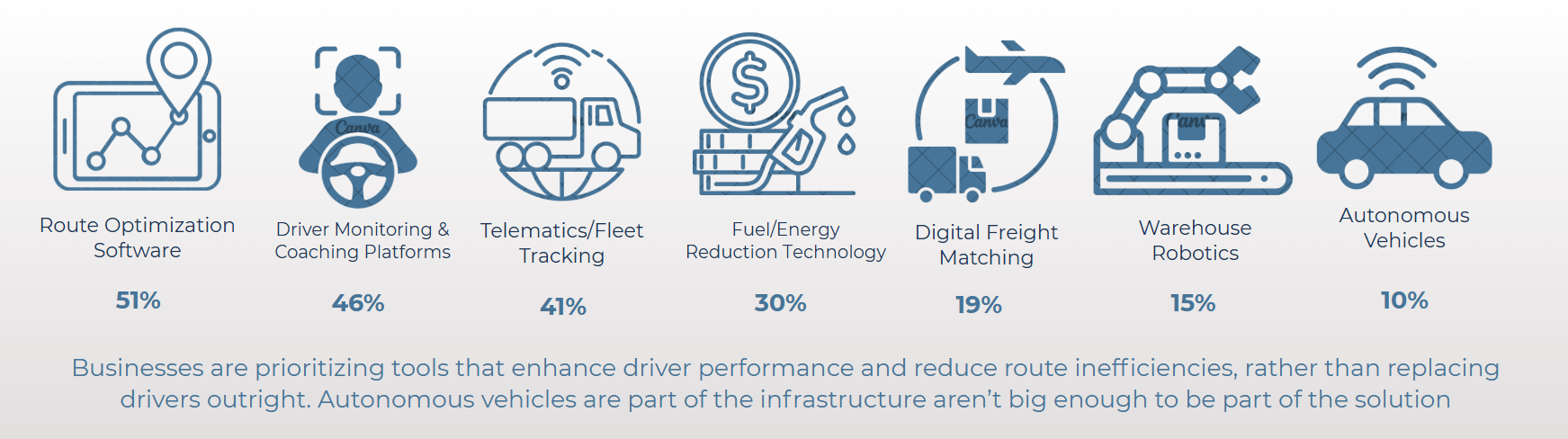

Route optimization software topped the list of the the tried-and-true solutions, with an impressive 51% of total respondents adding them within the last year.

Driver monitoring and coaching platforms (46%) clocked in close behind route optimization. These solutions allow the managers of truck fleets to rapidly adjust to changing conditions such as weather and traffic patterns, so that a long-haul truck’s route across a country or last-mile delivery within a neighborhood can be completed more quickly or while conserving the most fuel.

Telematics and fleet tracking (41%) and fuel or energy reduction tech (30%) were also included (although these tools are typically included as features within route optimization software, and so adding them as a separate element is arguably double-dipping). Finally, digital freight matching was less adopted, though 19% did start using it.

Among those implementing logistics technology, the most common tools reflect a strong focus on efficiency, visibility, and driver productivity. Source: Tech.co survey results

Adaption of these software solutions is simple, too, in stark contrast to expensive and less popular tools like warehouse robotics (15%) or automated vehicles (10%).

These days, the single most popular trucking solution, fleet management software, can centralize all commonly adapting tech, since the best solutions deliver routing and dispatch optimization, safety habit tracking, and additional perks like fuel tracking. The increased visibility of drivers’ actions can avoid costly mistakes while automatically optimizing for efficiency — addressing both major industry pain points at once.

How Businesses Are Responding to Emerging Cyberthreats

Technology’s impact on the logistics business can be oppositional, too. In some cases, scammers and other cybercriminals are relying on new tech for large-scale enterprise identity theft, prompting businesses to shore up their software in response.

The bad actor might pair a stolen tax ID with a counterfeit website and LinkedIn accounts, complete with a just-slightly modified business name. The whole ruse allows freight to be delivered to the scam artist’s designated warehouse, leaving the actual company without the cargo they paid for.

Leading transport and logistics company Gebrüder Weiss ran into this exact scam, a representative tells Tech.co. After reporting it, the company learned that the same warehouse had been reported for fraudulent deliveries by 66 other logistics companies. Clearly, the right approach can allow one scammer to do a lot of damage, even while straightforward smash-and-grab physical thefts remain more common.

Tech safeguards like strong facility monitoring and better driver communication protocols can help stem these problems, although bad actors can continue investing in their own tech advancements as well. Large companies may have the resources to opt for a supply chain risk platform that might help. This is one area in which the technology arms race doesn’t have a clear winner.

The Dangers of Rapid Adaptation

The freight industry’s tendancy to stick with reliable, proven technology solutions stands in contrast to the wider tech industry’s long-held belief in rapid adapation.

First embodied in the Mark Zuckerberg-coined phrase “move fast and break things” — Facebook’s internal motto up until 2014 — this trend is now most visible in the AI hype train. Tons of Fortune 500 companies are all-in on generative artificial intelligence to the point that many managers are mandating their employees incorporate it into their workflows, under the assumption that it will boost efficency.

It’s not clear that this is true. Journalist Brian Merchant recently debuted a series of anonymous interviews that highlight the dangers of shoehorning AI into workflows, from bad code to one worker “terrified someone will notice I’m actually doing all my own work.” Generative AI tools are often a solution in need of a problem… which means they can become just another problem.

According to the hype, generative AI can do anything. However, a business is better off with software that does one thing well — like the route planning or safety habit tracking solutions that are popular with trucking operations. These systems can give managers the actionable benefits and set KPIs they need to track real improvements.

When applied within clear guidelines, AI tools can prove useful in these contexts as well, if Samsara’s new “Weather Intelligence” or safety tracking functions are anything to go by.

Change isn’t inherently bad. At the same time, new technology should always be used to address specific pain points, and never slathered on as an all-purpose salve. Industry adaptation of AI is no different.

In 2025, the Best Tech Adaptation Is Slow and Steady

The freight operators who identify specific problems to address — for many businesses, that’s route efficiency, cost savings, and driver visiblity — can then find the best tech solutions. The easiest ones to roll out are accessable, software-based, and scalable, from route optimization software to safety tracking solutions.

Fully autonomous AI-powered vehicles may be revolutionary once they are widely available, safe, and come with attractive payment plans. In 2025, however, the data shows fleet owners and managers are looking for less disruptive, more dependable solutions.