GoDaddy will now allow businesses to take payments via a mobile phone, without the need for dedicated point of sale (POS) hardware.

The new feature utilizes QR codes, which the customer must then scan with their mobile phone to complete payment.

The announcement comes hot on the heels of last week’s news from Apple that iPhone users will be able to may payments directly to another iPhone later this year, with its new ‘Tap to Pay’ feature.

How GoDaddy Payments Works

While Apple’s news last week about its new payment feature revolves around NFC and iPhones communicating with each other, GoDaddy has taken a quite different path. Its solution is QR codes.

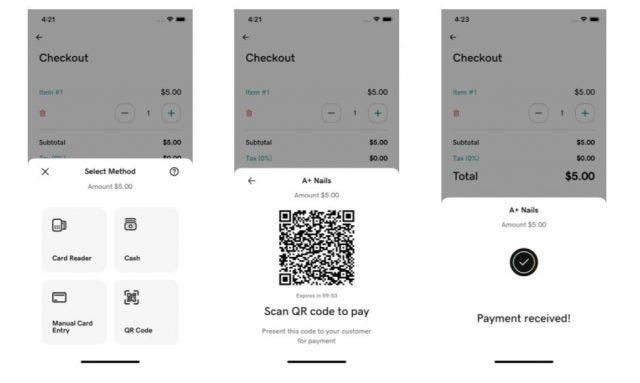

Using the GoDaddy Payments app, the vendor can produce a one-time QR code which the customer then scans with their own phone, before completing their purchase with their preferred digital wallet. Once the transaction is completed, the QR code automatically expires.

GoDaddy is pitching payments as a solution for small traders who don’t want, or can’t afford, a separate POS system. Transaction fees are charged at 2.3%, the same as it charges for payments via is POS hardware, although there is also 30 cent surcharge per QR code.

Is this the End of POS Hardware? (Spoiler – No)

Although it may appear that the writing is on the wall for the poor old dedicated POS device, its funeral may be some way off yet. While many businesses would no doubt jump at the chance to do everything on a mobile phone and not purchase separate POS tech, many have already invested millions in this area, ingraining it within their business and linking it to sales, stock taking and even CRM. For these businesses, it’s a case of if it ain’t broke, don’t fix it.

The second wrinkle with some phone payment platforms is that they only accept payments from mobile devices, meaning customers who want to pay by card are left out in the cold. In fact, according to YouGov America data, cash is still king, with 59% of in-store purchases fuelled by good old paper money. Only 9% of customers choose to pay by a mobile app, so don’t go throwing away your POS system just yet.

In the case of GoDaddy’s platform, the company has told us that it is possible for customers to enter their debit/credit card details after scanning the QR code, so it’s not restricted solely to digital wallet payments.

Then there’s the logistics of using a mobile phone on the shop floor. Sure, its fine for the small trader selling coffees out of a van, but is a larger retailer really going to expect staff to use their own phones to take payments? And if they’re going to supply the phones themselves, they may as well put the money into a dedicated POS instead.

Picking the Right POS System

While the retail industry felt the brunt of the pandemic, it has at least done one thing for it – normalized POS systems. With customers being more aware than ever about keeping a safe distance, the ability to pay for goods with just a tap of a card, rather than with cash, meant contact was kept to a minimum.

A POS system can drastically cut the amount of time an employee has to spend handling payments, can collect data about your customers, generate mailing lists, track inventory and more.

POS systems are convenient for both customer and business alike, so its perhaps unsurprising that the industry is predicted to be worth a huge 116 billion by 2026. However, GoDaddy aren’t the only option out there, so we’ve collected some of the best options below for you:

| Price The typical lowest starting price. The lowest price available for your business will depend on your needs | Tech.co retail rating Score out of 5 for general retail suitability based on Tech.co's independent market research. | Best retail POS for Tech.co's verdict to help you identify the most suitable choice for your retail business | Hardware | iPad app Is there a version of the software made specifically for iPad use? | Android app Is there a version of the software made specifically for Android tablet use? | 24/7 support | Get started | ||

|---|---|---|---|---|---|---|---|---|---|

| BEST OVERALL | |||||||||

| Free (but transaction fees apply) | |||||||||

| 4.8 | 4.5 | 4.5 | 4.3 | 4.1 | |||||

| Ease of use | Managing rapid retail expansion | Data-driven sales insights | Managing in-store and online sales in one platform | Managing multiple stores | |||||

| Sold by Square, separately or bundled. Works with most leading brands and has a great free trial. | Sells everything from full cash stations to mobile card readers | Sells a range of in-house hardware, including iPad stands, card readers, and KDS | Sold by Shopify, but also works with iPads and Android tablets | Specialized hardware available. Not compatible with weighing scales | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| Try Square | Compare Prices | Try SumUp | Try Shopify | Compare Quotes |

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page