The logistics industry is nearing an inflection point. Our latest report, Moving Goods With Fewer Hands, reveals a staggering 85% of logistics businesses are operating at close to full capacity – and demand is unlikely to slow down any time soon.

To compound this issue, the industry is stricken with a massive labor shortage, with more than half (63%) of surveyed respondents confirming what many have long suspected – recruiting and retaining drivers is getting harder. Largely, this is a problem of quality: 45% of participants indicated that drivers weren’t meeting the required threshold to join their fleets.

Automation poses a genuinely compelling solution to a lot of these problems. So in this guide, I’ll be taking you through the current state of automation in logistics to give you a better idea of what’s working and where the industry needs to improve.

Automation in Logistics: An Overview

Automation in logistics covers a broad spectrum – from fully driverless trucks to robotic warehouse workers and everything in between. And the good news is that there’s a clear appetite for it in the industry.

In our report, over one-third (34%) of surveyed respondents cited “operational efficiency” as the primary motivator for adopting new technology, ahead of “cost savings” (19%) and “safety and compliance” (8%). Efficiency is top of mind for many in the business, and automation is the clearest way towards it.

Encouragingly, this inclination towards automation is borne out in other areas. For instance, over 60% of surveyed respondents claim that they’ve already adopted some form of technology to reduce their reliance on drivers, with a further 29% implementing “multiple technologies” to achieve the same ends.

Most tellingly, just 20% of respondents indicated that they’re unwilling to adopt new technologies – suggesting that the industry is largely in favor of automation. With that said, which areas have undergone seismic changes in recent years thanks to automation? I’ll explore it fully in the next section.

How is Automation Making a Difference Across the Industry?

One area in which it is making an impact is the warehouse. For instance, some companies are reaping the benefits of robotic employees. Since 2012, Amazon has deployed more than 750,000 robots across its warehouses, and it’s not hard to see why.

This particular innovation can improve labor conditions by reducing the physical burden on human employees and freeing up space, as well as bringing about a higher standard of quality control and accuracy by reducing the margin for human error.

What’s more, robotic workers can speed up your operations, and they make it easier to scale your operations up and down during periods of seasonal demand.

This will appeal to your human workforce, who are often forced to work grueling hours when demand is high. Recently, Amazon made headlines when it emerged that its corporate staff had been asked to volunteer to make up the shortfall ahead of Prime Day.

Elsewhere, DHL has been enjoying the fruits of what it terms “Robotics as a Service” since 2017, when it collaborated on a trial with Locus Robotics. It was an unqualified success: the company recorded 50% fewer pick errors, alongside a 60% reduction in order times.

DHL’s AI-powered “DHLBot” can sort over 1,000 small parcels per hour. Source: DHL

FedEx, meanwhile, launched an AI-powered sorting robot – known as DoraSorter – in 2022, which has helped the firm to “sort a higher volume of cross-border e-commerce shipments,” according to its founder, Xiaobai Deng.

In terms of other automated solutions that are turning the industry on its head, our survey participants expressed a strong interest in tools that can improve efficiency, visibility, and driver productivity. Among them, route optimization software had the most uptake (51%), closely followed by driving monitoring and coaching (46%), and telematics and fleet tracking (41%).

For fleet managers, the appeal of automated software is plain to see. Advanced fleet management platforms, such as Samsara, deliver an all-in-one package to optimize your routes, boost your driver performance, and ultimately save you money on engine idling, downtime, and more.

Similarly, by monitoring and reporting on vehicle and asset data, telematics can be used to train your drivers. In an era in which attracting and retaining top talent is proving so difficult for logistics firms, this kind of technology is invaluable.

It can help you to keep costs low in terms of both route efficiency and lower insurance premiums, while at the same time improving the health and safety practices of your drivers.

The benefits don’t stop there. With the logistics regulatory landscape in its current state of flux, telematics and similar software can be used to train your drivers on the latest compliance. This will ensure that you’re never caught cold from a legal standpoint, and ultimately save you money in the long run.

Make sure you check out our guide to staying ahead of compliance challenges for more information.

Which Areas of Automation Have Yet to Take Off?

Self-driving trucks have long been touted as the future of the logistics industry, a solution to the labor shortage, human error, and a massive exercise in cost-cutting. At this point in time, however, they’ve yet to deliver on that promise.

The reason for this is that there is no federal law explicitly governing the testing and rollout of autonomous trucks. That responsibility has instead fallen to state governments, creating an uneven legal landscape, which has ultimately stymied progress.

As I’ve covered in the guide linked above, only a handful of states permit the testing of autonomous trucks on their roads – fewer still freely allow them on the road. In April 2025, Indiana and Ohio agreed on a deal that will see self-driving trucks operating on the highway that connects the two states, the I-70, dragging the dormant issue back into the spotlight.

A pair of platooning automated trucks operating on I-70. Source: Forbes

There’s an added complication in the form of human operators – specifically, should these vehicles be allowed to operate totally independently, or do they require a human on standby at all times? It’s a question that continues to puzzle both lawmakers and insurance companies. If and when an accident involving an autonomous vehicle occurs, where does the blame lie?

In 2018, Elaine Herzberg was struck and killed by a self-driving Uber test vehicle, which had a human operator in attendance, in the first such recorded case of its kind. The National Transportation Safety Board (NTSB) promptly made a series of recommendations and criticized Uber, which stopped testing its self-driving vehicles for nine months.

In March 2019, Uber was ruled not criminally responsible for the crash by Arizona prosecutors. The human operator, however, was charged with negligent homicide. Uber has been testing its self-driving vehicles ever since, with the company recently making headlines by trialling the cars on the road in Austin. Years later, this legal case continues to hang over the heads of decisionmakers.

External movement has been limited, and to make matters worse, nor is there much pressure coming from inside the industry. According to our survey, just 19% of respondents would choose a self-driving truck over a new driver for carrying out a “standard route.” By contrast, 70% would opt for the driver, and a further 11% are “unsure.”

While not many of our surveyed respondents signaled a willingness to choose an autonomous truck over a human, many more believe that it’s a question of when, not if. To be exact, 42% of respondents agree that we can expect “widespread use” of self-driving trucks on public roads in the next 15 years, with just 14% believing that it won’t happen until after 2050. The future is coming, whether we like it or not.

What Does the Future Hold?

Now it’s time to look at the future of automation more broadly – what role will it play in logistics in the coming years?

In truth, we’re only just scratching the surface of what’s possible. With the industry market size projected to hit $23.14 trillion by 2034, there’s a clear need for solutions that optimize supply chain management, boost performance, and ultimately arm owners and operators with all the tools they need to push the industry forward.

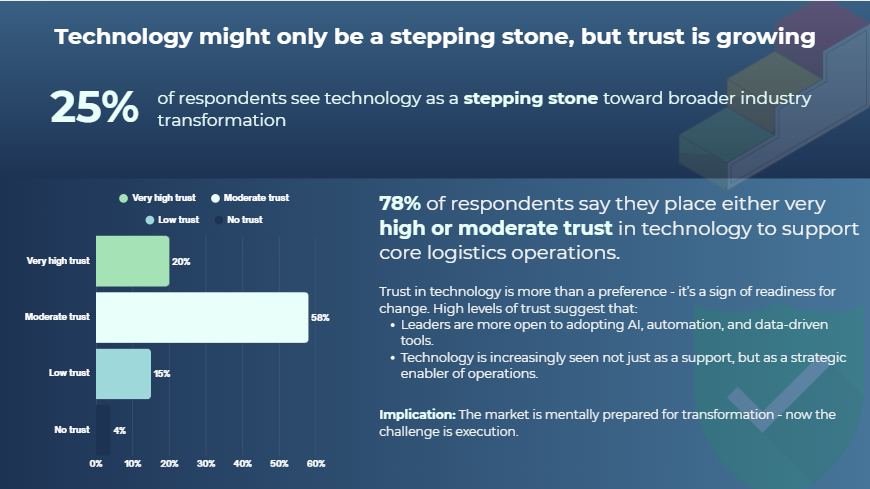

Nor is this lost on the industry leaders themselves. Our survey finds that the overwhelming majority (78%) place either “very high or moderate” trust in technology to support core logistics operations, and a further 25% view technology as a “stepping stone toward broader industry transformation.”

A breakdown of how much trust freight leaders are putting into technology. Source: Tech.co testing

In terms of what this looks like, the labor shortage is a clear issue that needs to be solved. As we’ve previously covered on Tech.co, it’s one of the biggest blockers standing in the way of a freight boom.

I’ve already discussed the inherent difficulties in getting autonomous trucks off the ground, but if consumer demand continues to outpace worker supply, there will be few alternatives left. While the industry remains reluctant and lawmakers drag their feet, the chasm widens.

My prediction? Senior leaders at freight firms across the US will begin to lobby politicians to relax regulations governing the testing and use of autonomous trucks, and perhaps attempt to bring the issue to President Trump’s attention. After all, with the US economy built off the back of logistics, the federal government can’t afford to stay silent.

Elsewhere, the adoption of tools that augment and enhance the driver experience will continue. Our report identified a concerted effort to make the logistics profession more palatable to prospective hires, and one of the key ways that employers are going about this is by “improving work-life balance” for drivers.

Alongside this, 27% of respondents cited a focus on “improving company culture,” while 44% vowed to provide “better training and development opportunities.”

Fleet management software is an excellent tool to help bring these aims closer to fruition. By making your route planning more efficient, there will be less downtime across your fleet, and thus your drivers will have more time off.

Not only this, but through the use of telematics, you can monitor your drivers’ performance in real-time, which can later be used as an invaluable training tool in the development of their careers.

Automation in Logistics: A Summary

The logistics industry has arrived at a pivotal moment. Consumer demand far outweighs the ability of freight firms to meet it, and supply chains are drying up as a result. Added to this, an ongoing labor crisis is making a bad issue worse, with no clear end in sight.

Hope appears in the form of automation. Through cutting-edge technology, fleet managers can improve efficiency, ease the burden on their staff, and hopefully attract the next generation of drivers. To bring about change, however, senior leaders must embrace the full possibilities of technology. Otherwise, the industry risks grinding to a halt.

If you’re interested to learn more about the challenges and opportunities that the logistics industry faces, make sure you download our latest report, Moving Goods with Fewer Hands. It’s full of fascinating insight and statistics to give you a complete picture of the landscape at present, and where we’re going.