Based on our testing, the best free accounting software is Wave. It includes support for unlimited users and invoices – which gives it a huge leg up over other free solutions – and lets you track and manage an unlimited number of invoices and payments. Other options may be right for your organization, however, such as ZipBooks and its wealth of features, or Akaunting and its support for a whopping 45 languages.

In this guide, you can learn about the best free accounting software choices with an easy-to-follow breakdown of each. At the same time, you can consider the benefits of making a small financial commitment to get even more from your accounting software. If you’re willing to pay just a few dollars a month, we have a guide to the best accounting software worth paying for.

To make sure you get the most bang for your buck, you can also check out the latest accounting software deals and discounts.

If you’re committed to a free accounting software plan, we recommend prioritizing three factors: Ease of use, features, and ability to scale up to a paid plan down the road. For a comprehensive breakdown of the various software to choose between, read on.

The Best Free Accounting Software

You can trust our research for both free and paid accounting software, as it’s carried out by industry experts with years of experience. Like you, they’re looking at not only which solutions have the most features on paper, but which ones have the best real-world benefits for businesses and are easiest to use.

You also want to be sure you’re getting good value from your accounting software, should you choose to upgrade, so this guide also considers the pricing of advanced tiers. With this information in mind, here are the best free accounting software options for small businesses today:

- Zoho Books – Best for integrations

- Wave – Best overall free accounting software

- ZipBooks – Best for large feature catalog

- Akaunting – Best for language support

- GnuCash – Best for simple, standard service

- NCH Express – Best for rare free features

| Max users | Best for | Paid plans: | |||

|---|---|---|---|---|---|

| ZipBooks | Akaunting | GnuCash | NCH Express | ||

| 1 | 1 | 1 | 1 | 1 | 4 |

| Managing sales and inventory | Best free option | Large Feature Catalog | Language Support | Simple, Standard Service | Rare Free Features |

| Starts at $15/month | Starts at $16/month | Starts at $15/month | Starts at $8/month | | Starts at $8.25/month |

1. Zoho Books – Best For Integrations

Who can use Zoho Books for free? One user and one accountant.

Zoho Books is one of our top-rated pieces of accounting software, with some great automation features and affordable plans. Comparatively, its free plan is a little limited, but it’s still an option worth considering if you need an accounting solution and you don’t want to pay for it.

You’ll be limited to one user, one accountant, and 1,000 invoices per year, as well as 1,000 expenses and 5 reports. However, you’ll get some pretty robust sales features, including quotes, recurring invoices, credit notes, sales receipts, customer portal, payment reminders, and online payments.

You’ll get some great integration options, too, including Google Workspace, Microsoft 365, Slack, Zapier, Dropbox, Google Drive, Evernote, OneDrive, and WhatsApp – all on the free plan. In addition to this, you’ll also get access to other Zoho products, including Practice, Payroll, Inventory, Expense, Analytics, CRM, SalesIQ, Mail, Desk, Cliq, Bigin, Billing, Campaigns, and Commerce.

Pros

- Extensive data import/export features built in

- Time tracking tools with billable hours conversion for invoicing

- Highly effective transaction documentation

Cons

- No customer support outside business hours (no weekends)

- Limited third party integrations outside of Zoho

- Shorter free trial than most other accounting platforms

- Free: $0/month

- Standard: $15/month

- Professional: $40/month

- Premium: $60/month

- Elite: $120/month

- Ultimate: $240/month

Free features

- 1,000 invoices per year: Not quite unlimited, but 1,000 per year should be more than enough for one user. What’s more, you can schedule recurring invoices for repeat clients.

- Banking features: Manually import bank statements, categorize transactions, and reconcile your accounts with ease.

- Accept online payments: Accept Stripe and PayPal payments, with several other gateways available on later plans.

- Integrate with other platforms: With Zoho Books, you can integrate with leading third-party software, as well as other products in the Zoho suite.

Is Zoho Books scalable?

Zoho Books’s one-user limit puts a bit of a lid on its scalability. Saying that, with a generous helping of integration options, users will be able to manage their back office affairs from within one interface.

Is Zoho Books really free?

Yes, Zoho Books has a free forever plan. It’s designed with solopreneurs and micro businesses in mind, but for anything beyond that, you might want to consider one of its paid plans. Zoho Books is actually one of the more affordable accounting solutions on the market, with paid plans starting at just $15 per organization, per month.

2. Wave – Best Overall Free Accounting Software

Who can use Wave for free? Everyone, but online payment processing will charge a fee.

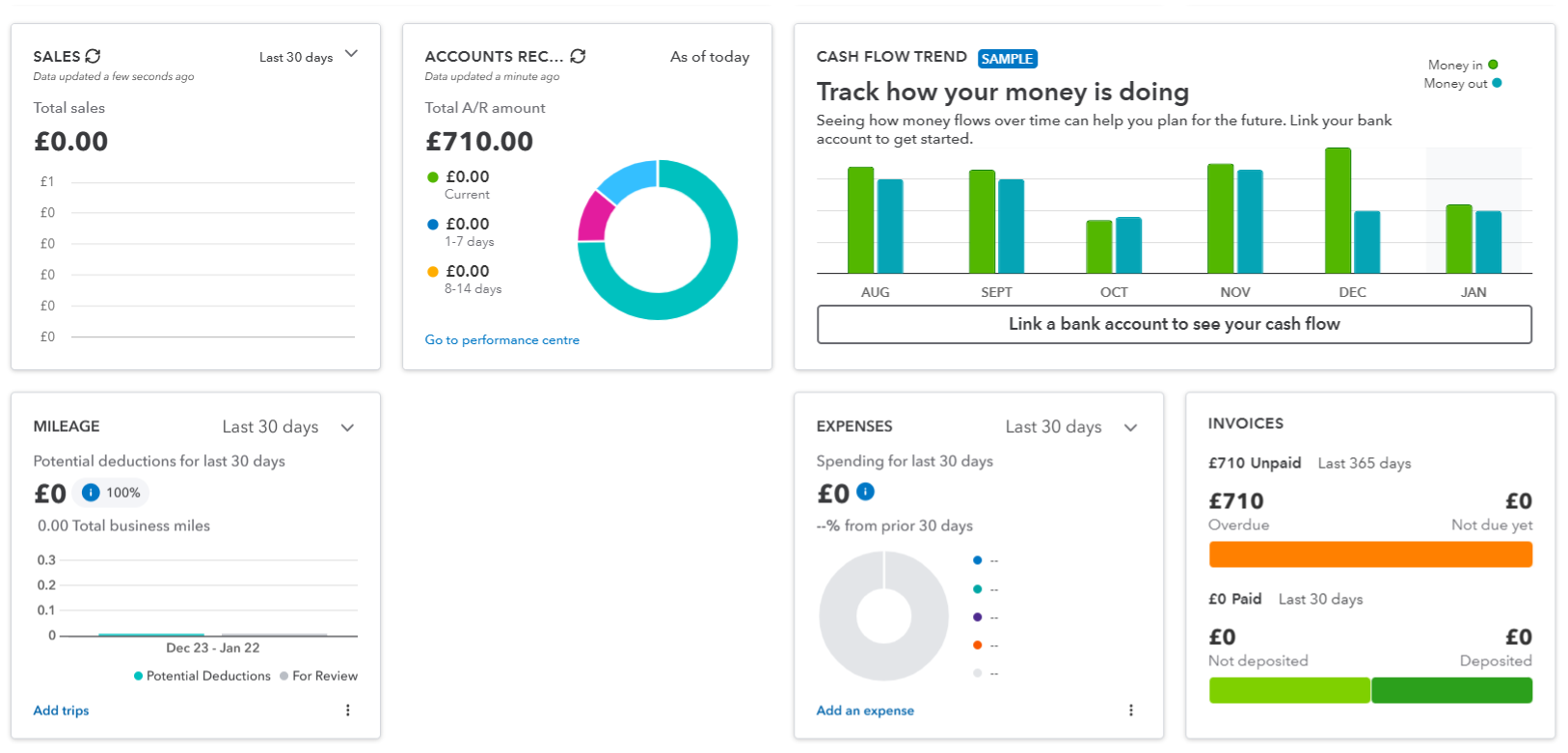

Our pick of the best free accounting software is Wave Financial. Wave is a comprehensive solution that offers an impressive array of free features. You’ll get unlimited estimates, invoices, bills, income tracking, and users. You’ll also get access to reports on topics from overdue invoices and bills to profit and loss summaries, and thanks to its dynamic dashboard, you’re also able to use the platform to spot new trends.

Our research found that Wave is ideal for freelancers and accountants alike, as well as budding accountants looking to cut their teeth with a streamlined platform. The only downsides are that you’ll have to subscribe to its Pro plan in order to access help from the support team. Wave Financial recently made its AI chatbot, Mave, available to all customers, but you might find it insufficient for complex queries. What’s more, learning the software can take a bit of time.

Pros

- Impressive free features, including unlimited estimates, invoices, bills, income tracking, and users

- In-built AI chatbot to automate routine tasks

Cons

- Limited support options on free plan

- Complicated interface means a steep learning curve for beginners – might not be suitable for time-poor business owners

Free features

- Unlimited invoices: Don’t worry about any quotas or limits, you can send as many invoices as you like, with Wave sending automatic follow-ups.

- Receipt scanning: Keep track of your expenses in one place, by keeping all your receipts logged by scanning them with your phone.

- Unlimited bank/card connections: Sync up as many bank cards or accounts as you’d like.

- Multiple businesses: You can connect multiple businesses to one Wave account.

- Unlimited user accounts: Allow as many people as you’d like to view your books.

- Comprehensive reports: See plenty of numbers and figures on your business that allow you to know where your business stands financially.

Is Wave scalable?

If Wave’s free features fall short, you’re also able to upgrade to its Wave Pro ($16 per month) for additional automatic bank transaction imports, unlimited receipt scanning, and advanced customer support. The provider’s advanced tier also has no user limit, making it a great option for growing teams.

Is Wave really free?

Free software sounds great on paper. However, in reality, these free accounting services often incur hidden charges and limitations, making them less of a good deal than they initially seem. In some respects, Wave does fall into this bracket, as many key features are either only available as paid add-ons or reserved for Pro plan members.

For instance, receiving online payments from your customers requires an add-on, which is billed as 2.9% and ¢60 per credit card transaction. This may not seem like much, but if you receive a lot of payments this way, it will start to eat into your earnings. If you do opt for this bonus feature, you’ll also unlock automatic invoices, late payment reminders,

Aside from this, there are a number of bonus features that you can pay for. If you want to be able to digitally upload unlimited receipts, which are then automatically converted into bookkeeping records, it’ll cost you $8 per month or $72 per year. Alternatively, this in included in the Pro plan, which costs $16 per month. There’s also the ability to run payroll, which costs $20 per month, and hire a bookkeeper, which will set you back $149 per month. Neither of these add-ons are included in the Pro plan.

3. ZipBooks – Best for Large Feature Catalog

Who can use ZipBooks for free? One user, with one bank account.

ZipBooks is one of the larger-scale software on this list. There’s a lot on offer when you open the ZipBooks platform for the first time, and our research found that its sheer number of features means it’s likely to provide what most users need from free accounting software.

You’ll be able to access unlimited invoices, and can manage unlimited vendors and customers, for one user and one bank account. Supported digital payments include Square and PayPal, and you’ll also get basic reports. The platform is easy to use, with customer service provided by the company.

I took ZipBooks for a spin, and I was impressed by how clearly laid out it was. Previous accounting software that I’ve tested (Xero springs to mind) hasn’t always had the most logical site-mapping, but this was not an issue with ZipBooks. In other words, everything was where you would’ve expected it to be.

The site mapping on ZipBooks is very logical, with no features hidden in unusual places. Source: Tech.co testing

Pros

- Massive feature catalog, including basic reports, digital payments, unlimited vendors and customers

- Easy-to-use interface adds up to a good user experience

- Excellent customer support options across all plans

Cons

- Lots of features can be daunting for a first-time user

- Paid plans start at $15 per month, which is quite expensive

Free features

- Unlimited invoices: This matches Wave, although the free Zipbooks plan doesn’t automate reminders.

- Management of unlimited vendors and customers: If you have a larger business, you’ll be able to keep track of them all in one spot.

- Digital payments from PayPal and Square.

- Estimates and quotes: Craft custom estimates and quotes for each client.

- Integrates with other software platforms: Impressively, Zipbooks offers a few different integration options with other small business software, including Slack, Gusto, and more.

Is ZipBooks scalable?

As far as free accounting software plans go, ZipBooks is pretty scalable. It has a decent array of features, including unlimited invoices and customer and vendor management, as well as the ability to receive Square and PayPal payments. By integrating with third-party software like Gusto, you can open up a raft of bonus functionality that other free accounting plans do not offer. To run payroll on Wave, for instance, you’ll have to fork out an additional $20 per month, regardless of which plan you’re on.

However, the one bank account and user limit does put a ceiling on what you can achieve with the ZipBooks free plan. With this in place, ZipBooks is only really suitable for sole traders or freelancers.

Is Zipbooks really free?

They say nothing in life is free, and that is the case with ZipBooks. While free plan users will get a decent amount of bang for their buck, some elements of the service will incur a fee. Payments, for instance, come with processing fees, which we’ve listed below:

- Square – 2.9% + ¢30 per transaction

- Stripe – 2.9% + ¢30 per transaction

- PayPal – 2.9% + fixed fee per transaction (varies)

4. Akaunting – Best for Language Support

Who can use Akaunting for free? One user and one accountant.

Akaunting is one of the more popular free accounting software options, due to its availability in 45 languages. The free plan is capped at one user, with one additional accountant allowed access to the data.

Akaunting has its own app store, allowing you to download or buy add-ons or widgets that might suit your niche, like shipping trackers or inventory management. You’ll be able to connect up to four apps for free, although you’ll have to pay for more apps beyond those four.

Features include 20 invoices, 5 bills, and unlimited customers and vendors (but no estimates), as well as support for multiple currencies to go with all those languages. However, our research team didn’t find Akaunting to be the most intuitive platform. We didn’t find it particularly user-friendly, and the customer support isn’t too helpful either. Still, it performs its primary functions well and offers good language capabilities, both of which still make it a fair pick.

Pros

- Available in 45 languages, with multiple different corresponding currencies

- Open-source software means greater security, as source code is available for inspection

Cons

- Akaunting has a steep learning curve, so won't be ideal for users who aren't familiar with accounting software

- Poor customer support options

Free features

- Custom fields: Add custom fields to invoices, customers, items, accounts, transfers, bills, vendors, and more.

- Multi-currency: Allow buyers to pay in whichever currency they prefer.

- Billing calendar: Manage your calendar regarding your books, which helps to reduce the likelihood of overdue payments

Is Akaunting scalable?

No, not really. The Akaunting free plan is quite limited in terms of features. For instance, you’re limited to just 20 invoices and 5 bills. Compared to the likes of ZipBooks and Wave, which both offer unlimited invoices, this is highly disappointing. The Akaunting app store is a nice touch, but many of the best apps are only available as paid add-ons.

Is Akaunting really free?

The Akaunting free plan is very limited, so much so that it may force your hand into upgrading to its Plus plan ($24 per month). Once your 20 invoices are exhausted, there isn’t really anywhere else for you to go. For individuals working on temporary projects, this might be sufficient. But it’s hard to see the long-term value in Akaunting Free.

5. GnuCash – Best for Simple, Standard Service

Who can GnuCash for free? Everyone.

GnuCash is one of the older accounting software options on our list, but that doesn’t mean it’s outdated, at least when it comes to its features, which received generally favorable reviews from our research team. These features include invoicing, billing, double entry (ensuring a debited account matches a credited account to the cent), automatic recurring transactions, cash flow categories, statement reconciliation, and multiple currencies.

However, GnuCash is probably the most antiquated-looking software on this list. In comparison to Wave and Zipbooks, GnuCash was one of the least intuitive platforms tested — the mobile support isn’t great, and the interface was pretty hard to navigate.

Pros

- Solid feature selection, including invoicing, billing, double entry, recurring transactions, and more

- Completely free across the board

Cons

- Very outdated interface and poor mobile support

- No paid plan options, so scalability is nonexistent

Free features

- Scheduled transactions: Arrange a time for money to clear while you’re away from the computer.

- Double entry: A transaction can only clear once an account has been debited, meaning no money can get lost or stuck in limbo.

- Comprehensive reports: See your business’s important figures in one easy-to-digest place.

- Multi-currency: Allow transactions to clear in any currency worldwide.

- Online stock and mutual funds: Update your investment portfolio automatically with quotes from recognized sites.

Is GnuCash scalable?

There are no paid add-ons for GnuCash. It’s all one free software, with nothing locked behind paywalls. While this won’t be an issue if you only need to manage simple accounting processes, if your needs are likely to evolve over time, we wouldn’t recommend using GnuCash.

Is GnuCash really free?

Yes! GnuCash is a totally free to own, open-source software that is maintained by a likeminded community of developers. This means that you won’t find many advanced features, but as a robust bookkeeping tool, you’re unlikely to find many better.

6. NCH Express – Best for Rare Free Features

Who can use NCH Express for free? Small businesses with less than five employees.

NCH makes many different kinds of software, one of which is their free accounting software, NCH Express. Our research found that NCH Express fares pretty well as a free accounting software, although you’ll have to install it yourself and it’s only free for businesses with fewer than five employees.

Features include quotes and estimates, automatic recurring orders and invoices, reports, sales tracking, income statements, and purchase orders. The software lacks in the customer service field, and we found the interface to be a bit abrasive when compared to other systems like Wave, but overall, we found the features to be respectable for a cost-free option.

Pros

- Good features for free option, with highlights including recurring orders and invoices, balance sheets, and inventory management

- Paid options follow a simple pricing structure, so upgrading isn't difficult

Cons

- In order to update the software, you need to download newer versions, which is time-consuming

- Abrasive interface, which adds up to a fairly poor user experience

Free features

- Generate quotes and estimates: Craft estimates and quotes specifically for each client you’re sending to.

- Recurring orders and invoices: If you have clients who regularly buy from you, have these orders and invoices appear automatically.

- Create an income statement: If you’re ever going to seek out investors, use an income statement to show off about your company’s revenue.

- View a balance sheet: Get a dense rundown of what your company currently owns and how it’s faring on a larger scale.

- Inventory management: A rare feature in free accounting software, this allows you to stay on top of your company’s stock.

Is NCH Express scalable?

If you’re looking to expand your NCH software, you can upgrade to a more feature-rich version, the Express Accounts Plus Quarterly Plan, for $26.46 quarterly, or $8.83 per month. You can also opt for the Basic package for a one-time fee of $129.

Is NCH Express really free?

Yes, it really is free. NCH Express has a dedicated free version for companies of five or fewer. With these restrictions, it won’t be suitable for larger teams or businesses. However, sole traders and entrepreneurs will find it useful.

Accounting Software Free Trials – the Middle Ground

If you don’t love the look of any of the free accounting software we’ve listed, but you’re also not thrilled about the idea of paying for something without knowing what you’re committing to, a free trial might be just what you need.

A free trial can give you a good sense of what you’ll be getting out of accounting software, without you needing to commit to a full subscription or purchase. In this section, we’ll give you a rundown of the best paid accounting software that offers free trials.

QuickBooks

QuickBooks’ Online pricing structure starts with a free trial for all of their main plans. These plans are the Simple Start, Essentials, Plus, and Advanced plans, as well as the limited Self Employed plan. You can sign up for any of them using their free 30-day trial.

While these plans are obviously tiered, you’re able to try any one of them for 30 days, so you can spring for Advanced and see everything it has to offer. Keep in mind though, you’ll obviously need to pay the highest rates to keep any features you get used to, so if you know you’re only looking for lower-end functionality, maybe try the Simple Start or Self-Employed trial.

Compare QuickBooks vs FreshBooks in more detail

We were able to create in-depth reporting dashboards with QuickBooks, but the learning curve was a bit steep. Source: Tech.co testing

FreshBooks

FreshBooks is another paid accounting software. Like QuickBooks, it offers three tiers of service. These tiers are Lite, Plus, and Premium. There is a fourth option, the Select option, where you can customize your plan based on what you want and don’t want, but you aren’t able to get a free trial of a Select plan.

While none of their tiers are free beyond the trial, FreshBooks’s first tier is very cheap at only $17 a month (currently on offer for $8.50). In fact, even Plus, the second tier, is only a little more than a lot of the paid tiers found in free software, so if you’re looking to avoid spending a lot of money, both of these systems would offer you great features without breaking the bank.

There are a lot of features that are only available through a custom plan, like data migration services or secure card storage, but again, you won’t be able to try a free trial of a custom plan. We recommend getting a free trial, and seeing if you like the features offered by FreshBooks. Only then should you look into a Select plan.

FreshBooks’ inventory management make it easy to add new items and apply relevant taxes. Source: FreshBooks

Xero

Our final stop on our free trial quest is Xero. Like our other two options, Xero offers three tiers, all with an option for a free 30-day trial.

One of Xero’s biggest benefits is the fact that even the simplest plan can allow you to add unlimited users to your account, meaning you won’t have to pick and choose who in your company has access to your books.

Keen to learn more? Compare QuickBooks vs Xero

Xero’s financial planning interface. Source: xero.com

Hidden Costs: Is Free Accounting Software Really Free?

Free software sounds great on paper. However, in reality, these free accounting services often incur hidden charges and limitations, making them less of a good deal than they initially seem. To avoid getting caught out, here are some warning signs you should be aware of before pursuing free options.

- Time limits – Oftentimes, free accounting services are only free for a limited amount of time. So, it is always worth ensuring that free plans are free forever -not only for a trial period – to avoid getting roped into paying monthly fees later down the line.

- Paid add-ons – While free accounting lets you get started with basic features, often times they keep useful tools behind a paywall. The price of these add-ons can escalate quickly, so be mindful of these costs before moving forward with free software.

- Software integrations – Lots of free accounting software aren’t capable of integrating into other services, or charge businesses for the privilege. To avoid shelling out extra costs, we recommend checking if your chosen solution can integrate into your existing set-up for free before signing up.

- Customer service – Many free accounting software, like Wave, don’t offer customer support as part of their complimentary package. This can be a huge inconvenience for businesses, especially if they’re using the software for the first time, and can lead to costly issues if queries aren’t able to be resolved.

Is It Worth Upgrading from Free Accounting Software?

Free services offer a great opportunity to test out new software or provide much-needed features for a small business or self-employed individual in the short term, but ultimately, you get what you pay for. If you’re considering a paid option, you can always test them with a free trial, a service offered by many paid accounting software, like Zoho Books, FreshBooks, or Xero.

Businesses that switch to cloud-based accounting software see, on average, a 15% revenue bump – but can you do it at zero cost? If you’re looking for any of the following services, you might have to want to take advantage of paid accounting software.

Here are some of the accounting features that are normally only reserved for paid plans.

1. Payroll and tax capabilities

This functionality will automatically distribute your taxes and wages to the appropriate parties, without the need for manual calculation. Manual processing comes with a significant risk of human error – automating it will save you time and stress.

2. Sophisticated reports

“Sophisticated reports” is a bit of a broad term, but mainly refers to the nitty gritty details of your incomings and outgoings. If you decide to fork out for a paid accounting software, they will be able to offer you more comprehensive information, like data visualization, customizable invoices, or a number of other details that can help you get a more granular, accurate grip on your business.

3. Forecasting

If you want to know not just where your business has been, but where it’s going, forecasting can help you out. It will take the numbers and data of the past and use that to project possible trajectories, allowing you to prepare for drier sales periods, or get excited about an upcoming influx of customers. And considering 95% of organizations with effective forecasting make quotas, compared to only 55% without, it’s safe to say this kind of tool can make a big difference.

4. Inventory and order tracking

If you’re selling physical products, you might want to have some software to stay on top of your inventory. Some paid accounting software can keep tabs on your stock, as well as tracking any orders as they’re sent, both of which are crucial if you’re hoping to run a smooth business.

5. User and invoicing count

Commonly, free accounting software limits the amount of users per account. Some software will also cap the amount of customers you can invoice or the amount of invoices you can send per month. If your small business is growing fast, you might want to look at a paid service that allows you to handle higher numbers.

See our guide to the Best Invoicing Software for Small Business

And don’t forget to learn more about solutions tailored to your specific needs with our guide to the best accounting software for the self-employed.

Verdict: What Is the Best Free Accounting Software?

So, there you have it, Wave comes in first, thanks to its unlimited users and invoicing, with Zipbooks not far behind.

However, free software can only take you so far. If you’re looking for free software as a way to save money, keep in mind that FreshBooks’ cheapest plan, currently on offer for $7.60 per month for the first 6 months, is one of the cheapest. It offers many more options than standard free software, while also being a lot easier on the wallet than its contemporaries. It also offers a free trial, so you can try before you commit.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored’ table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page